Macro Week Ahead: U.S. inflation and consumption, Japan GDP and China economic activity

Macro Week Ahead: U.S. inflation and consumption, Japan GDP and China economic activity

By:Ilya Spivak

Fear of recession may once again make the markets fall and the yen rise

Stock markets might turn lower if U.S. inflation and consumption data underwhelms.

The Japanese yen may rise on local economic data, while the British pound is at risk.

Chinese retail sales and industrial production figures might boost global recession fears.

Financial markets spent most of last week licking their wounds after a brutal sell-off on Monday. The bellwether S&P 500 and the tech-tilted Nasdaq 100 managed to finish the week little-changed, having been down 4.5% and 6.3% respectively. Treasury yields managed to correct a bit higher as cooling risk aversion deflated panic rate cut expectations.

Gold and the U.S. dollar finished the week nearly flat. So too did the Japanese yen, echoing the seesaw in equity markets. Crude oil managed to push higher as worries about another shootout between Iran and Israel introduced geopolitical risk premium into prices. Bitcoin continued to fall, losing 3.1%.

Against this backdrop, here are the macro waypoints likely to shape what comes next.

U.K. consumer price index (CPI) and gross domestic product (GDP) data

July saw a pickup in U.K. inflation, according to economists’ median forecast. Headline CPI is seen rising 2.3% year-on-year, marking the highest reading in three months and the first uptick since December 2023.

Later in the week, GDP data is expected to show output grew 0.6% in the second quarter. Taken together with a 0.7% rise in the first three months of the year, this would mean the first half of 2024 saw the fastest expansion in over two years.

Analytics from Citigroup show that U.K. economic data outcomes have softened relative to baseline projections over recent weeks. This hints that analysts’ models are tuned to a rosier setting than realized results have validated, which may set the stage for downside surprises when this week’s reports come across the wires.

Underwhelming results may hurt the British pound as traders adjust Bank of England monetary policy expectations to a more dovish setting.

.png?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

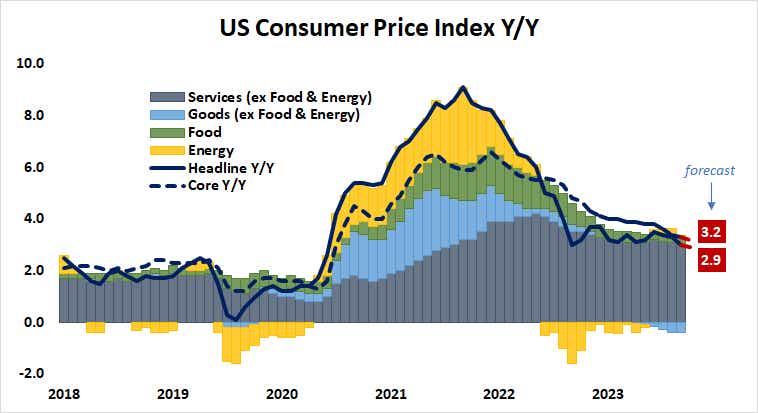

U.S. consumer price index (CPI) data

Inflation in the U.S. is expected to have taken another small step lower last month. The headline CPI gauge is seen rising 2.9% year-on-year to mark the lowest reading since March 2021. The core measure excluding volatile food and energy prices – a focal point for Federal Reserve officials – is penciled in at 3.2%. This too would be a three-year low.

A closely watched “nowcast” estimating inflation trends from the Cleveland Fed anticipates slightly higher figures, pointing to 3% at the headline and 3.3% on the core print. However, the trend in U.S. economic data outcomes continues to point toward disappointment relative to forecasts, according to Citigroup.

Soft figures are likely to be interpreted as signaling weakening demand, stoking fears about an oncoming recession. That will probably weigh on stock markets while driving capital flows to defensive cash-out venues, including U.S. Treasury bonds and the dollar. The Japanese yen may likewise strengthen as the unwinding of the carry trade resumes.

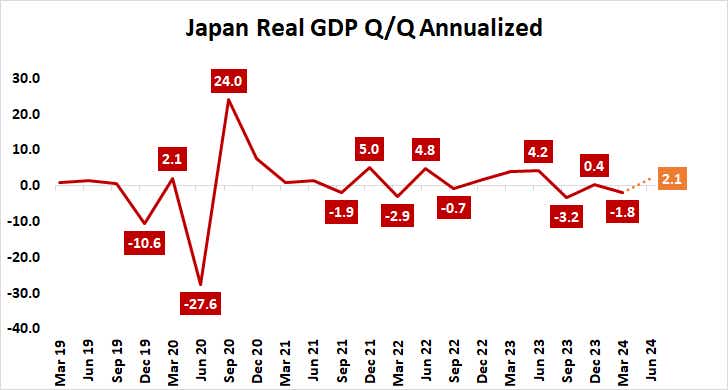

Japan gross domestic product (GDP) data

Japanese economic growth is expected to have accelerated in the second quarter, with output rising at an annualized pace of 2.1%. That would mark the strongest expansion in a year.

Leaving aside the onset of the COVID-19 pandemic in 2020, the three months through June appear to have some positive seasonality. That may be linked to an upswell of demand as new outlays are made following the rolling over of Japan’s fiscal year, which begins in April.

Nevertheless, an upbeat result coupled with well-anchored activity readings from S&P Global purchasing managers index (PMI) data into the second half of the year may help reinforce a modestly more hawkish bias at the Bank of Japan (BOJ). That might put a cap on local stock markets and breathe new life into the Japanese yen.

China retail sales and industrial production data

A batch of economic activity data from China is seen showing that industrial production growth slowed to 5.2% year-on-year in July – the weakest in four months – while retail sales picked up a bit with a rise of 2.6%. That would mark a modest acceleration from the 2% recorded in June.

Such outcomes would echo last week’s trade data, which showed a spirited jump in import growth (7.2% year-on-year vs. 3.5% expected) even as exports disappointed (7% vs. 9.7% expected). A slightly stronger CPI reading—0.5% year-on-year, the highest since February – likewise hinted at warming domestic demand.

It may be too early to celebrate revival in the world’s second largest economy, however. Core CPI excluding food and energy rose just 0.4% in July, the weakest year-on-year rise since January. Meanwhile, the Chinese yuan was down 1.06% last month from the previous year.

Taken together, this hints that imported inflation instead of improving at-home demand accounts for last week’s results. What’s more, Citigroup data signals ongoing deterioration in Chinese economic news-flow relative to median forecasts. If this sets the stage for limp results this week, that may amplify global recession fears.

.png?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

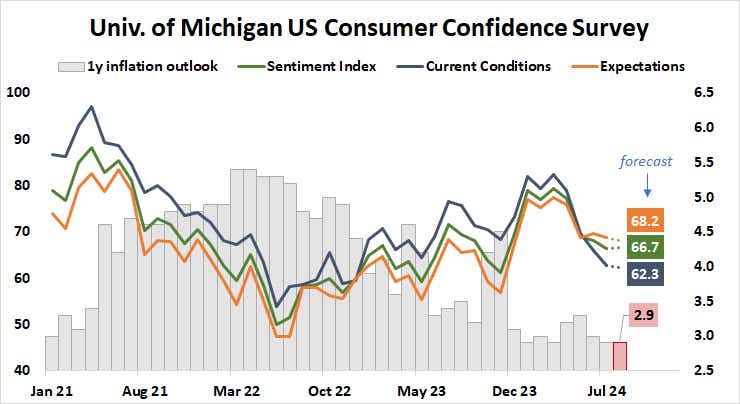

U.S. retail sales and consumer confidence data

July marked a pickup in U.S. retail sales growth, according to economists’ expectations, with receipts rising 0.3% from the prior month. That would mark an improvement from June’s flat result and match the rise recorded in May. Meanwhile, the University of Michigan (UofM) is seen showing steady consumer confidence and inflation expectations.

Household consumption is the leading driver of U.S. economic growth, accounting for close three quarters of demand. This means a disappointment on the retail sales print in line with the soggy trend in U.S. data flow since mid-April may go a long way toward fueling recession fears.

As for sentiment, it was steadily improving as inflation expectations were declining since mid-2022 as the rate hike cycle started by the Federal Reserve in March of that year began to bear fruit. That trend held until June of this year, when lower price growth estimates lost their ability to uplift consumers’ mood.

More of the same would amount to yet another worrying sign for the U.S. demand trajectory.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.