Gold Price Forecast Q2 2022: Outlook Proves Mixed

Gold Price Forecast Q2 2022: Outlook Proves Mixed

There’s no two-ways about it: gold prices outperformed our expectations in Q1’22. Our rationale for not taking a bullish outlook on gold was, and still is, well-grounded: central banks, including the Federal Reserve, have begun to wind down pandemic-era stimulus efforts, with rate hike cycles just getting started.

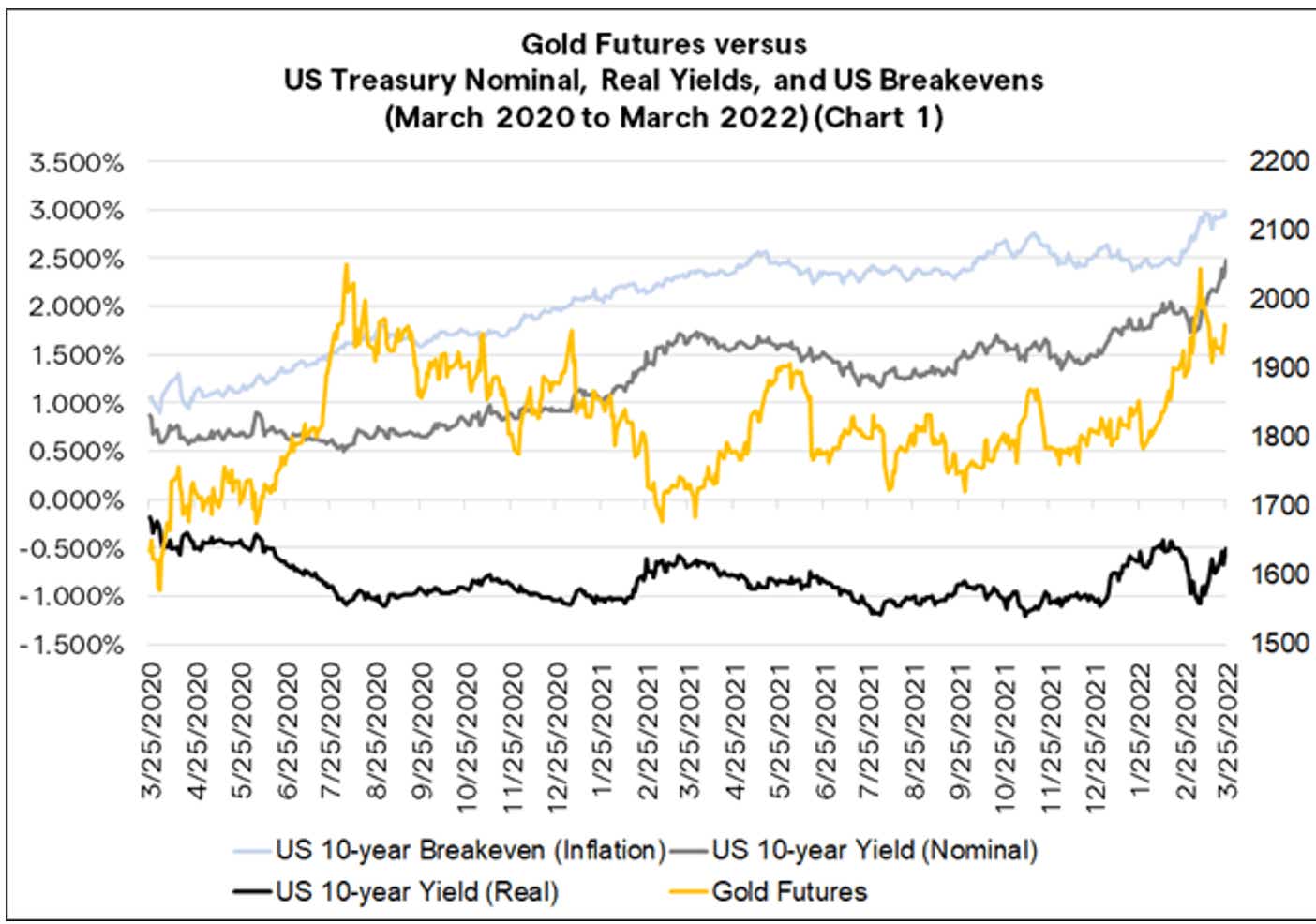

At least in the short-term, a potent catalyst arrived that trumped interest expectations: Russia’s invasion of Ukraine. With global financial markets upended and commodity supply chains in disarray, inflation expectations skyrocketed again. Instead of rising real yields, we saw falling real yields from mid-February through the end of March.

Alas, with the prospect of a Russia-Ukraine ceasefire gathering steam towards the end of Q1’22, it’s possible that sanctions against Russia are lifted, thereby removing pressure on global commodity supply chains. In turn, inflation expectations could backoff, and consistent with the longer-term narrative of central banks raising interest rates, real yields could start to rise again.

Therein lies the challenge for gold prices in Q2’22: unless there is a dramatic escalation in the conflict between Russia and Ukraine that ensnares the European Union and the United States into a protracted dispute, the catalyst that drove gold prices higher in recent months is likely to be short-lived.

US REAL YIELDS PROVE PROBLEMATIC

Despite the disruption created by the Russian invasion of Ukraine, the same obstacles remain for gold prices henceforth. With central banks acting to tamp down persistently higher realized inflation in the short-term, longer-term inflation expectations should begin to ease back, pushing down real yields and thus preventing gold prices from holding onto recent gains.

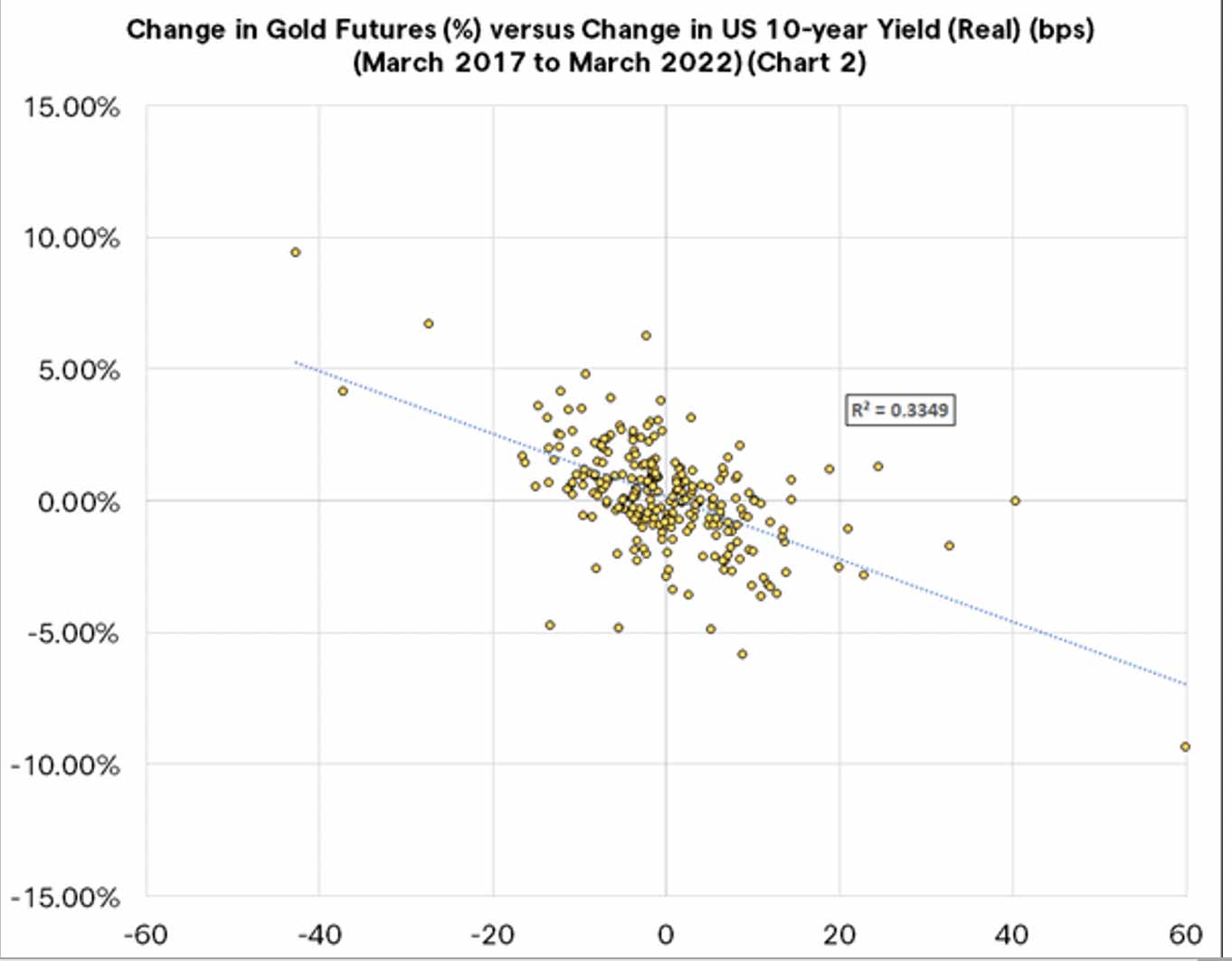

Gold, like other precious metals, does not have a dividend, yield, or coupon, thus rising US real yields remain problematic. In other words, when other assets are offering better risk-adjusted returns, or more importantly, offering tangible cash flows during a time when inflation pressures are raging, then assets that don’t yield significant returns often fall out of favor. Gold behaves, in effect, like a long duration asset (as measured by modified duration, not Macaulay duration); a zero-coupon bond.

Gold Futures vs US Treasury Nominal (Chart 1)

The facts on the ground haven’t changed and will become a greater influence should the Russia invasion of Ukraine stop. Monetary easing enacted by central banks and fiscal stimulus provided by governments are now firmly in the rearview mirror. A ceasefire between Russia and Ukraine will relieve pressure in food and energy prices, which in turn will help reduce inflation expectations. But because of how high inflation readings are in economies like the EU, the US, and the UK, central banks will still raise interest rates aggressively over the course of 2022.

It thus stands to reason that rising real rates are a meaningful obstacle for gold prices over the next few months. Over the past five years, gains by US real yields have been generally correlated with losses by gold prices. A simple linear regression of the relationship between the weekly price change in gold prices and the weekly basis points change for the US 10-year real yield, reveals a correlation of -0.34. As a rule of thumb, rising real yields are bad for gold prices.

Barring World War 3, it’s difficult to envision how the environment becomes any more appealing for gold prices from a fundamental perspective. Yes, there is chatter about how the EU and US sanctions against Russia threaten US Dollar hegemony, which ultimately may provoke more countries to abandon USD-denominated reserves and instead allocate more reserves to gold. But that’s a longer-term story, one that won’t play out over the next quarter, or even year, particularly as over 40% of global trade continues to be denominated in USD (and another 35% in EUR).

In short, gold prices have two likely paths forward: sideways (as the Russian invasion of Ukraine continues, keeping inflation expectations elevated as central banks raise rates, keeping the status quo in real yields); or lower (as the Russian invasion of Ukraine ends, sinking inflation expectations as central banks raise rates, pushing higher real yields).

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Christopher Vecchio, CFA, Senior Strategist

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.