Energy Markets Slide as OPEC+ Delays Crucial Meeting

Energy Markets Slide as OPEC+ Delays Crucial Meeting

Meanwhile, natural gas inventories are continuing to rise North America and Europe

Crude oil prices slumped sharply today amid news that OPEC+ would delay a critical meeting to discuss production cuts.

- Rising inventories in North America and Europe continue to weigh on natural gas prices.

- Gasoline prices suggest the U.S. national average could fall to $3 per gallon in the coming weeks.

Market update: crude oil down 7.94% month-to-date

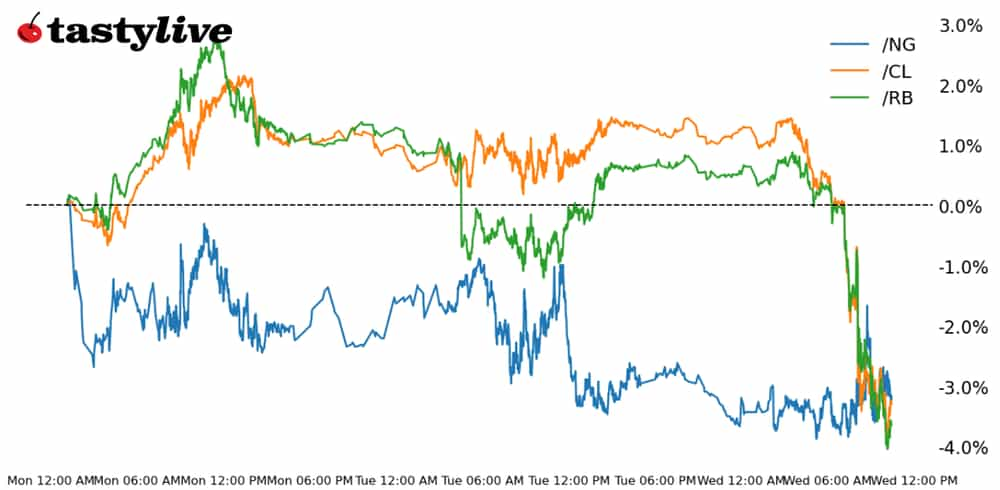

Energy markets were posting a solid rebound over the past few days, but a series of unfortunate events have stacked up to change the course in short order. Inventories continue to build on both sides of the Atlantic, suggesting demand is in a rut. Europe’s natural gas storage is at capacity ahead of the winter months, and U.S. crude oil inventories have jumped meaningfully. The recent American Petroleum Institute (API) report showed a buildup of 9.05 million barrels vs. the expected 100,000.

Supply is problematic as well. An OPEC+ meeting scheduled for today was cancelled because members disagree about how much production would be cut heading into 2024. Apparently, smaller members are reticent to cut production—which is a precondition for Saudi Arabia to turn off its pumps. Even though OPEC+ projected production would be reduced by around 3 million barrels per day (bpd) through 4Q ’23, data suggests that some smaller members are producing beyond their stated quotas, which has translated to a more meager 2 million bpd production cut.

Finally, the ongoing, the ongoing reduction in geopolitical risk premium may also be a factor. News of a truce between Israel and Hamas emerged over the past 24-hours, allowing humanitarian aid to flow into Gaza in exchange for hostages kidnapped from Israel on Oct. 7.

/CL Crude Oil Price Technical Analysis: Daily Chart (April 2023 to November 2023)

The sharp recovery experienced between last Friday and yesterday has been nearly eliminated after the sudden plunge in crude oil prices (/CLF4) today. Down over 4%, /CLF4 is less than $2 off last week’s lows and barely $2.50 away from the uptrend off of the May and June lows.

Momentum is weak and increasingly bearish, with /CLF4 below its daily 5-, 13- and 21-EMA (one-moving average) envelope, which is in bearish sequential order; /CLF4 hasn’t closed above its daily 21-EMA since Oct. 27. MACD (moving average convergence/divergence) has issued a bearish crossover while below its signal line, and slow stochastics turning lower after failing to move above their median line. A drop into and through 72 can’t be ruled out in the short-term; a significant OPEC+ production cut will be necessary to stave off a bigger decline.

/NG Natural Gas Price Technical Analysis: Daily Chart (April 2023 to November2023)

Natural gas prices (/NGF4) have been sliding since the start of November, when reports emerged that Europe’s inventories were full, thus curbing fears of a renewed energy crisis thanks to Russia’s invasion of Ukraine. /NGF4 hit its cycle lows today, now back down below 3 MMBtu. Momentum is firmly negative: /NGF4 is firmly below its daily EMA envelope; MACD is trending lower below its signal line; and Slow Stochastics are nestled in oversold territory. Volatility isn’t that high either (IV Rank: 27.8; IV Index: 69.6%), so a tradeable low does not appear in focus yet.

/RB Gasoline Price Technical Analysis: Daily Chart (April 2023 to November 2023)

Gasoline prices (/RBZ3) have been choppy throughout November, trading between 2.0900 and 2.1745. But this may simply be a bearish flag in context of the decline from the September high, considering that this chop has transpired around the uptrend from the May, June and October swing lows. The continuous contract (/RB) shows that gasoline prices are bouncing around their lowest levels since December 2022. Regardless, the bearish outside engulfing bar today suggests that more weakness is ahead; a return to and through the monthly low of 2.0900 can’t be ruled out. Given the lag and spread to prices at the pump, this means the U.S. national gas average could fall toward $3 per gallon in the coming weeks).

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2024 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.