The Stock Market is at Risk if the Fed Continues to Push Back Rate Cuts

The Stock Market is at Risk if the Fed Continues to Push Back Rate Cuts

By:Ilya Spivak

Prices hinge on FOMC minutes, Powell comments and economic data

- Financial markets are hinting the Fed is wrong to delay interest rate cuts.

- Leading data hints inflation is cooling, but are officials more confident?

- Stock markets now hinge on FOMC meeting minutes and Powell comments.

The Federal Reserve has been disappointed with the pace of progress on lowering inflation so far in 2024. In May, officials grumbled that, “in recent months, there has been a lack further progress toward [our] 2% inflation objective.” In June, they revised this year's policy forecast from three 25-basis-point (bps) rate cuts to just one.

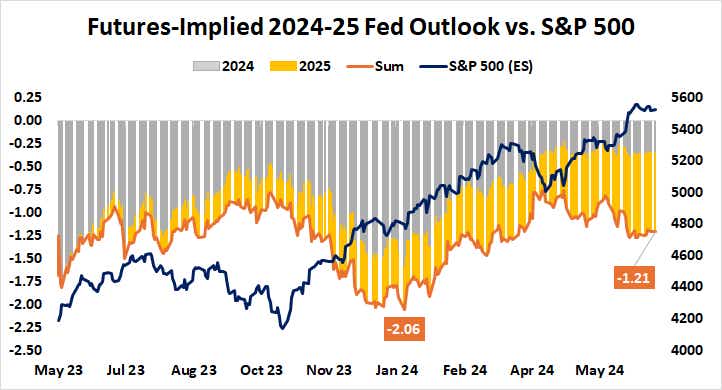

The markets seem to have concluded this foot-dragging is wrongheaded. The rates path priced into in Fed Funds futures reveals that, while traders have broadly accepted the Fed’s one-cut view for 2024, they reckon that accelerated easing is on the menu for 2025 as the central bank scrambles to reverse course.

Stock markets cheered amid swelling 2025 Fed rate cut bets

Since mid-April, the readjustment of baseline expectations to reflect this view has seen the cumulative rate cut tally due by the end of next year expand from 77bps to 121bps. This dovish adjustment amounts to shifting from three to four fully priced-in 25bps rate cuts, with a 76% probability of a fifth one.

Stock markets cheered the change, with the bellwether S&P 500 pointedly turning higher after a month-long pullback to launch a ten-week rally. The stock index has added nearly 10% from the low set April 19. The move higher tellingly stopped two weeks ago, however, as the repricing process stalled.

Meanwhile, disinflation has picked up momentum. May’s consumer price index (CPI) data showed slower price growth than expected, with the core rate excluding volatile food and energy down to a three-year low of 3.4% year-on-year. The Fed’s preferred personal consumption expenditure (PCE) gauge marked an analog milestone at 2.6%.

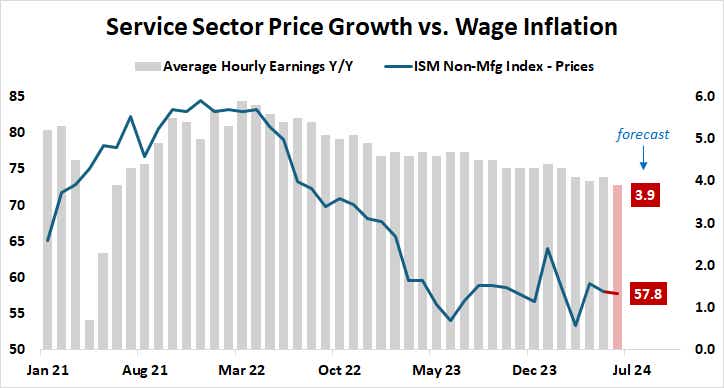

Leading purchasing managers index (PMI) data hints that June marked another step in the right direction. Data from S&P Global had inflation at a five-month low. A parallel survey from the Institute of Supply Management (ISM) put manufacturing sector price growth at the softest since December.

Will renewed progress on inflation bring stimulus closer?

The service sector ISM report is due later this week. It is also expected to show price growth easing. The growth rate in average hourly earnings—a measure of wage inflation and a key input into the Fed’s calculus—is seen coming down to 3.9% year-on-year when it is published alongside the monthly jobs report on July 5.

The top question now seems to be whether the Fed is prepared to endorse such outcomes.

If policymakers signal their confidence in a timely arrival at the 2% inflation target has increased, traders may reckon that a rate cut could arrive sooner than currently expected. That seems likely to be cheered by stock markets. Alternatively, opting to remain in “wait and see” mode will probably be met with disappointment.

This week, the release of minutes from June’s meeting of the rate-setting Federal Open Markets Committee (FOMC), as well as a speech by Fed Chair Jerome Powell at the annual ECB Central Bank Forum in Sintra, Portugal, will mark key waypoints in this story.

The mood on Wall Street will probably brighten if the minutes document suggests Fed officials did not take May’s soft CPI data into account—leaving room for a dovish rethink—and Mr. Powell strikes a more optimistic tone. Otherwise, displeasure with ongoing stimulus delay might push markets downward.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2024 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.