Nasdaq 100 Slumps, AMD Disappoints and Accounting Issues Grow for SMCI

Nasdaq 100 Slumps, AMD Disappoints and Accounting Issues Grow for SMCI

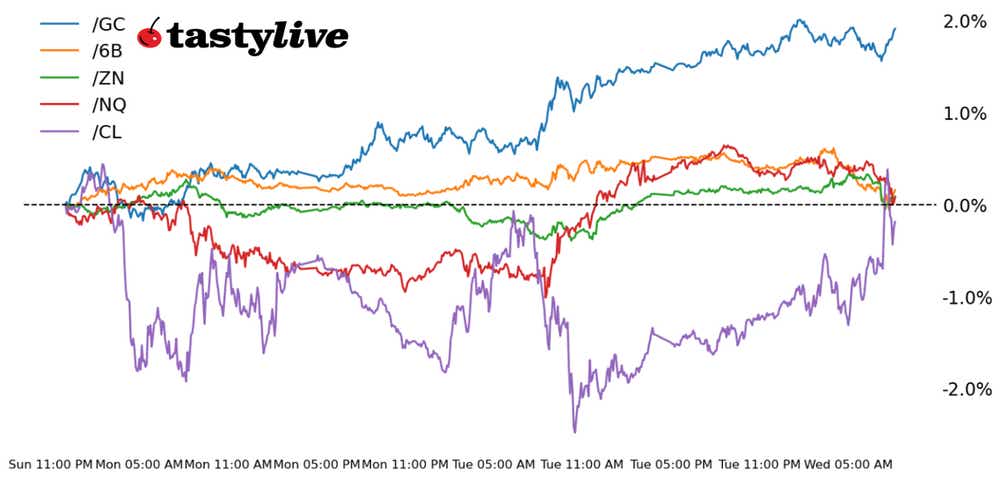

Also 10-year T-note, gold, crude oil and Japanese yen futures

- S&P 500 E-mini futures (/ES): -0.09%

- 10-year T-note futures (/ZN): +0.17%

- Gold futures (/GC): +0.31%

- Crude oil futures (/CL): +1.44%

- Japanese yen futures (/6J): -0.33%

This morning’s price action in equity markets is instructive. Alphabet (GOOG), which accounts for nearly 5% of the Nasdaq 100, beat earnings expectations handily last night, but the broad Nasdaq 100 is not trading higher today. Why? Two companies within this bull market’s leadership group—Advanced Micro Devices (AMD) and Super Micro Computer (SMCI)—are having, shall we say, difficult sessions today. If semiconductors are going to struggle to retain bullish traction, then the Nasdaq 100 may likewise struggle to break out. Elsewhere, bonds are trying to reverse higher after the October U.S. ADP employment change and 3Q ’24 U.S. gross domestic produce (GDP) reports.

Symbol: Equities | Daily Change |

/ESZ4 | -0.09% |

/NQZ4 | -0.19% |

/RTYZ4 | -0.35% |

/YMZ4 | -0.15% |

Nasdaq futures (/NQZ4) traded slightly lower this morning despite Alphabet rising nearly 7% after reporting earnings that beat estimates yesterday afternoon. SMCI plunged 30% this morning, dragging the entire tech sector down with it. Nasdaq losses extended once news crossed the wires that the company’s auditor resigned after flagging concerns. Microsoft (MSFT) is set to report after the bell today.

Strategy: (50DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 18500 p Short 19000 p Short 22000 c Long 22500 c | 62% | +2350 | -7650 |

Short Strangle | Short 19000 p Short 22000 c | 67% | +6350 | x |

Short Put Vertical | Long 18500 p Short 19000 p | 83% | +1240 | -8860 |

Symbol: Bonds | Daily Change |

/ZTZ4 | -0.02% |

/ZFZ4 | +0.05% |

/ZNZ4 | +0.17% |

/ZBZ4 | +0.61% |

/UBZ4 | +1% |

Treasuries rose across the middle- and long-end of the curve after the United States reported a drop in job openings and a very strong seven-year note auction yesterday. ADP came in warmer than anticipated this morning, but the GDP report was solid yet a touch weaker than anticipated. We are about a week away from the U.S. election and the next Federal Reserve rate decision, which is likely injecting some uncertainty into the bond market. That volatility is reflected by the ICE BofA MOVE Index rising to fresh yearly highs this morning. 10-year T-note futures (/ZNZ4) were higher ahead of the New York open.

Strategy (58DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 108 p Short 109 p Short 115 c Long 116 c | 62% | +296.88 | -703.13 |

Short Strangle | Short 109 p Short 115 c | 69% | +812.50 | x |

Short Put Vertical | Long 108 p Short 109 p | 81% | +203.13 | -796.88 |

Symbol: Metals | Daily Change |

/GCZ4 | +0.31% |

/SIZ4 | -1.89% |

/HGZ4 | -0.37% |

Gold futures (/GCZ4) surged to fresh highs today after Reuters reported Chinese policymakers were considering approval of a $1.4 trillion stimulus package to bolster domestic economic conditions. The drop in yields is also helping to clear some upside for the metal ahead of next week’s U.S. elections.

Strategy (57DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2625 p Short 2650 p Short 2950 c Long 2925 c | 60% | +850 | -1650 |

Short Strangle | Short 2650 p Short 2950 c | 69% | +4290 | x |

Short Put Vertical | Long 2625 p Short 2650 p | 84% | +370 | -2130 |

Symbol: Energy | Daily Change |

/CLZ4 | +1.44% |

/HOZ4 | +1.47% |

/NGZ4 | -2.27% |

/RBZ4 | +0.91% |

Crude oil prices (/CLZ4) rose nearly 2% this morning after a Reuters report revealed the oil cartel OPEC+ could decide to push back the rollback of voluntary production cuts because ofsoft global demand. The group, which includes Russia, was set to raise output by 180,000 barrels per day in December. The news comes after the American Petroleum Institute (API) reported a surprise inventory drop yesterday. The Energy Information Administration (EIA) is set to report its own inventory figures today.

Strategy (47DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 58 p Short 60 p Short 77 c Long 79 c | 63% | +450 | -1550 |

Short Strangle | Short 60 p Short 77 c | 69% | +1630 | x |

Short Put Vertical | Long 58 p Short 60 p | 79% | +270 | -1730 |

Symbol: FX | Daily Change |

/6AZ4 | +0.21% |

/6BZ4 | -0.33% |

/6CZ4 | -0.1% |

/6EZ4 | +0.06% |

/6JZ4 | +0.1% |

British Pound futures (/6BZ4) fell after the Labour government offered its first budget, which calls for higher taxes and spending. The plan wasn’t kind to the sterling, but it was nothing compared to former Prime Minister Liz Truss’s budget that crashed the bond market because of higher spending plans with little insight into how to pay for it. Finance Minister Rachel Reeves plans to spend about $52 billion in fiscal measures, according to a Reuters report citing government sources familiar with the matter.

Strategy (65DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.25 p Short 1.26 p Short 1.34 c Long 1.35 c | 65% | +168.75 | -456.25 |

Short Strangle | Short 1.26 p Short 1.34 c | 70% | +512.50 | x |

Short Put Vertical | Long 1.25 p Short 1.26 p | 88% | +87.50 | -537.50 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts #Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.