Stocks at Risk as Uncertainty Swells and Hope for Fed Lifeline Fades: Macro Week Ahead

Stocks at Risk as Uncertainty Swells and Hope for Fed Lifeline Fades: Macro Week Ahead

By:Ilya Spivak

A look at U.S. employment, ISM services PMI and Australia's pending (RBA) interest-rate decision

- Wall Street is down even as U.S. lawmakers pass a stopgap deal to avert a government shutdown.

- A worried tone at Australia’s central bank may be a canary in the coal mine for risk assets.

- U.S. employment data headlines a busy calendar: Signs point to a “higher-for-longer” Fed rates path

The markets seemed hardly impressed as U.S. lawmakers cobbled together another eleventh-hour deal to avoid a government shutdown. Stock index figures opened the week on the upswing amid muted cheers at having avoided a fiscal headwind at a time when growth is already slowing to a trickle, but the optimism proved short-lived.

As it stands, the bellwether S&P 500 is on track to finish today’s session with a loss, building on a four-week losing streak. U.S. shares have shed nearly 8% since peaking in late July, with two thirds of the move suffered just in the past two weeks. Worries about a "higher-for-longer" path for interest rates amid an increasing risk of recession seem to be driving sellers.

Tellingly, equity market losses have come alongside bearish steepening in the yield curve. Front-end yields have held steady while longer-term borrowing costs have jumped, implying a rise in term premium that comports with traders perceiving greater uncertainty on the horizon and thereby demanding higher compensation.

Here are the key macro waypoints likely to drive price action in the week ahead:

Reserve Bank of Australia (RBA) interest rate decision

Australia’s central bank is expected to keep its target cash rate unchanged at 4.1% at October’s monetary policy meeting. The move will mark the first rate decision led by newly-minted Governor Michele Bullock.

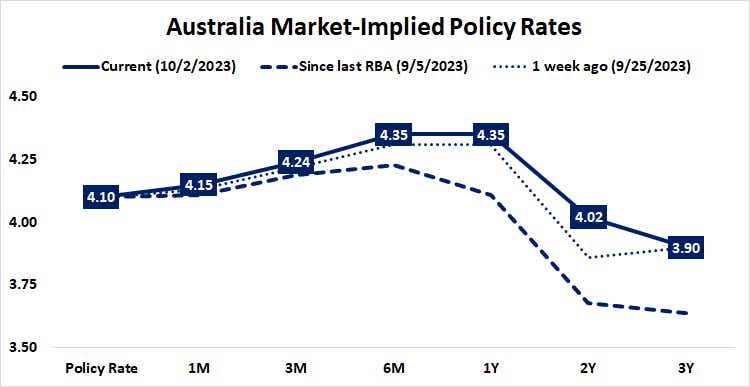

Economic performance has improved a bit since the central bank’s last conclave, with purchasing managers index (PMI) data suggesting growth stabilized last month after contractions in July and August. The priced-in policy path implied in rates markets duly steeped, penciling in one more 25-basis-point (bps) rate hike in the first half of 2024. Rate cuts are seen starting in 2025.

The swaps market is now pricing inflation’s return to the RBA target range of 2%-3% within a year. That’s surely welcome news for Bullock and company at a time when the Australia’s economy remains fragile and that of its main trading partner—China—continues to face daunting headwinds.

If that translates into cautious wait-and-see positioning that presents a central bank uneasy about the direction of global growth and feeling itself in no hurry to hike again, the Australian dollar may come under pressure.

U.S. JOLTs job openings

U.S. vacancies are expected to be little changed when August’s Job Openings and Labor Turnover Survey, or JOLTs, comes across the wires, inching down to 8.81 million from 8.83 million in the previous month. That might be unwelcome news for traders who are hoping that a cool-off in labor demand will hasten a pivot toward interest-rate cuts at the Federal Reserve.

Stocks might wobble as Treasury yields and the U.S. dollar tick higher if the print is higher than expected.

U.S. ISM services PMI

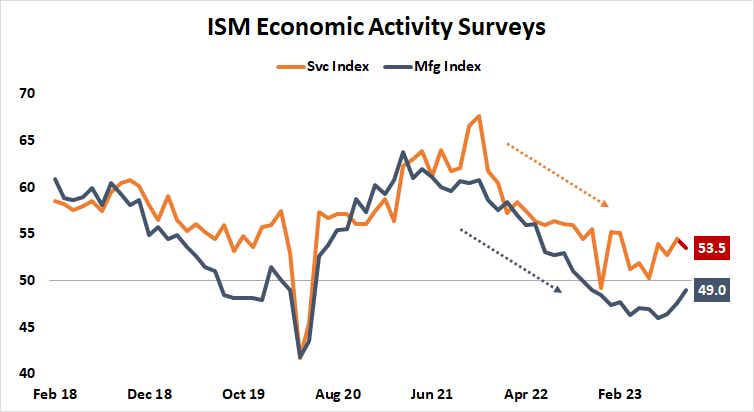

The purchasing managers' index, or PMI, gauge tracking U.S. services from the Institute of Supply Management is expected to show growth slowed in the largest sector of the economy in September after jumping to a six-month high in August. Traders will be keen to see what the report has to say about pricing and employment trends and will adjust Fed policy bets accordingly.

As it stands, the markets are about 50-50 on the likelihood of another rate hike before the end of the year. An easing cycle is penciled in to start by July and deliver two 25bps rate cuts in the second half of 2024, with a 56% probability of a third.

An analog PMI gauge from S&P Global published last week showed an overall sector slowdown but flagged resilient employment and sticky prices. If that translates to the ISM version, the takeaway for Fed-watchers may be that a “higher-for-longer” policy bias remains in play.

U.S. employment situation

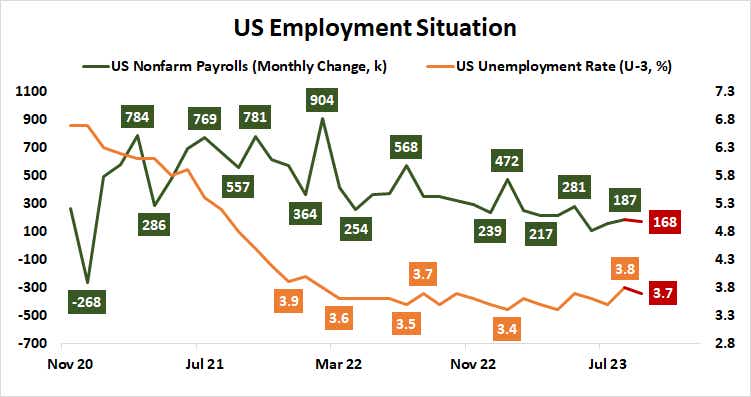

The U.S. economy is expected to add 168,000 workers to nonfarm payrolls in September. The outcome would mark a slight downtick from the 187,000 rise recorded in August but fall broadly in line with recent trends. The jobless rate is seen ticking a touch lower to 3.7%.

The release will mark something of a crescendo after a week of speculation driven by JOLTs and ISM data as well as a leading payrolls estimate from Automatic Data Processing (ADP), the human-resources management giant. It, too, is expected to show cooling, with private companies adding 153,000 workers last month vs. 177,000 in August.

The balance of risk seems negatively tilted for stocks and other risk-sensitive assets, including cyclical currencies and commodities like the Australian dollar and copper. Signs of strength echoing S&P Global PMIs may translate as Fed reluctance to begin rate cuts. Unexpectedly weak results may warn that global recession is afoot.

The window for a “goldilocks” result for Wall Street seems uncomfortably narrow.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.