Nasdaq 100 Tests Multi-Week Downtrend as Yields Continue to Ease

Nasdaq 100 Tests Multi-Week Downtrend as Yields Continue to Ease

Also, 10-year T-note, silver, natural gas and Japanese yen futures

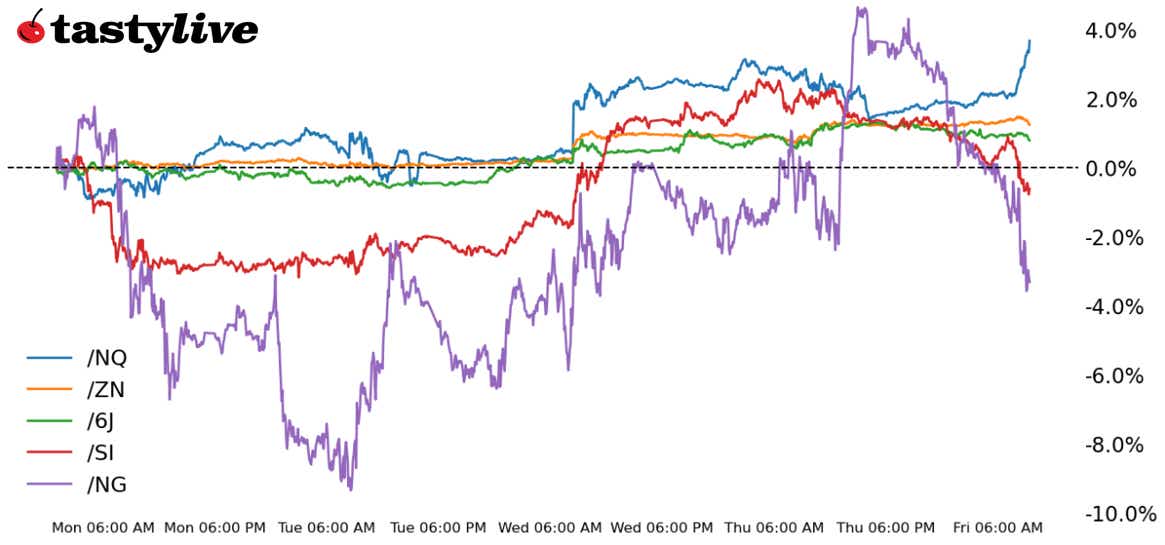

- Nasdaq 100 E-mini futures (/NQ): +1.44%

- 10-year T-note futures (/ZN): -0.06%

- Silver futures (/SI): -2.3%

- Natural gas futures (/NG): -6.79%

- Japanese yen futures (/6J): -0.48%

“Relief” is probably the best way to describe the mood in financial markets this week, underscored by price action today. A warm (but not hot) inflation report on Wednesday followed by softer retail sales and jobless claims yesterday and then stronger housing starts figures today have curated a goldilocks view: The U.S. economy is still growing, but it’s not overheating—reinflating—to the degree many feared. Moreover, a reported phone call between U.S. President-elect Donald Trump and Chinese President Xi Jingping has likewise boosted hopes the looming trade war may not be as disruptive as feared.

Symbol: Equities | Daily Change |

/ESH5 | +0.77% |

/NQH5 | +1.44% |

/RTYH5 | +0.69% |

/YMH5 | +0.65% |

Nasdaq futures (/NQH5) guided higher this morning as traders shifted to a risk-on mood following the week’s data prints that showed the Federal Reserve has some room to cut interest rates this year. The earnings results from several banks this week helped inject some confidence ahead of the next couple of weeks when earnings from big tech names are due. However, traders seem more focused on rates than earnings. That could change as we move deeper into the earnings season. But for now, traders see a green light to go risk on from the Fed’s path forward.

Strategy: (42DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 20100 p Short 20300 p Short 22900 c Long 23200 c | 62% | +1095 | -4905 |

Short Strangle | Short 20300 p Short 22900 c | 69% | +4610 | x |

Short Put Vertical | Long 20100 p Short 20300 p | 82% | +550 | -3450 |

Symbol: Bonds | Daily Change |

/ZTH5 | -0.05% |

/ZFH5 | -0.09% |

/ZNH5 | -0.06% |

/ZBH5 | +0.14% |

/UBH5 | +0.24% |

Bonds are on track to record gains for the week, which would mark the first week of the year when yields dropped. President-elect Trump will be sworn into office next week, and traders are eager to see what the first days in office will bring, especially with tariffs and trade policy. Meanwhile, there is concern in Washington about how bond yields could affect the President-elect's plan to extend the 2017 tax cuts. This morning’s strong housing starts number didn’t manage to derail falling Treasury yields.

Strategy (63DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 104.5 p Short 106 p Short 111 c Long 112.5 c | 62% | +359.38 | -1140.63 |

Short Strangle | Short 106 p Short 111 c | 67% | +656.25 | x |

Short Put Vertical | Long 104.5 p Short 106 p | 88% | +171.88 | -1328.13 |

Symbol: Metals | Daily Change |

/GCG5 | -0.4% |

/SIH5 | -2.3% |

/HGH5 | -1.58% |

Silver prices (/SIH5) fell nearly 2% this morning as market sentiment improved and traders shifted back into equities. The drop today was enough to wipe out the metal’s gains for the week. The losses come amid a weaker dollar and lower bond yields. Yesterday, silver hit a one-month high as rising bond prices opened some upside for the metal. Next week could prove volatile for metals because Trump’s inauguration and whatever moves he happens to make in the following days will likely affect the dollar and yields.

Strategy (39DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 28 p Short 28.75 p Short 34 c Long 34.75 c | 63% | +1010 | -2740 |

Short Strangle | Short 28.75 p Short 34 c | 70% | +3135 | x |

Short Put Vertical | Long 28 p Short 28.75 p | 80% | +525 | -3225 |

Symbol: Energy | Daily Change |

/CLG5 | -0.49% |

/HOG5 | -0.82% |

/NGG5 | -6.79% |

/RBG5 | -0.29% |

Natural gas bears are out in force. Prices (/NGG5) are down over 6% this morning, with the contract falling from its highest levels since late 2023. Still, the commodity remains in positive territory for the week as a cold weather front is forecasted to sweep through the United States through late January. However, traders are looking beyond and with prices already at high levels, profit-taking combined with eager shorts are pushing volatility into the product. Inventory moves have been bullish this week, but we’ll need to see another bullish print next week to support prices remaining near 4.

Strategy (39DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 3.05 p Short 3.2 p Short 5 c Long 5.15 c | 61% | +620 | -880 |

Short Strangle | Short 3.2 p Short 5 c | 69% | +2050 | x |

Short Put Vertical | Long 3.05 p Short 3.2 p | 66% | +550 | -950 |

Symbol: FX | Daily Change |

/6AH5 | -0.51% |

/6BH5 | -0.52% |

/6CH5 | -0.32% |

/6EH5 | -0.23% |

/6JH5 | -0.48% |

The U.S. dollar may be the top-performing currency at the moment, but that doesn’t tell the full story: The greenback has been losing ground while this note was being written and has started to flip over into negative territory on the day. A quiet week ahead for the Federal Reserve, which is in its blackout window, will put the focus on the Bank of Japan and the Japanese yen (/6JH5).

Strategy (49DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.0061 p Short 0.00625 p Short 0.0067 c Long 0.00685 c | 67% | +412.50 | -1462.50 |

Short Strangle | Short 0.00625 p Short 0.0067 c | 70% | +650 | x |

Short Put Vertical | Long 0.0061 p Short 0.00625 p | 84% | +225 | -1650 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. #@fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.