Nasdaq 100 Pulls Back as Traders Await Nvidia Earnings

Nasdaq 100 Pulls Back as Traders Await Nvidia Earnings

Also, 5-year T-note, gold, crude oil, and Canadian dollar futures

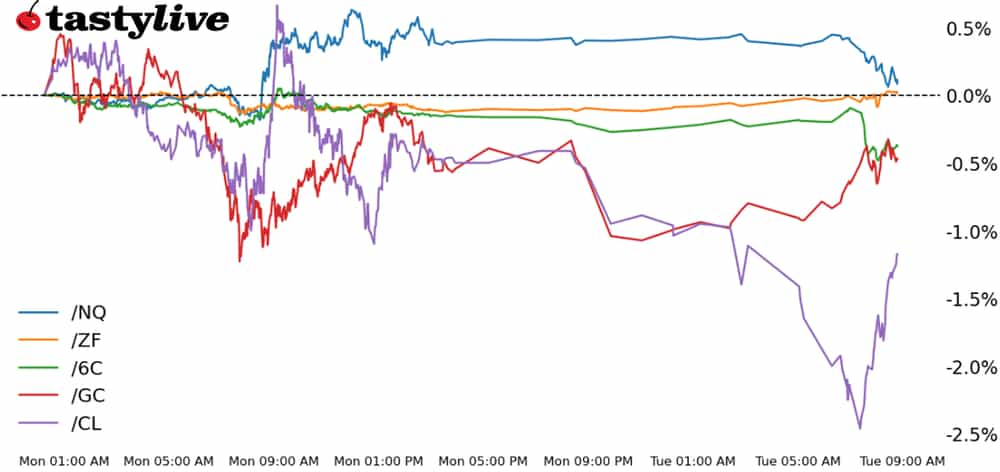

Nasdaq 100 e-mini futures (/NQ): -0.26%

Five-year T-note futures (/ZF): +0.06%

Gold futures (/GC): -0.28%

Crude oil futures (/CL): -1.48%

Canadian dollar futures (/6C): -0.33%

Traders are biding their time at the start of the week, awaiting the May Federal Open Market Committee (FOMC) meeting minutes and the Nvidia (NVDA) earnings report on Wednesday afternoon.

U.S. equity markets are effectively treading water, with each of the four major indexes basically unchanged on the week. Bond yields are modestly lower ahead of a bevy of Fed speakers today. A stronger U.S. dollar may be weighing on USD-denominated commodities, which are otherwise retaining recent current trajectories (higher prices).

Symbol: Equities | Daily Change |

/ESM4 | -0.06% |

/NQM4 | -0.26% |

/RTYM4 | -0.55% |

/YMM4 | +0.02% |

Nasdaq 100 edges down

Volatility is on the floor (the VIX has a 12-handle) and traders are awaiting the AI bellwether’s results on Wednesday, leading to curtailed price action and a relatively staid situation.

The winners from yesterday are the losers today, and vice versa; the Nasdaq 100 (/NQM4) is off by just over one-quarter of a percent. Once NVDA earnings happen, a flurry of trading activity on Thursday may be the only day worth trading intraday.

Strategy: (38DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 17250 p Short 17500 p Short 20000 c Long 20250 c | 62% | +635 | -4365 |

Short Strangle | Short 17500 p Short 20000 c | 64% | +1840 | x |

Short Put Vertical | Long 17250 p Short 17500 p | 86% | +245 | -4755 |

Symbol: Bonds | Daily Change |

/ZTM4 | +0.02% |

/ZFM4 | +0.06% |

/ZNM4 | +0.1% |

/ZBM4 | +0.24% |

/UBM4 | +0.3% |

Treasury markets wait

Treasury markets are in wait-and-see mode as nearly half a dozen Fed speakers are set to hit the lecture circuit today. There are no noteworthy auctions today, although there is a 20-year bond auction tomorrow. The 2s10s spread remains tethered near -40-bps. Fed funds futures (/ZQZ4) are discounting 35-bps of cuts by the end of the year, while three-month SOFR futures (/SR3Z4) are pricing in 43-bps of cuts.

Strategy (31DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 104.75 p Short 105 p Short 107.5 c Long 107.75 c | 64% | +70.31 | -179.69 |

Short Strangle | Short 105 p Short 107.5 c | 70% | +226.56 | x |

Short Put Vertical | Long 104.75 p Short 105 p | 92% | +31.25 | -218.75 |

Symbol: Metals | Daily Change |

/GCM4 | -0.28% |

/SIN4 | -1.27% |

/HGN4 | +1.4% |

Small dent in precious metals rally

A stronger U.S. dollar may be provoking some short-term profit taking in precious metals, but a small dent in the face of a robust rally in recent months is nary a concern.

Gold prices (/GCM4) continue to make progress outside of a bullish symmetrical triangle, while silver prices (/SIN4) are holding near their highest level since January 2013. Elsewhere, copper prices (/HGN4) are holding over $5 per pound, having just set a new all-time high yesterday.

Strategy (35DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2300 p Short 2325 p Short 2550 c Long 2575 c | 65% | +650 | -1850 |

Short Strangle | Short 2325 p Short 2550 c | 71% | +2380 | x |

Short Put Vertical | Long 2300 p Short 2325 p | 87% | +240 | -2260 |

Symbol: Energy | Daily Change |

/CLM4 | -1.48% |

/HOM4 | -1.51% |

/NGM4 | -3.49% |

/RBM4 | -1.2% |

Energy prices move lower

Energy prices are down across the board as technical selling pressure may have kicked in.

Crude oil prices (/CLM4) reversed lower after failing to retake the neckline of a head and shoulders pattern, while natural gas prices (/NGM4) dropped after tagging the high close of 2024. The weekly US API crude oil stock change report is due out later today.

Strategy (57DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 70 p Short 71 p Short 86 c Long 87 c | 64% | +250 | -750 |

Short Strangle | Short 71 p Short 86 c | 71% | +1480 | x |

Short Put Vertical | Long 70 p Short 71 p | 83% | +140 | -860 |

Symbol: FX | Daily Change |

/6AM4 | -0.07% |

/6BM4 | -0.07% |

/6CM4 | -0.33% |

/6EM4 | -0.11% |

/6JM4 | +0.02% |

Canadian dollar drops

The U.S. dollar is stronger across the board, save against the Japanese yen (/6JM4), which may be enjoying a tailwind from lower yields and weaker energy prices.

But attention this morning is on the Canadian dollar (/6CM4), the weakest performer in the wake of the April Canada inflation report. The sharp drop in Canadian inflation pressures has seen BOC rate cut odds jump, weighing on /6CM4 just as it has failed to clear meaningful technical resistance.

Strategy (45DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.715 p Short 0.72 p Short 0.745 c Long 0.75 c | 63% | +110 | -390 |

Short Strangle | Short 0.72 p Short 0.745 c | 67% | +230 | x |

Short Put Vertical | Long 0.715 p Short 0.72 p | 93% | +45 | -455 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2024 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.