Macro Week Ahead: Will the dollar keep rising as the U.S. economy leaps ahead of the rest?

Macro Week Ahead: Will the dollar keep rising as the U.S. economy leaps ahead of the rest?

By:Ilya Spivak

Can the world economy hold up if U.S. strength brings higher interest rates for everyone?

- The markets seem to be lining up for reflation and higher interest rates.

- The Bank of Canada update might offer clues about U.S. economic trends.

- S&P Global PMI data to show the U.S. diverging from other economies.

Wall Street shifted into a lower gear last week. The bellwether S&P 500 index rose 0.8% and while the tech-tilted Nasdaq 100 added just 0.2%, following gains of 1% and 1.1% respectively in the previous week. The bond market idled, with yields inching a hair lower after four weeks of gains.

The U.S. dollar was undeterred, however, rising for a third week straight. Nevertheless, gold prices continued to push upward, scoring their best performance in five weeks. Crude oil plunged 9.1% amid seemingly cooling fears about direct military escalation between Israel and Iran.

Taken together, all this seems to distill into a tale about a Federal Reserve that will be too slow to respond to reflation. A parallel rise in gold and the greenback alongside a yield curve hovering near its steepest setting in over two years suggests markets foresee a hamstrung central bank in 2025 after it cuts rates in November and December of this year.

Against this backdrop, here are the macro waypoints likely to shape what comes next.

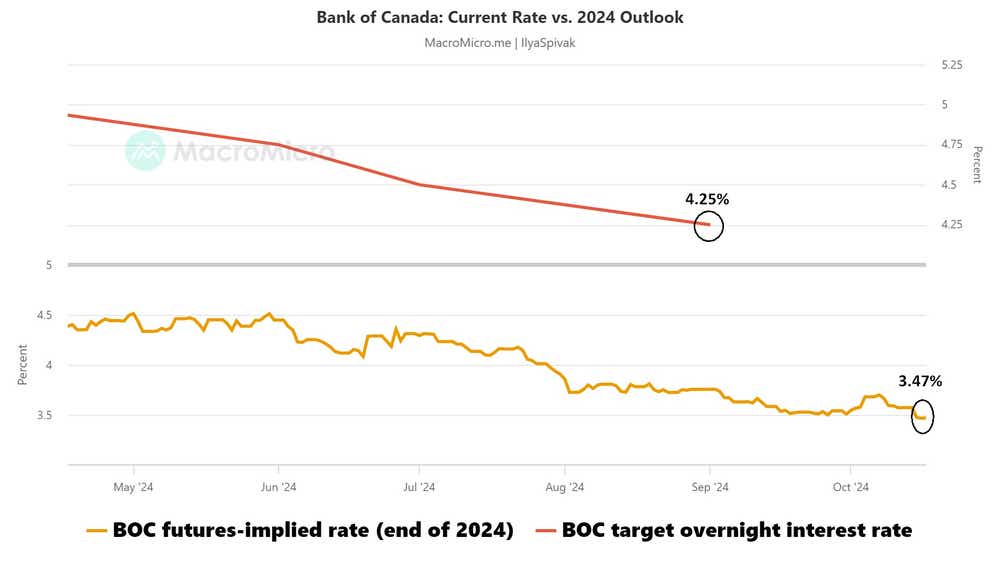

Bank of Canada (BOC) interest rate decision

Canada’s central bank is expected to deliver the equivalent of three 25-basis-point (bps) rate cuts over its remaining two meetings in 2024. That breaks down to 50bps priced in for this week’s rate decision, followed by 25bps more in December. The outsized move follows a sharp drop in inflation amid an ongoing contraction of economic activity.

An updated set of economic forecasts will be closely watched. Canada’s economy is typically tied at the hip with that of the U.S. because the latter soaks up nearly 80% of former’s exports. The two have strayed recently however, with the U.S. outperforming by a wide margin. Traders will be keen to gauge which way the two might re-converge.

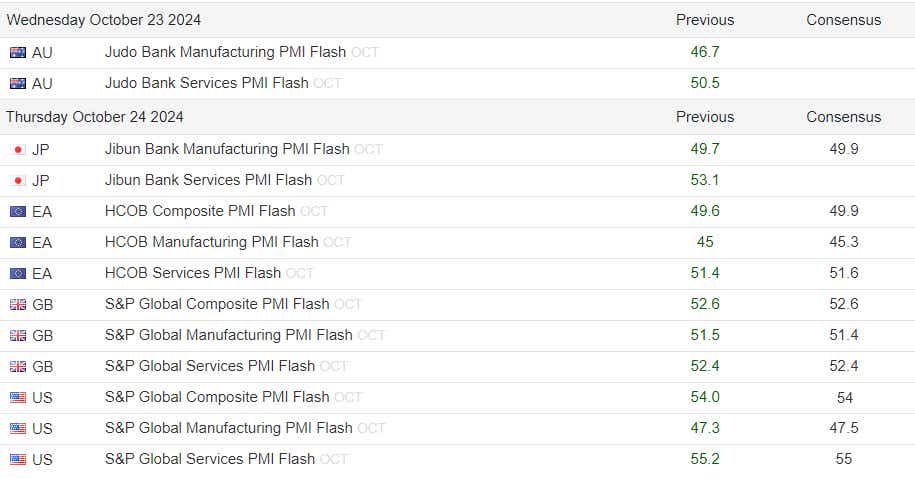

S&P Global purchasing managers index (PMI) data

An update on global growth trends will come by way of October’s purchasing managers’ index (PMI) surveys covering most major economies from S&P Global. The numbers are expected to show a resilient U.S. continues to defy deterioration elsewhere. The Eurozone is seen contracting for a second month and at a faster rate.

This will raise an important question for investors. If the trend in U.S. growth, inflation and interest rates continues to diverge from the rest, economies outside the North American giant will find themselves facing higher borrowing costs at precisely the wrong time.

That’s because the Fed largely sets the trend for the price of global credit because it is toggling the cost of loans in the world’s ubiquitous settlement currency, the U.S. dollar. If Fed Chair Jerome Powell and company find they are unable to ease with gusto as a strong economy revives inflation, the lagging economies beyond U.S. shores will be doubly burdened.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.