FOMC May 2023 Meeting Preview: Is the Fed Finished?

FOMC May 2023 Meeting Preview: Is the Fed Finished?

FOMC Meeting: Rate Hikes Could Be Ending

With the May Federal Reserve rate decision set for Wednesday, it’s an opportune time to review comments and speeches made by various Fed policymakers before the communications blackout window. Just like during the prior communications blackout window, a bank failed (then: Signature Bank; now: First Republic). Accordingly, commentary regarding financial stability and the fight against inflation remains relevant heading into the May Fed meeting.

One and Done? Maybe Not

Fed policymakers spend the interim window between the March and May FOMC meetings trying to assuage market fears that the regional banking issue was an episode and not a crisis spiraling out of control. Under that premise, Fed officials continued to talk up the possibility for additional rate hikes in the face of still-uncomfortably high inflation.

What Did Fed Officials Say Between Meetings?

March 24 – Barkin (Richmond president) said that the case for raising rates at the March FOMC meeting was “clear,” as “inflation, unfortunately, has stayed too high.”

March 26 – Kashkari (Minneapolis president) offered some perspective on how the Fed is viewing the failures of SVB and Signature Bank. “What’s unclear for us is how much of these banking stresses are leading to a widespread credit crunch. Would that slow down the economy? This is something that we’re monitoring very, very closely.”

March 27 – Barr (Fed Vice Chair for Banking Supervision) remarked that the Fed “will continue to closely monitor conditions in the banking system and are prepared to use all of our tools for any size institution, as needed, to keep the system safe and sound.”

Jefferson (Fed governor) noted that bank failures cropping up are a result of the lagged impact of monetary policy on the economy, and that “we are still learning about the full effect of our tightening thus far.”

March 28 – Bullard (St. Louis president) wrote that financial conditions have tightened as a result of the banking crisis.

Barr confirmed that the Fed’s inspector general has launched a review of the failure of Silicon Valley Bank.

March 29 – Powell (Fed Chair), in a private meeting with lawmakers, suggested that the Fed will only hike rates once more by 25-bps in 2023.

March 30 – Barkin said that he still sees inflation risks, but if credit risks pop up, then policymakers will have to be nimble to adjust course.

Collins (Boston president) suggested that inflation remains “too high” and that “there is more work to do.”

Kashkari noted “what’s unclear right now is how much of the banking stresses of the past few weeks is leading to a sustained credit crunch which would then slow down the US economy.”

March 31 – Collins again noted that “we still do have more work to do and more to see to know that inflation is really on a sustained downward path.”

Williams (New York president) argued that Fed policy is not on a preset course, and that “our policy decisions will be driven by the data and the achievement of our maximum employment and price stability mandates.”

April 3 – Bullard, reacting to the OPEC+ production cut announcement, said “some of that might feed into inflation and make our job a little bit more difficult.”

Cook (Fed governor) remarked “we are still going to see inflation from that but we’ve seen wage gains moderating quite a bit.”

April 4 – Mester (Cleveland president) said that the Fed’s main rate should move above 5% this year and stay there for some time, with how long depending upon how inflation pressures recede.

April 5 – Mester again called for higher rates, saying that they need to be “a little bit higher” and remain there for some time.

April 6 – Bullard noted that “financial stress seems to be abated, at least for now,” which gives the Fed room to turn its attention back to inflation.

April 10 – Williams pushed back against the idea that the Fed brought about these bank failures, downplaying the systemic risk as “there were some pretty idiosyncratic specific issues with those institutions” that failed in March.

April 11 – Williams said that the Fed has more work to do on inflation and that work won’t be impacted by what’s happening in the banking sector.

Goolsbee (Chicago president) warned against raising rates too quickly in the wake of the banking crisis, “given how uncertainty abounds about where these financial headwinds are going, I think we need to be cautious.”

Harker (Philadelphia president) said that the Fed remains data dependent as it takes up to 18 months for monetary policy changes to filter through to the real economy.

Kashkari offered an optimistic assessment, noting “I’m not ready to declare all clear but there are hopeful signs that these risks are now better understood and calm is being restored.”

April 12 – Daly (San Francisco president) commented there are “good reasons to think that the economy may continue to slow, even without additional policy adjustments.”

The March Fed meeting minutes showed that Fed policymakers were ratcheting back expectations of additional rate hikes in 2023 in the wake of the failures of SVB and Signature Bank.

April 14 – Goolsbee again cautioned against being too aggressive with further interest rate hikes.

Waller (Fed governor) took a hawkish approach, saying “because financial conditions have not significantly tightened, the labor market continues to be strong and quite tight, and inflation is far above target, so monetary policy needs to be tightened further.”

Bowman (Fed governor) commented that banking regulations were not to blame for the recent bank failures.

April 17 – Barkin declared he was not done favoring rate hikes as he wants “to see more evidence that inflation is settling back to our target.”

April 18 – Bullard downplayed calls for an imminent recession, “that isn’t really the way you would read an expansion like this.”

Bostic (Atlanta president) argued that “there is still more work to be done” with respect to bringing inflation pressures down.

April 19 – The Fed’s Beige Book is released. “Several districts noted that banks tightened lending standards amid increased uncertainty and concerns about liquidity” following the March banking crisis.

Goolsbee noted that he’s waiting to see how the banking crisis unfolds before he jumps on the recession bandwagon. “Everybody is forecasting some growth slowdown for the second half of the year. How intense that will be is going to depend a lot on the financial part.”

Williams called the banking system “sound and resilient.”

April 20 – Mester took a hawkish approach, saying that she anticipated “that monetary policy will need to move somewhat further into restrictive territory this year, with the fed funds rate moving above 5% and the real fed funds rate staying in positive territory for some time.”

Harker took a more tepid approach, warning “we need to be a little cautious here to not just respond to the current level of inflation, but where we think it’s going.”

April 21 – Cook remarked that she believed the Fed funds rate at 5% will be sufficient to bring inflation back down to 2% over time.

The Pause is Imminent

We can measure whether a Fed rate hike is being priced-in using Fed funds over a specific time horizon in the future in order to gauge where interest rates are headed. Chart 1 below showcases the difference in Fed funds futures for the front month and August 2023 contracts.

Fed Funds Futures Contract Spread (May-August 2023) [orange], US 2s5s10s Butterfly [blue], DXY Index [RED]: Daily Timeframe (August 2022 to March2023) (Chart 1)

The difference of -6-bps between the front month and August contracts suggests that futures markets are pricing in no additional rate hikes from the Federal Reserve after their actions this week. Declining Fed rate hike odds and a flatter belly of the US Treasury yield curve have proved problematic for the US Dollar (and beneficial for gold, /GC, and the Euro, /6E) in recent months.

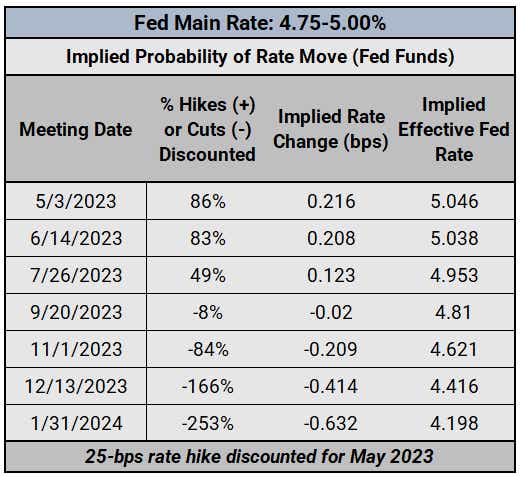

Federal Reserve Interest Rate Expectations: Fed Funds Futures (May 2, 2023) (Table 1)

Rates markets see an 86% chance of a 25-bps rate hike in May, with no rate move favored in June (97% of a hold, 3% chance of a 25-bps rate cut). In other words, peak Fed funds rates have arrived. Contextually, rising rate cut odds at the end of 2023 – 66% chance of 50-bps worth of cuts – are not proving supportive for risk (after all, if the Fed has to cut rates aggressively, it probably means that something bad happened, e.g. many more bank failures).

Expectations for Markets

The May Fed meeting will produce a policy statement and a press conference from Fed Chair Powell. No new Summary of Economic Projections (growth, inflation, and unemployment rate forecasts plus the dot plot) will be produced. The fact that another bank failed during the recent communications blackout window heightens the risk that the Fed will take a relatively cautious tone, even as it promises to continue its fight against inflation.

For bulls, the window is small and closing to find a positive resolution after the May Fed meeting. An end to the Fed hike cycle may be a pyrrhic victory, as the Fed has backed off its hike cycle due to stresses in the banking system (as many Fed officials noted between the March and May meetings). The recent bank failure and sell-off in regional banking shares makes it difficult for the Fed to continue to preach that the banking crisis is contained.

For bears, it’s easy to envision markets reacting negatively to whatever the Fed has to say. If Fed Chair Powell downplays the banking crisis, or promises to do more on inflation, or leaves the door open for further rate hikes – all of those would run counter to the narrative that’s been building in recent weeks that the Fed is finished. Given the fact that the US may default on its debt as soon as June 1, according to US Treasury Secretary Janet Yellen, it does not seem likely that regulators and legislators will be able to address the banking crisis in the immediate future.

--- Written by Christopher Vecchio, CFA, Head of Futures and Forex

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.