GBP/USD: BOE Struggles to Tame Inflation

GBP/USD: BOE Struggles to Tame Inflation

By:Ilya Spivak

As inflation persists, will the UK central bank trigger a recession?

- Expectations rise for inflation in the U.K. despite a hawkish Bank of England.

- Wage growth is derailing rate hikes, demanding still harsher tightening.

- The British pound may fall if the markets question policymakers’ conviction.

The world’s top central banks are worried that they are not doing enough to tame inflation.

Officials at the Reserve Bank of Australia and Bank of Canada surprised the markets by increasing interest rates this month. The hike announced by the European Central Bank was expected, but President Christine Lagarde and company struck a noticeably more hawkish tone than traders were anticipating. The U.S. Federal Reserve loudly talked up its inflation-fighting appetite, even as it paused after increasing rates at 10 consecutive policy meetings.

U.K. inflation refusing to yield to Bank of England interest rate hikes

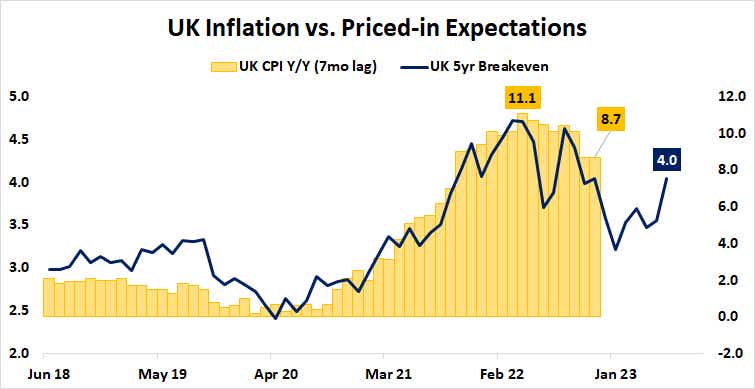

The Bank of England (BOE) is next up. The situation bedeviling Governor Andrew Bailey and the bank's rate-setting Monetary Policy Committee amounts to the nightmare scenario that other central banks are so keen to avoid. Inflation expectations are marching higher despite a spirited 440 basis points or 4.4% in hikes from the lows in late 2021. This threatens to derail even the modest cooling from last year’s peak price growth above 11% to 8.7% in May.

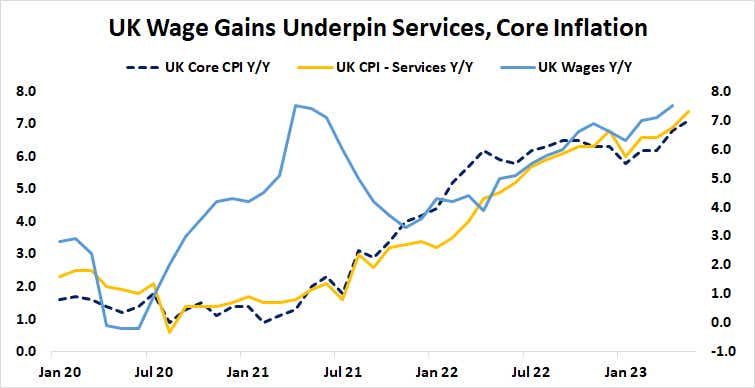

This pullback in headline consumer price index (CPI) inflation has mostly come from slowing price growth on the “goods” side of the ledger, as the global rise in borrowing costs slows trade. However, core prices—excluding volatile items like food and energy—continue to move higher, lifted by pressure from the “services” side. Accelerating wage growth appears to be the culprit here, reflecting the still-tight U.K. jobs market.

Triggering recession: the nightmare scenario for central banks

Despite some modest loosening this year, labor supply relative to demand is about 50% lower now than the pre-pandemic average. Brexit has made tapping external labor markets more difficult at a time when access to workers from across the European Union might have been helpful. With little hope for a supply-side solution, demand destruction—in other words, willfully triggering recession—seems to be the central bank’s only viable path to disinflation.

Predictably enough, the markets are pricing in a string of rate hikes in the second half of this year. An increase of at least 25 basis points is fully baked in at every BOE policy meeting for the remainder of the year. The target Bank Rate is seen peaking close to 6% as the calendar turns to 2024. That adds up to 150 basis points in hikes over five meetings, suggesting at least one of them will bring an outsized 50 basis points increase.

Even this seemingly heroic effort appears insufficient in the minds of investors. Inflation expectations have continued to increase even against the backdrop of a sharp steepening in the expected rate hike path since the last BOE conclave in early May. Markets will look for the BOE to up the ante this week. In essence, they will call on the central bank to punish the economy more harshly if its efforts are to be seen as credible.

The British pound stands to suffer if policymakers fail to appear sufficiently convincing, aggressive rate hikes notwithstanding. The currency tellingly fell even after May’s CPI report produced a higher-than-expected inflation reading, an outcome ostensibly supportive of a firmly hawkish stance. This hints that traders question whether Bailey and team have the stomach for the kind of blood-letting that appears to be required. Central banks keen to avoid a similar fate may find morbid inspiration in the BOE’s plight to press on with their own rate hikes, lest they too face the stark choice between runaway price growth and a self-inflicted slump.

Ilya Spivak, tastylive head of global macro, has 15 years of expertise in trading strategy, specializing in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday.

For live daily programming, market news and commentary visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.