FX Week Ahead –Top 5 Events: BOE, ECB, & RBA Rate Decisions; Canada Jobs Report; US NFP

FX Week Ahead –Top 5 Events: BOE, ECB, & RBA Rate Decisions; Canada Jobs Report; US NFP

FX Week Ahead Overview:

- The first week of February brings forth several rate decisions and jobs reports from G20 economies.

- While the Reserve Bank of Australia and the Bank of England may take actual action this week, the European Central Bank is still several months away from pivoting from its dovish stance.

- Both the Canada jobs report and the US nonfarm payrolls report for January may prove disappointing as the COVID-19 omicron variant roiled North America.

For the full week ahead, please visit the DailyFX Economic Calendar.

02/01 Tuesday | 03:30 GMT | AUD Reserve Bank of Australia Rate Decision

The Reserve Bank of Australia will take note of the fact that inflation pressures and expectations remain elevated, and a rebounding labor market is expected to help keep growth tilted higher for the foreseeable future. Similarly, they will likely zero out their QE program. The current Australian unemployment rate of 4.6% is quickly approaching the RBA’s 2022 year-end forecast of 4.2%. These factors point to an aggressive RBA this year – but no rate hikes are imminent.

According to Australia overnight index swaps (OIS), the first 25-bps rate hike is anticipated for July (54% chance). A second rate hike is expected in September (61% chance) and a third rate hike anticipated in December (64% chance). Any commentary that drags forward rate hike odds will prove beneficial for the Australian Dollar, as the RBA closes the policy gap with more hawkish central banks like the Federal Reserve.

02/03 Thursday | 12:00 GMT | GBP Bank of England Rate Decision

With UK inflation rates at their highest level in a decade and accumulating evidence that the labor market is steadily improving, both Bank of England policymakers and rates markets believe that more policy tightening is ahead. Rates markets are discounting February 2022 as the most likely period for when rates will rise next, with an 98% chance of a 25-bps rate hike; this is an increase from 66% at the start of January. Moreover, rates markets have discounted a fourth rate hike in 2022, up from three at the start of 2022. A BOE rate hike this week aligns neatly with the release of the Monetary Policy Committee’s next iteration of the Quarterly Inflation Report (QIR). The British Pound should remain well-supported around an increasingly hawkish BOE.

02/03 Thursday | 12:45 GMT | EUR European Central Bank Rate Decision & Press Conference

ECB policymakers have been beating the same drum for the past several months: no rate hikes are coming in 2022. The final policy meeting of 2021 noted that the Governing Council believed that “monetary accommodation is still needed for inflation to stabilise at the 2% inflation target over the medium term.” ECB President Christine Lagarde has called the current rise in inflation as a “hump.” Inflation data this week is showing that price pressures are not pulling back as quickly as anticipated, however. Rates markets are pricing in an 89% chance of the first 10-bps rate hike to arrive in July 2022. Nevertheless, Euro rallies may be providing a selling opportunity as ECB rate hike odds fall back, in line with policymakers’ commentary.

02/04 Friday | 13:30 GMT | CAD Employment Change & Unemployment Rate (Jan)

A surge in COVID-19 omicron variant infections coupled with increasing protests about mandatory vaccinations may have hindered the Canadian labor market at the start of 2022. According to a Bloomberg News survey, the Canadian economy lost -117.5K jobs in January after adding +54.7K jobs in December. The Canadian unemployment rate is expected to jump considerably, from 5.9% to 6.2%. But with risk appetite starting to stabilize and oil prices continuing to press higher, any weakness seen in the Canadian Dollar around a weak January labor report may prove to be a ‘buy the dip’ opportunity.

02/04 Friday | 13:30 GMT | USD Nonfarm Payrolls & Unemployment Rate (Jan)

Like in Canada, the spread of the COVID-19 omicron variant appears to have weighed on the US labor market. Notably, US jobless claims have ticked higher every week through January, and alongside declining PMI readings, a weaker US jobs reading is expected. According to a Bloomberg News survey, forecasters are looking for jobs growth of +153K while the unemployment rate (U3) is anticipated to hold at an impressive 3.9%. Meanwhile, the US labor force participation rate is due to stay on hold at a still-meager 61.9%. Wage growth is expected to remain robust, at +5.2% y/y in January from +4.7% y/y in December.

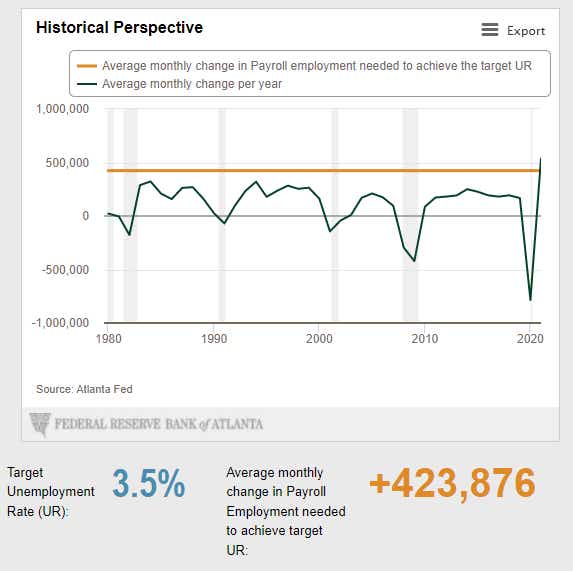

Atlanta Fed Jobs Growth Calculator (January 2022)

The US economy continues to inch closer towards achieving ‘full employment’ as experienced pre-pandemic. According to the Atlanta Fed Jobs Growth Calculator, the US economy needs +424K jobs growth per month over the next 12-months in order to return to the pre-pandemic US labor market of a 3.5% unemployment rate (U3) with a 63.4% labor force participation rate.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2024 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.