U.S. CPI and Retail Sales, China Economic Activity: Macro Week Ahead

U.S. CPI and Retail Sales, China Economic Activity: Macro Week Ahead

By:Ilya Spivak

Stocks may continue to rise while the U.S. dollar faces renewed selling pressure if CPI inflation and retail sales data does not disrupt the markets’ hopes for a mid-2024 start of Federal Reserve interest rate cuts

- Stocks may rise as the U.S. dollar falls and CPI data leaves rate cut bets intact.

- Chinese economic data need not be good, just tolerable, to lift related assets.

- Soft U.S. retail sales data may be more helpful for risk-on markets than a strong result.

Financial markets were mostly in digestion mode last week, though Wall Street managed to eek out a bit more upside following the previous week’s explosive rally. The bellwether S&P 500 added 1.25% having surged 5.8% in the preceding five-day period. The U.S. dollar eked out a gain of 1.2%, recovering a bit from earlier losses. Bonds held in familiar ranges.

Most of the action was centered on commodities, where geopolitical risk continued to filter out of prices as markets seemingly concluded that the conflict in the Middle East will not expand beyond Israel and the Gaza-based terrorist group Hamas. It triggered hostilities Oct. 7 with an attack that killed 1,200 Israeli civilians. Gold prices plunged 2.7% while WTI crude oil shed 4.15%.

Here are the key macro waypoints for traders in the week ahead:

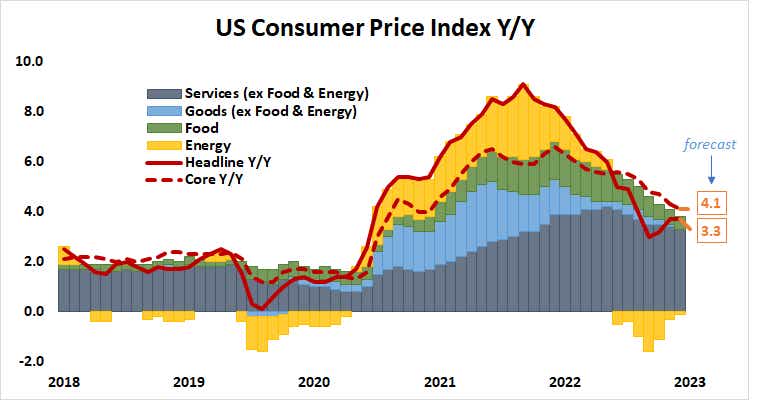

U.S. consumer price index data

The headline measure of U.S. inflation—the consumer price index, or CPI— is expected to show price growth slowed to 3.3% year-on-year in October. That would mark the lowest reading since March 2021. The core gauge excluding volatile food and energy prices is seen matching September’s two-year low of 4.1%.

Absent an improbably wild deviation from baseline forecasts, the release is unlikely to shift Federal Reserve policy expectations in a meaningful way. The uneventful passing of event risk may be read as a “risk on” signal by the markets, pushing up stocks and weighing on the U.S. dollar.

At this stage, the markets are all-but-certain rate hikes have ended, with cuts beginning at mid-year 2024. The first 25-basis-point (bps) reduction is priced in to occur no later than July. The probability of a sooner cut in June is penciled in at a hefty 78%. A total of 75 bps in cumulative easing is fully reflected in Fed Funds futures pricing for next year.

China industrial production and retail sales data

Chinese retail sales are expected to pick up the pace in October, growing 7% year-on-year. That would translate to the fastest expansion since May 2023, a hair off the peak scored in the immediate aftermath of Beijing’s move to scrap “zero-COVID” lockdowns in December 2022. Industrial production is seen growing 4.5%, matching the previous two months.

Analytics from Citigroup suggests Chinese data outcomes now skew toward surprising on the upside relative to expectations. This may indicate markets have already priced in the bulk of the bad news about the country’s disappointing performance this year.

Results need not be “good” in this case, with investors settling for “tolerable” to nibble on bargain-hunting opportunities in China-sensitive assets. Local stocks have vastly underperformed U.S. analogs this year, and numbers suggesting conditions have stopped getting worse may stoke some catch-up gains. The Australian dollar may also get a lift.

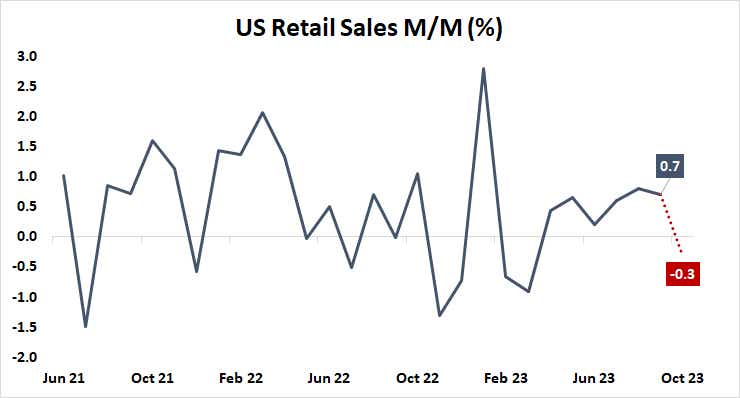

U.S. retail sales data

As with the CPI data earlier in the week, the key consideration for October’s U.S. retail sales report will be whether it marks any considerable change in the outlook for Fed monetary policy.

Expectations point to a soft result, with receipts down 0.3% to mark the first decline since March. Leading consumer confidence data from the University of Michigan suggests sentiment has been deteriorating recently while assorted labor market indicators are signaling emerging weakness.

For markets hoping for the soonest possible start of interest rate cuts, it may be supportive to see numbers showing that all of this has translated into sluggish retail activity. Stocks may thus cheer a soft result while the U.S. dollar is pressured lower against its major counterparts.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.