Nasdaq 100 E-minis, 30-Year T-Notes, Gold, Crude Oil and Canadian Dollar Futures

Nasdaq 100 E-minis, 30-Year T-Notes, Gold, Crude Oil and Canadian Dollar Futures

Five futures in focus. Right here, every weekday morning.

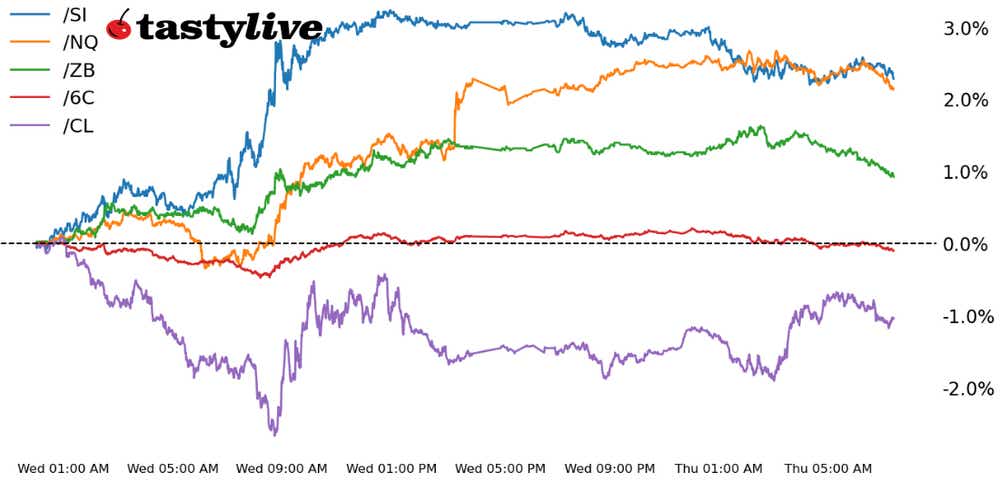

- Nasdaq 100 E-mini futures (/NQ): +0.96%

- 30-Year T-Note futures (/ZB): -0.31%

- Gold futures (/SI): -0.36%

- Crude oil futures (/CL): -0.23%

- Canadian dollar futures (/6C): -0.09%

Arguably the biggest binary event risk of the week has come to pass, with Nvidia (NVDA) earnings blowing past expectations and providing a lift to U.S. equity markets. Both /ESU3 and /NQU3 surged at the end of the day on yesterday, with opening gaps producing meaningful gains once trading resumed on today. With evidence in hand that the AI narrative may have just received a new lifeline, attention is refocusing tomorrow on the Federal Reserve Jackson Hole Economic Policy Symposium and Fed Chair Jerome Powell’s speech.

Symbol: Equities | Daily Change |

/ESU3 | +0.40% |

/NQU3 | +0.95% |

/RTYU3 | -0.24% |

/YMU3 | -0.20% |

What was said yesterday—“the ability of /ESU3 and /NQU3 to maintain turns higher, however, will ride or die with NVDA’s earnings”—has proven true. NVDA accounts for approximately 4% weighting in each of the S&P 500 and the Nasdaq 100, and the stock’s +6.17% gain pre-market has fueled the rally (as well as helping lift other plays in AI).

Strategy: (1DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 15325 p Short 15330 p Short 15350 c Long 15360 c | 52% | +150 | -50 |

Long Strangle | Long 15330 p Long 15350 c | 48% | x | -4195 |

Short Put Vertical | Long 15325 p Short 15330 p | 51% | +45 | -55 |

Symbol: Bonds | Daily Change |

/ZTU3 | -0.11% |

/ZFU3 | -0.21% |

/ZNU3 | -0.28% |

/ZBU3 | -0.31% |

/UBU3 | -0.30% |

Yesterday's sharp rallies in the long-end of the U.S. Treasury curve have been met by modest selling pressure thus far today. Once more, the trio of /ZNU3, /ZBU3 and /UBU3 are leading the action, as markets brace for signs from Fed Chair Powell that while another rate hike is possible, rate cuts are certainly nowhere close to being considered. “Higher for longer” doesn’t necessarily mean another rate hike; it could mean the Fed maintains rates at their current level for an extended period. The latest U.S. durable goods orders report reinforced the idea that U.S. growth isn’t slowing down in the near-term.

Strategy (1DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 119 p Short 119.5 p Short 120.5 c Long 121 c | 40% | +281.25 | -218.75 |

Long Strangle | Long 119.5 p Long 120.5 c | 44% | x | -671.88 |

Short Put Vertical | Long 119 p Short 119.5 c | 65% | +140.63 | -359.38 |

Symbol: Metals | Daily Change |

/GCV3 | -0.36% |

/SIU3 | -0.73% |

/HGU3 | -1.00% |

Gold and silver declined this morning as bond yields and the stronger U.S. dollar pressured traders to sell the precious metals after U.S. jobless claims for the week ending Aug. 19 fell to 230,000 from 240,000. U.S. durable goods orders impressed against expectations when excluding transportation for July. That said, both /GCV3 and /SIU3 have exhibited meaningful technical turnarounds in recent days, suggesting that any weakness presented may be a ‘buy the dip’ opportunity.

Strategy (1DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1905 p Short 1910 p Short 1920 c Long 1925 c | 32% | 340 | -160 |

Long Strangle | Long 1920 c Long 1910 p | 44% | x | -1,050 |

Short Put Vertical | Long 1905 p Short 1910 p | 77% | 90 | -410 |

Symbol: Energy | Daily Change |

/CLV3 | -0.23% |

/NGU3 | -2.28% |

Crude oil is little changed despite the larger-than-expected U.S. stockpile draw of 6.1 million barrels for the week ending Aug. 18 that the Energy Information Administration (EIA) reported yesterday. The bullish headline print was likely tempered by rising distillate inventories as the summer season heads toward an end. /CLV3 continues to contend with a potential topping pattern in the form of a head and shoulders, which suggests a potential drop toward 73 over the coming weeks—if initiated.

Strategy (1DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 79.75 p Short 80 p Short 80.5 c Long 80.75 c | 13% | 230 | -20 |

Long Strangle | Long 80.5 c Long 80 p | 47% | x | -1,700 |

Short Put Vertical | Long 79.75 p Short 80 p | 27% | 210 | -40 |

Symbol: FX | Daily Change |

/6AU3 | -0.63% |

/6BU3 | -0.59% |

/6CU3 | -0.09% |

/6EU3 | -0.38% |

/6JU3 | -0.84% |

The U.S. dollar is back on the offensive, following better-than-expected economic data. That underscores the juxtaposition of the North American and European (Eurozone and U.K.) economies. But the one currency proving insulated, perhaps due to its close ties to the U.S., is the Canadian dollar. Among FX futures, /6CU3 has weakened the least, even though the technical structure of the charts (in both /6CU3 and the USD/CAD spot rate) suggest the Canadian dollar may be set on a path toward weakness in the near-term.

Strategy (15DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.7325 p Short 0.735 p Short 0.74 c Long 0.7425 c | 34% | +170 | -80 |

Long Strangle | Long 0.735 p Long 0.74 c | 43% | x | -490 |

Short Put Vertical | Long 0.7325 p Short 0.735 p | 72% | +80 | -170 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2024 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.