If a Global Recession is Coming, the Australian Dollar May See It Early

If a Global Recession is Coming, the Australian Dollar May See It Early

By:Ilya Spivak

Active investors can watch for warning signs in Australian dollar trading. They could spell trouble.

Australian dollar price swings echoed the seesawing stock markets in July and August.

Financial markets are betting on RBA rate cuts, but the central bank is resisting.

Incoming inflation data may provide a telltale clue about risks to local and global growth.

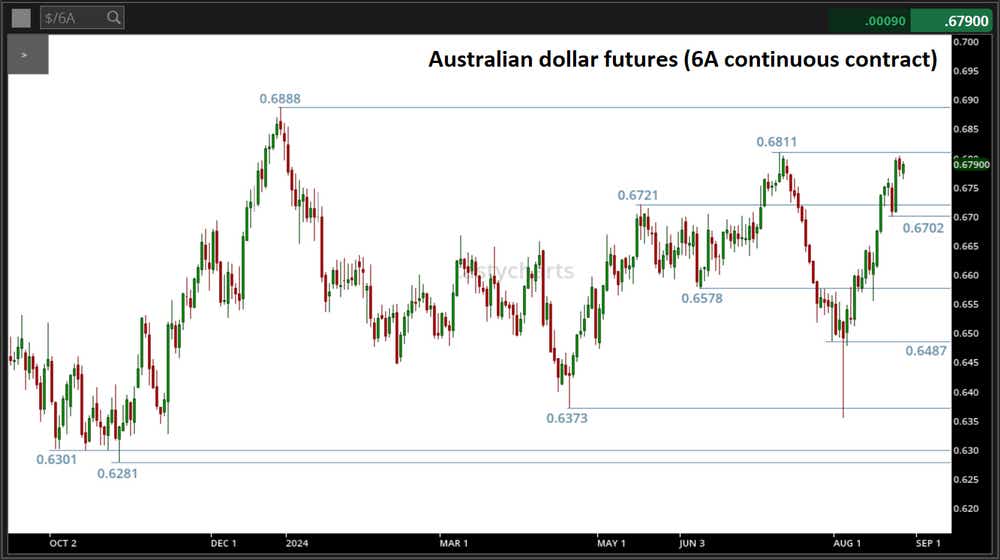

The rapid ups and downs of Wall Street in July and August have appeared in nearly perfect parallel in Australian dollar price action. The currency sank against its U.S. counterpart as swelling recession fears gripped financial markets but then mounted a spirited rebound along with stocks after a crescendo sell-off on August 5.

This has brought prices to a decisive level. After a blistering three-week rally, the currency now trades within a hair of July’s peak just above the 0.68 figure. A daily close above this barrier may set the stage for extension higher to the December 2023 high, which sits a bit below the 0.69 mark.

Immediate support appears to be at the 0.67 threshold. A move lower that re-establishes a foothold below this barrier would put prices back into a familiar congestion area where they have been finding friction at least since the beginning of the year. Its lower bound appears to be just under 0.66.

Incoming economic data may define how the currency resolves itself at this crossroads. Economists expect to see that Australian inflation slowed for a second consecutive month in July. The monthly consumer price index (CPI) gauge is penciled in for a downtick to 3.4% year-on-year, the slowest since February.

All eyes on inflation as markets and the RBA diverge on rate cuts

This lines up with recent clues appearing in leading purchasing managers’ index (PMI) data. It showed that “the rate of output price inflation softened to the slowest since January.” Meanwhile, “higher raw material, transportation and labor costs [led] input prices to rise at the fastest pace in 17 months.”

The disparity comes as “firms opted to lift prices at a weaker pace in an effort to boost sales,” with Australian businesses “finding it difficult to pass on [cost pressures].” That is a worrying sign of demand erosion that might help explain a sharpening divergence between where the markets and the central bank think interest rates are going.

.png?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

As it stands, the markets are pricing in one standard-sized 25-basis-point (bps) rate cut for 2024. By contrast, minutes from the Reserve Bank of Australia (RBA) policy meeting in August revealed officials considered a rate hike before opting to remain “higher for longer” to press down on sticky prices.

Is what’s bad for the Aussie dollar also bad for the global economy?

With all of this in mind, a soft local CPI reading bodes doubly ill for the Australian dollar. First, it would suggest the markets’ dovish leanings are well-founded and signal the RBA has some repositioning to do in the months ahead. Second, it would speak to an unwelcome business cycle turn in a pivotal economy, which may spook risk appetite.

Australia is one of the world’s top commodity exporters, making it a crucial node near the start of the global supply chain. If the break in cost transmission is an early signal of weakening demand among Australian consumers, that may amount to an ominous sign of uptake downstream and add to mounting fears of a worldwide downturn.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.