Apple and Google Have Catching Up to Do in 2024

Apple and Google Have Catching Up to Do in 2024

By:Mike Butler

Both are lagging behind other FAANG companies in revenue growth

- Apple and Google are two FAANG stocks that have struggled in 2024.

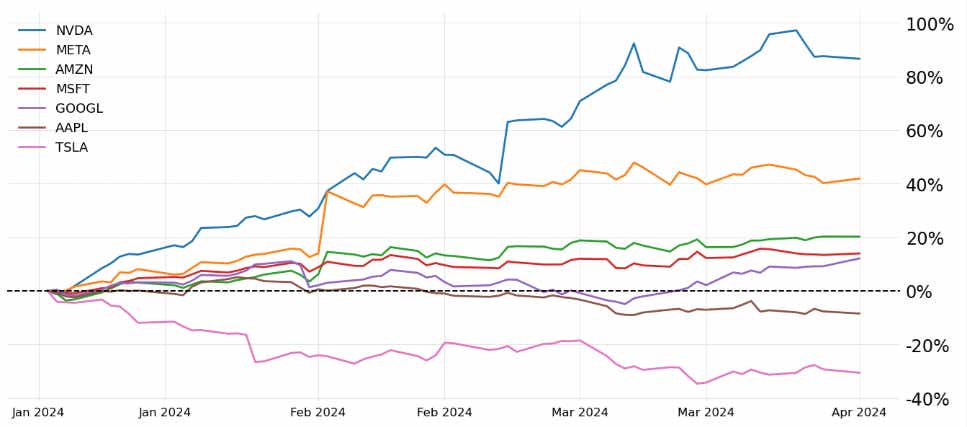

- The NASDAQ is up over 9% in 2024 so far. Google is up 12%, and Apple is down 9% this year.

- The other FAANG stocks are up an average of 28.3% in 2024.

Apple and Google: 2024 first quarter review

Apple (AAPL) has struggled in 2024, with mounting pressure from competitors like privately held Huawei, a company that has seen strong marketshare gains this year. In the first quarter, Apple iPhone sales have dropped 24% in China.

Compound that with a new lawsuit from the Department of Justice (DOJ), and Apple finds themselves in a deep hole to crawl out of the rest of the year:

On March 21 2024, the DOJ released a statement regarding the lawsuit:

"Apple’s broad-based, exclusionary conduct makes it harder for Americans to switch smartphones, undermines innovation for apps, products and services and imposes Extraordinary Costs on Developers, Businesses, and Consumers"

In an earnings report last year, Alphabet said Chief Financial Officer Ruth Porat would move into a new role and that the tech giant would search for a new CFO. They have yet to fill that job, which could leave investors reluctant to buy into the future of the company. With companies like Nvidia (NVDA), Advanced Micro Devices (AMD) and other tech stocks flying, the masses may feel they don't need to take a risk in a stock with question marks while others are taking off.

Magnificent 7 stock performance in 2024

When we compare Apple and Google to the rest of the Magnificent 7 stocks, we can see they are clearly underperforming. It will be interesting to see how these stocks fare throughout the year with the 2024 election, potential interest rate cuts and a few more earnings announcements for each stock.

Apple outlook for 2024

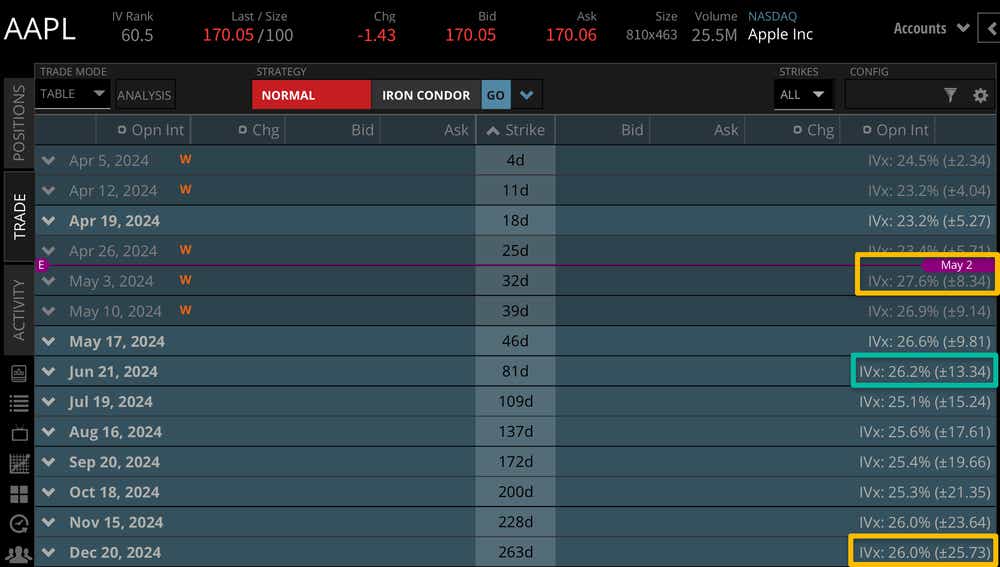

When a stock has mixed sentiment with both bulls and bears, I like to check out the implied volatility landscape for the rest of the year. Implied volatility is derived from the options market, and it helps us put context around expected stock price moves through different timeframes:

Apple is set to report earnings the first week of May, and the market is currently pricing in an expected move of +-$8.34 for the week with AAPL stock trading around $170 right now.

Apple will also hold its annual Worldwide Developers Conference (WWDC) online June 10-14. Many traders and investors will have their eyes peeled for this one, as Apple has been rumored to be working with Google to speed up AI implementation. The options market is also pricing in some more volatility around that week, with an expected stock price move of +-$13.34.

Apple has a stock price expected move of +-$25.73 through the December 2024 expiration cycle. Bullish investors in Apple will likely want to see a resolution to the DOJ lawsuit, an uptick in international iPhone sales and, of course, a big change to the lack of Apple's AI involvement so far this year.

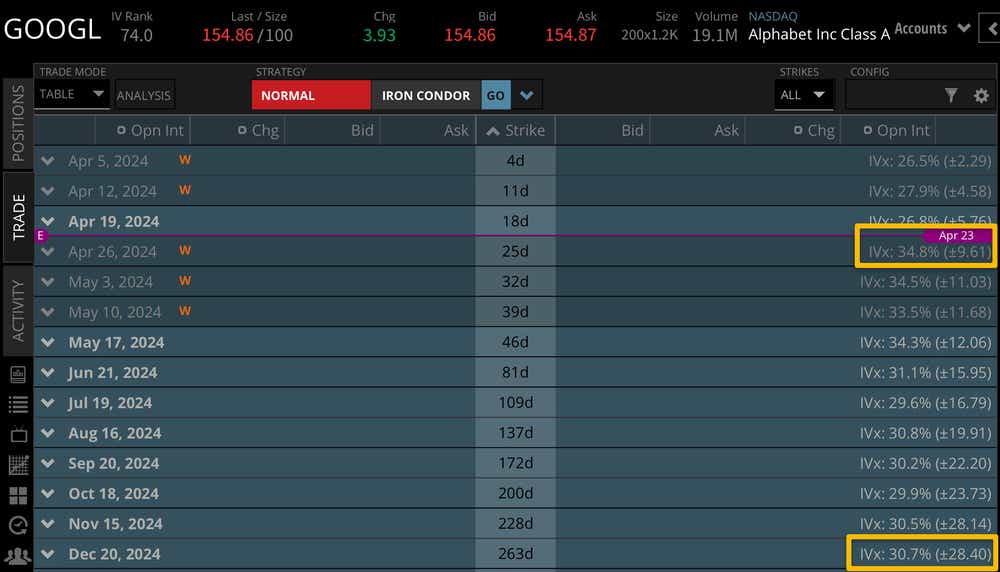

Google Outlook for 2024

Google has a stock price expected move of +-$9.61 for their next earnings announcement, which should take place at the end of April. This is a much higher expected move relative to the stock price of $155 when compared to Apple:

Google has an expected move of +-$28.40 through the end of the December 2024 cycle. Bullish investors in Google will likely want to see improved AI involvement through the year and a CFO appointment that results in a positive outlook for the company.

Tune in to Options Trading Concepts Live around the earnings announcements for these stocks for some in-depth options strategies!

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2024 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.