Deja Vu: Oil Prices are Climbing Higher, Again

Deja Vu: Oil Prices are Climbing Higher, Again

Crude oil is up 12.07% month-to-date

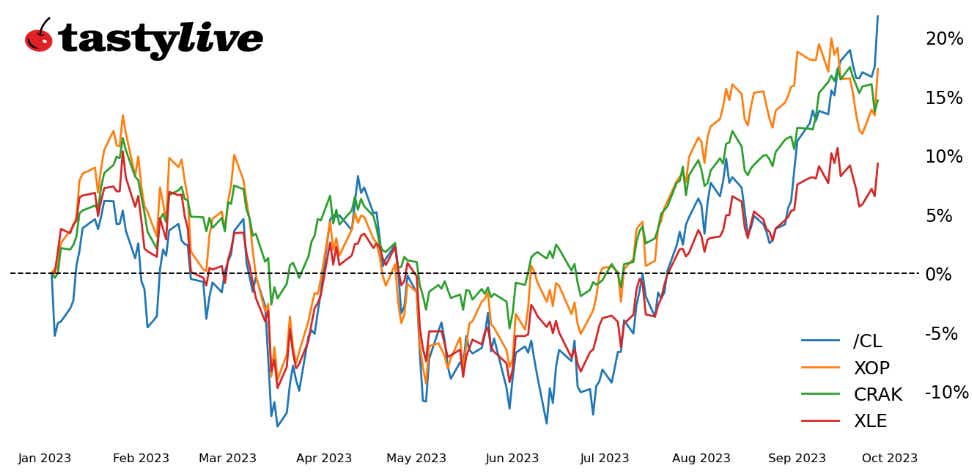

- Crude oil prices (/CL) have hit fresh yearly highs and 52-week highs as supply/demand imbalances are flaring once again.

- Despite struggling U.S. stocks otherwise, energy has been an outperformer since the start of August.

- XLE, XOP, and CRAK remain well-positioned to outperform their peers.

Much of this is a retread of what we’ve been saying since July. There is a supply/demand imbalance that favors higher crude oil prices (/CL) in the near-term. We now have some new data to support that perspective: stockpiles in Cushing, Oklahoma, the crucial U.S. storage hub, are reaching what are called “tank bottoms.” Not only is production down, but inventories are dwindling as well.

To keep it short and sweet: It's still a good time to be “an oil man.” Price action seen in /CLZ3, XLE, XLF, and CRAK underscore that view.

/CL price technical analysis: daily chart (February 2023 to September 2023)

/CLZ3 hit a fresh yearly high (and the continuous contract hit a 52-week high) today as supply concerns rear their ugly head once more. Momentum is still bullish, with /CLZ3 above its daily 5-, 13-, and 21-day exponential moving average (EMA) envelope, which is in bullish sequential order. MACD has issued a bullish crossover while above its signal line again, and slow stochastics are turning higher towards overbought territory. While /CLX3 has reached the 100% Fibonacci extension of the June 28 swing low/Aug. 10 swing high/August 28 swing low range at 93.03, /CLZ3 has not yet: 92.40 is still in reach. The technical measurement higher may be complete, which turns the technical outlook into a pure momentum play at this point.

XLE price technical analysis: daily chart (July 2022 to September 2023)

A few days ago, it appeared that XLE’s uptrend from the June and August lows was imperiled. Alas, a return above the trendline reinforces the view that bulls are back in control. Momentum is improving once again, with XLE above its daily EMA envelope (which is in bullish sequential order, moving average convergence/divergence (MACD) on the cusp of issuing a buy signal while above its signal line, and slow stochastics racing higher. It remains the case that a return to the November 2022 high at 94.71 is in focus.

XOP price technical analysis: daily chart (November 2022 to January 2023)

XOP struggled more than XLE during the recent downturn but is now flexing its muscles as the leader on the way back up. The momentum structure is not quite fully bullish yet, but the corrective move back into the August bull flag has been completed; the bullish breakout is in play once again. As such, the technical perspective looks for XOP to return to its November 2022 high at 161.42; only a meaningful setback in crude oil prices would undermine this outlook.

CRAK price technical analysis: weekly chart (September 2019 to September 2023)

CRAK tracks refiners, not producers, like XLE and XOP. It was previously noted that CRAK was on track to return to the all-time highs near 36; CRAK topped at 35.89 before taking a breather. That said, dwindling supplies and a diesel fuel shortage (particularly in the Northeastern U.S.) is likely to keep refiners humming along in the very near-term. The breakout from the symmetrical triangle that began in June 2022 remains the primary thrust, keeping in focus the much longer-term ascending triangle that may have formed dating back to 2018. All-time highs are in focus unless short-term momentum buckles.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.