U.S. PCE Preview: Stocks to Rise if Fed Rate Cut Bets Are Undisturbed

U.S. PCE Preview: Stocks to Rise if Fed Rate Cut Bets Are Undisturbed

By:Ilya Spivak

Stocks may push higher alongside bonds and gold prices while yields and the dollar continue to fall if the U.S. PCE inflation data doesn’t derail November’s surge in Fed rate cut expectations

- U.S. PCE data is expected to place core inflation at its lowest since April 2021.

- Leading CPI data foreshadows lower prices in the key “housing, utilities” sector.

- Stocks appear likely to rise as the U.S. dollar falls if the Fed rate bets remain undisturbed.

Data tracking the Federal Reserve’s favored measure of U.S. inflation—the personal consumption expenditure (PCE) price index—is expected to show the year-on-year growth rate slowed to 3.0% in October. The core gauge, which excludes volatile food and energy prices, is seen falling to 3.5%, the lowest since April 2021.

The central bank’s blistering rate hike program coupled with mending supply chains and receding base effects after the COVID-19 pandemic have driven goods-based inflation to an average of just 0.6% so far this year. That leaves the service sector, where price growth still ran a bit above 3% as of September.

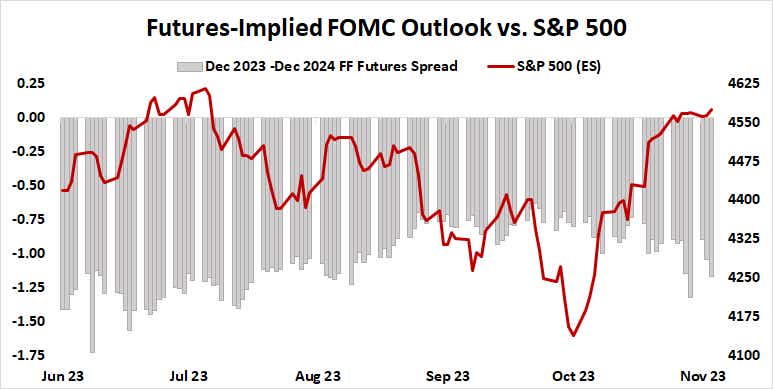

Markets have cheered swelling Fed rate cut expectations

For their part, stock markets have been flying high in November. They have been unbowed by war in the Middle East and Ukraine or by the corporate chaos at OpenAI, the darling of a resurgent tech sector. Meanwhile, traders have cheered a dovish turn in Fed policy expectations. If the PCE data passes without disrupting this dynamic, the risk-on tone is likely to remain.

That much appears likely. The analog consumer price index (CPI) measure of U.S. inflation published earlier this month showed a slightly greater slowdown than analysts expected, triggering loud applause from the markets as policy bets shifted to a more dovish setting.

Perhaps most tellingly, the lion’s share of core disinflation—holding apart the outsized impact of lower oil prices and a downtick in food costs on the headline number—came from the “shelter” component on the services side. That’s welcome foreshadowing for the PCE release, where “housing and utilities” make the largest contribution on the upside.

Wall Street before PCE data: “Just let it pass…”

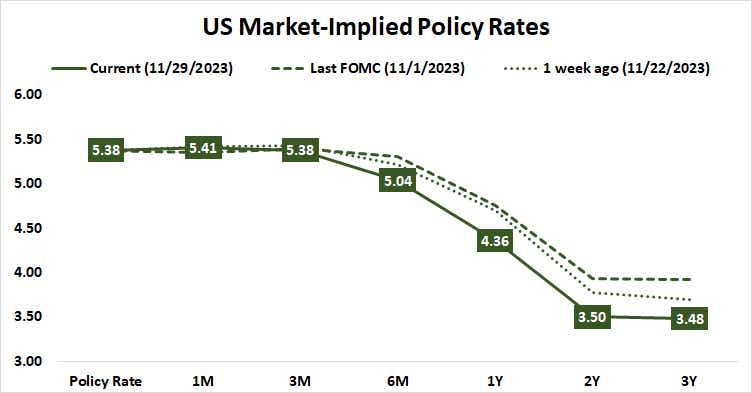

As it stands, the markets have fully priced in the first 25-basis-point (bps) interest rate cut by the May 2024 meeting of the policy-steering Federal Open Markets Committee (FOMC). Four cuts—100 bps or 1% in total—are now fully baked into Fed Funds interest rate futures for 2024. The likelihood of a fifth is at a commanding 64%.

Wall Street is likely to cheer if the PCE release leaves this baseline broadly intact. If price action after the CPI release is any indication, the outcome need not break new ground in the Fed outlook narrative. Instead, the numbers’ market-moving potential may be in their passing.

With key event risk in the rearview mirror, the dominant trend across key assets may extend simply because the potential for disruption has been diminished. That bodes well for stocks and bonds as yields continue to retreat. Gold may extend upward as well while the already battered U.S. dollar faces ongoing pressure.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2024 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.