ECB Interest Rate Decision, UK CPI and China GDP Data: Macro Week Ahead

ECB Interest Rate Decision, UK CPI and China GDP Data: Macro Week Ahead

By:Ilya Spivak

The U.S. dollar has been winning as markets rethink interest rate cut expectations. Will it keep going higher?

- Soft U.K. CPI inflation data might weigh on the British Pound.

- The euro may see deeper losses as the ECB turns more dovish.

- The Australian dollar is at risk as Chinese GDP continues to flounder.

Wall Street shifted into a higher gear last week. The S&P 500 added 1% while the tech-tilted Nasdaq 100 rose 1.1%. That contrasted favorably with the prior week’s near-standstill and marked the first acceleration in a month. Technology shares led with a rise of 2.45%, with industrials and financials not far behind at 2.15% and 1.88% respectively.

A slowdown in the rapid rise of interest rates over recent weeks probably explains some of this vigor. Two-year Treasury yields were barely changed, rising just 0.9% following a 10.2% moonshot in the previous week. Long-end rates continue to press higher, however, with the 10-year rising 3.4%. They’ve now scored the biggest four-week rise in a year.

This has translated into a steepening of the yield curve. The spread between 10- and two-year rates now stands at 13.7 basis points (bps), within a hair of the two-and-a-half-year high at 19.1bps recorded in late September. This likely reflects reflation expectations as the Federal Reserve begins a rate cut cycle even as the U.S. economy perks up.

The U.S. dollar has been a standout beneficiary becaue this repositioning boosts its yield appeal relative to other major currencies. The greenback has added 2.2% against an average of its top counterparts in the past two weeks, making for the strongest such run since February 2023.

Against this backdrop, here are the macro waypoints likely to shape what comes next.

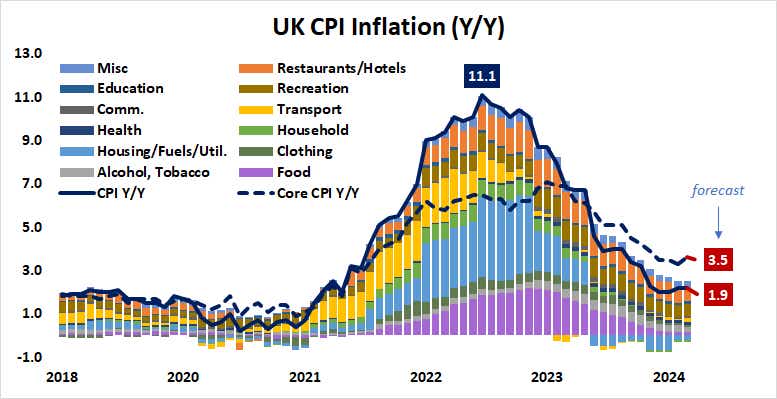

U.K. consumer price index (CPI) data

Inflation is expected to inch down to 1.9% year-on-year in the U.K., the lowest since April 2021. Recent economic data flow has increasingly deteriorated relative to the consensus forecast, according to analytics from Citigroup. That may foreshadow a downside surprise. That might inspire a dovish shift in Bank of England (BOE) policy bets.

As it stands, the markets are pricing in 30.5bps in rate cuts through year-end. That amounts to one standard-sized 25bps rate cut being fully priced in and a 61% cumulative probability of 50bps getting at the remaining policy meetings in November and December. Adjusting to a more dovish setting may hurt the British pound.

European Central Bank interest rate decision

European Central Bank (ECB) President Christine Lagarde and company are narrowly expected to cut the target deposit interest rate by 25bps to 3.25%. Another such move is all but fully priced in for December. Taken together, the markets have discounted 43bps in stimulus before year-end. That amounts to a cumulative 86% probability that both rate cuts will occur.

Next year is expected to bring still move easing. Benchmark ESTR interest rate futures are implying 92bps in rate cuts spread over the central bank’s eight policy meetings in 2025. At a total of 135bps between now and the end of next year, this is narrowly more dovish than the 129bps that markets expect from the Fed over the same period.

Meanwhile, economic growth dynamics in the Eurozone and the U.S. appear to be diverging. The currency bloc’s economy slipped backed into contraction mode in September while the North American behemoth kept continued to grow at a healthy clip, according to S&P Global purchasing managers index (PMI) data.

If ECB officials signal a greater appetite for policy support as economic performance flounders, a repricing of policy expectations may expand the expected policy gap between the two major engines of global demand to favor a more dovish vision for the Eurozone. That might send the euro lower.

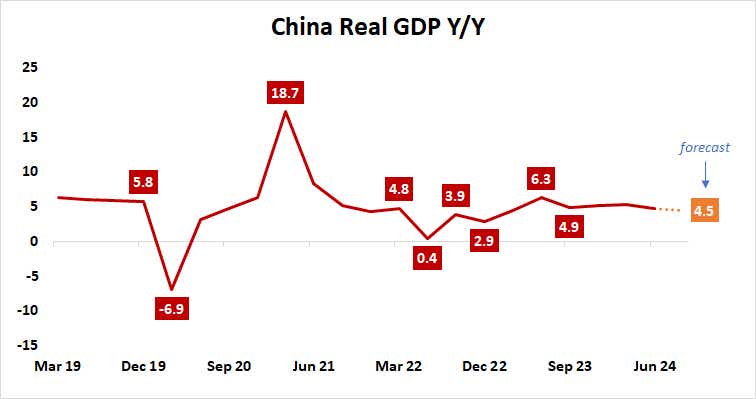

China’s gross domestic product data

Economic growth in China is expected to slow for a second consecutive quarter, registering at 4.5% year-on-year in the three months to September. This softening would extend a series of disappointments this week from the world’s second-largest economy.

Trade and inflation numbers have already fallen short of forecasts, as did a much-anticipated fiscal stimulus announcement. The Ministry of Finance announced measures to shore up municipal government finances and buy up idle land and commercial properties but stopped short of direct demand generation.

A soft result on GDP data might weigh on proxy assets sensitive to Chinese economic trends, such as the Australian dollar. Local stock markets may come under pressure also, but officially backed firefighting efforts might dilute the price transmission mechanism.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.