FOMC Preview: Stocks at Risk, Bonds May Rebound as the U.S. Dollar Falls

FOMC Preview: Stocks at Risk, Bonds May Rebound as the U.S. Dollar Falls

By:Ilya Spivak

With the spotlight on officials’ guidance for next year, the markets may be in for a rude awakening

- Another 25-basis-point Fed rate cut is almost certain at this week’s FOMC meeting.

- Markets are interested in what policymakers envision for next year.

- Stocks are at risk, bonds may bounce as the U.S. dollar falls on Fed gradualism.

All eyes are on the Federal Reserve and its Chair Jerome Powell for the U.S. central bank’s last meeting of 2024. The announcement of another interest rate cut seems a foregone conclusion. This puts the spotlight on officials’ guidance for what will come next year. On that score, the markets may be in for a rude awakening.

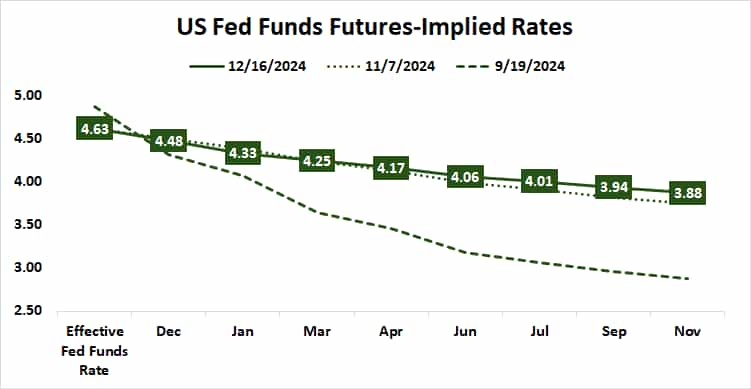

Fed Funds interest rate futures price in the probability of a 25-basis-point (bps) interest rate cut at this gathering of the policy-steering Federal Open Market Committee (FOMC) at a commanding 95.4%. That means the move has been thoroughly subsumed into asset prices, leaving little to inspire market action.

The markets care most about the FOMC rates forecast for 2025

This step lower completes the forecast that the Fed confidently issued in September, when its quarterly summary of economic projections (SEP) called for 100bps in cuts this year, 50bps of which were delivered upfront. From there, it was hardly a stretch to envision 25bps apiece at the year’s remaining meetings in November and December.

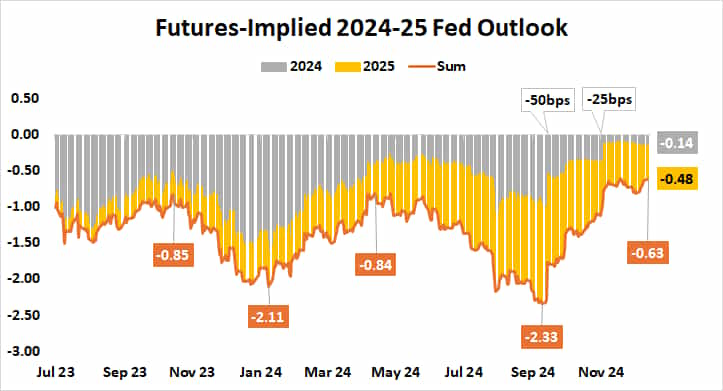

Policymakers penciled in another 100bps for 2025. The markets almost immediately judged that as unlikely because U.S. economic data pointed to strengthening momentum, signaling that rate cuts would reignite inflation and stop the central bank in its tracks.

It kicked off two months of repricing that sent Treasury bond yields and the U.S. dollar sharply higher as traders marked down 2025 rate cut expectations from 130bps on the eve of the Fed’s September meeting to just 48bps today. This boils down to two standard-sized rate cuts, down from five.

Stocks may wobble as bonds rise and the U.S. dollar falls on Fed guidance

For their part, Fed officials have mostly endorsed this rethink. Powell and company have spoken out repeatedly about the central bank’s intention to stay flexible, looking through economic data volatility yet still pivoting as need be. That means the FOMC wants to be careful not to overreact even as it asserts that policy is not on dovish autopilot.

On balance, this implies the committee will scale back dovish intent when it updates the SEP this week but probably not to the same extent as jumpy financial markets. For the Fed to pace traders’ thinking, they’d have to lower their forecast to at most two rate cuts for next year. They might opt for a more modest step down to three.

In this scenario, the markets might find themselves offside having overshot on hawkish repositioning. Rebalancing the books accordingly after the FOMC announcement may push bond prices higher as yields come down and the U.S. dollar weakens against most of its major currency counterparts. Stock markets may wobble too.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.