Central Bank Watch: BOC, RBA, & RBNZ Interest Rate Expectations Update

Central Bank Watch: BOC, RBA, & RBNZ Interest Rate Expectations Update

CENTRAL BANK WATCH OVERVIEW:

- Delta variant concerns and political considerations are changing the narrative around the BOC, RBA, and RBNZ as September begins.

- The RBA has announced a ‘lower for longer’ strategy – reducing its asset purchases but extending the time horizon of purchases – while the BOC may temper its own stimulus withdrawal.

- Retail trader positioning suggests that the near-term outlook is mixed for the trio of major commodity currencies.

CENTRAL BANKS LOSE THEIR NERVE

In this edition of Central Bank Watch, we’re examining the rates markets around the Bank of Canada, Reserve Bank of Australia, and Reserve Bank of New Zealand. While the RBNZ has already blinked and backed away from tightening measures until at least October, it appears that the RBA and BOC having been facing down similar decisions. True, the RBA did just announce an alteration to its QE program – more on that shortly. For the BOC, which has its September policy meeting on the immediate horizon, a test of its commitment to stimulus withdrawal is on deck.

BANK OF CANADA STIMULUS WITHDRAWAL PROCEEDING?

The BOC pushed ahead with its stimulus reduction efforts in July, by tapering its QE program by C$1 billion, bringing its asset purchases to C$2 billion per week. Since then, however, the situation in Canada has deteriorated on two fronts: political stability has been upended ahead of the federal elections on September 20; and rising COVID-19 infections have undercut the economy’s gathering momentum.

This mix curates an environment that suggests that the BOC will be cautious at its September policy meeting this Wednesday, diminishing the likelihood of a further reduction in asset purchases in the near-term.

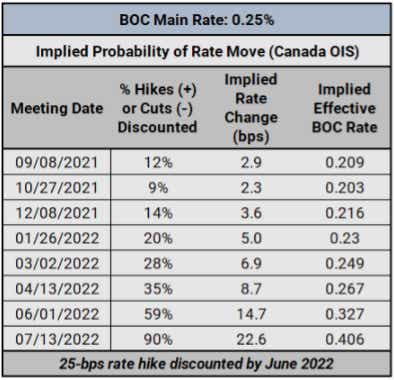

BANK OF CANADA INTEREST RATE EXPECTATIONS

(SEPTEMBER 7, 2021) (TABLE 1)

If the BOC does indeed blink and put political and public health concerns at the forefront of its decision making this week, rates markets are foreseeing only a temporary pause in stimulus reduction efforts. Indeed, relative to mid-August when Canada overnight index swaps were pricing in a 4% chance of a 25-bps rate hike by the end of 2021 and the first 25-bps rate hike arriving in July 2022, there is now a 14% chance of a 25-bps rate hike by the end of the year and the first 25-bps rate hike is due to arrive in June 2022.

IG CLIENT SENTIMENT INDEX: USD/CAD RATE FORECAST

(SEPTEMBER 7, 2021) (CHART 1)

USD/CAD: Retail trader data shows 65.35% of traders are net-long with the ratio of traders long to short at 1.89 to 1. The number of traders net-long is 15.42% lower than yesterday and 15.85% lower from last week, while the number of traders net-short is 18.01% higher than yesterday and 22.97% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USD/CAD prices may continue to fall.

Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current USD/CAD price trend may soon reverse higher despite the fact traders remain net-long.

RESERVE BANK OF AUSTRALIA’S ‘LOWER FOR LONGER’

Like in August, which produced a reduction in asset purchases by A$1 billion, the September policy meeting saw QE lighten its load by another A$1 billion to A$3 billion per week. However, the RBA is putting a twist on the phrase ‘lower for longer,’ by announcing that it would extend its QE program from November 2021 until February 2022. Thus, while the rate of asset purchases is now lower than previously, it will continue for several months longer than previously anticipated.

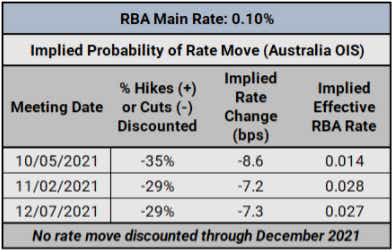

RESERVE BANK OF AUSTRALIA INTEREST RATE EXPECTATIONS

(SEPTEMBER 7, 2021) (TABLE 2)

The ‘lower for longer’ stance on the QE front has translated into a reduction in expectations that rate hikes are coming soon thereafter. Of course, tapering isn’t tightening, but it’s been long understood that the RBA’s QE program would be completely tapered off prior to any rate hikes. According to Australia overnight index swaps, there is a 29% chance of a rate cut through December 2021, down from 38% in mid-August.

IG CLIENT SENTIMENT INDEX: AUD/USD RATE FORECAST

(SEPTEMBER 7, 2021) (CHART 2)

AUD/USD: Retail trader data shows 41.74% of traders are net-long with the ratio of traders short to long at 1.40 to 1. The number of traders net-long is 4.96% lower than yesterday and 17.88% lower from last week, while the number of traders net-short is 0.14% lower than yesterday and 22.79% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests AUD/USD prices may continue to rise.

Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger AUD/USD-bullish contrarian trading bias.

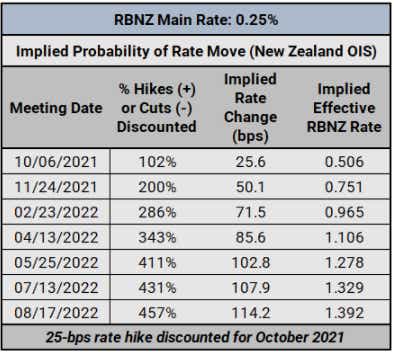

RBNZ BACK ON TRACK?

After New Zealand entered a “level four lockdown” in mid-August, rate hike odds plummeted for the RBNZ meeting set to convene the following day. By delivering no rate move, the RBNZ inevitably tanked the Kiwi, which had previously been riding higher on the back of a 100% chance of a 25-bps rate hike in August. Now, containment of the latest COVID-19 infections has recalibrated expectations that the RBNZ will deliver on its tightening promise when it meets next in October.

RESERVE BANK OF NEW ZEALAND INTEREST RATE EXPECTATIONS

(SEPTEMBER 7, 2021) (TABLE 3)

According to overnight index swaps for New Zealand, there is a 100% chance of a 25-bps rate hike when the RBNZ gathers next month. But that’s not all: there is also a 100% chance of a second 25-bps rate hike in November, and an 86% chance of a third 25-bps rate hike by February 2022. As vaccination rates accelerate in New Zealand, the ‘zero covid policy’ will fade away, giving the RBNZ clearance to act quickly to tighten monetary policy.

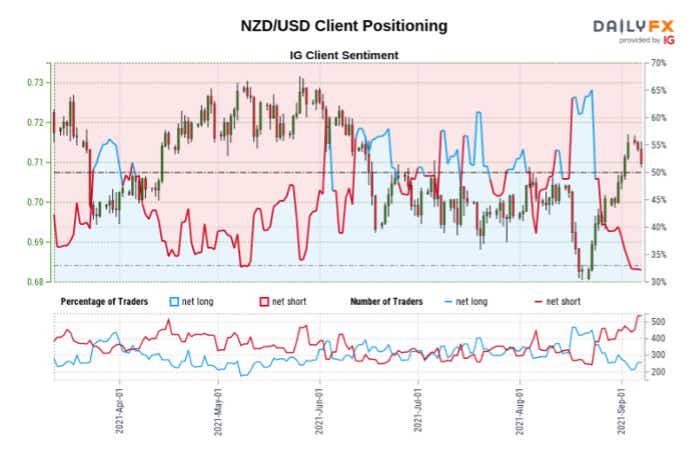

IG CLIENT SENTIMENT INDEX: NZD/USD RATE FORECAST

(SEPTEMBER 7, 2021) (CHART 3)

NZD/USD: Retail trader data shows 30.22% of traders are net-long with the ratio of traders short to long at 2.31 to 1. The number of traders net-long is 2.19% higher than yesterday and 12.08% lower from last week, while the number of traders net-short is 0.37% lower than yesterday and 22.00% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests NZD/USD prices may continue to rise.

Positioning is less net-short than yesterday but more net-short from last week. The combination of current sentiment and recent changes gives us a further mixed NZD/USD trading bias.

Written by Christopher Vecchio, CFA, Senior StrategistOptions involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2024 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.