FOMC Minutes: Stock Market May Cheer as the Fed Reiterates Rate Hike End

FOMC Minutes: Stock Market May Cheer as the Fed Reiterates Rate Hike End

By:Ilya Spivak

Stock markets may find welcome relief as November’s FOMC meeting minutes reiterate that the Federal Reserve is probably done raising interest rates. The U.S. dollar may fall further.

- Minutes from November’s FOMC meeting in focus on a slow holiday week.

- A familiar tone seems likely, signaling the rate hike cycle is probably over.

- Stocks may rise while the U.S. dollar falls as stimulus hopes soothe traders.

Minutes from this month’s fateful meeting of the Federal Open Market Committee (FOMC)–the U.S. central bank’s policy-steering body–stand out as an inflection point in an otherwise barebones week for financial markets. The minutes may offer a cheerful send-off for U.S. markets as they shutter for the Thanksgiving holiday midweek.

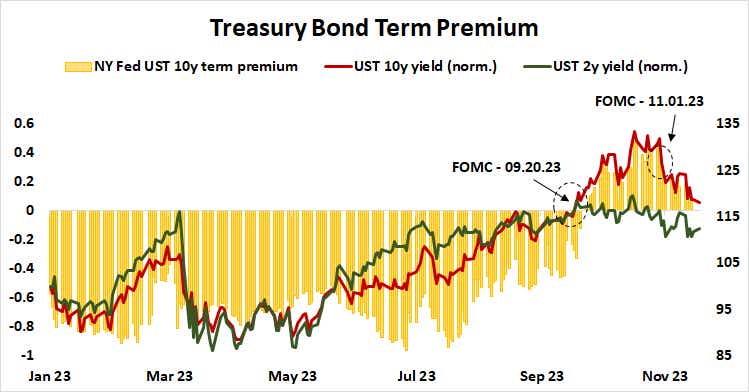

Traders cheered the outcome of November’s conclave, reading officials’ messaging to mean that–with all due disclaimers–the interest rate hike cycle has probably ended. It bookended the saga that began with September’s FOMC meeting, where Fed Chair Jerome Powell and company deftly talked the markets into tightening on their behalf.

Fed communication strategy: tightening without rate hikes

Worried investors walked away from that gathering shaken by a Fed threatening to keep interest rates “higher for longer”. Its updated set of economic forecasts implied needing rates to be 50 basis points (bps) higher in 2024 than previously expected. Stocks fell and long-end bond yields rose as swelling term premium pointed to building uncertainty.

By mid-October, Powell signaled in a speech at the Economic Club of New York that this yields surge has done enough to tighten financial conditions without further hikes. That followed a wave of dovish commentary from other central bank officials. The stage looked set for confirmation in November, and markets seem convinced that it came.

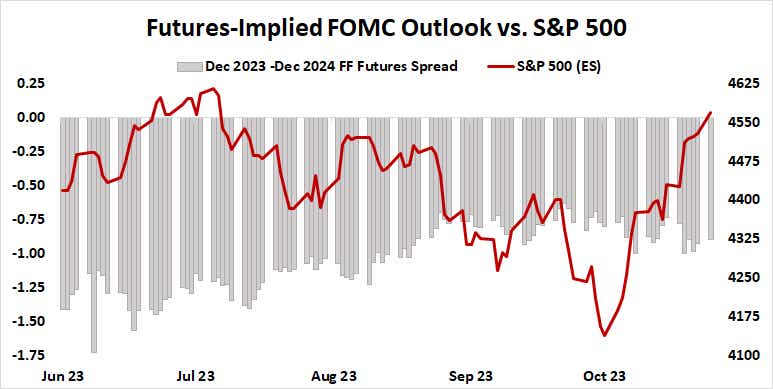

Wall Street cheered. The bellwether S&P 500 index is on pace for its best month since July 2022. The 10-year Treasury bond yield is down over 10%, amounting to the biggest downswing since March 2023, when the Silicon Valley Bank-led banking crisis gripped financial markets. The U.S. dollar is down 3.2%, the most in a year.

Now, the policy path priced into Fed Funds futures shows that the probability of further tightening in this cycle has been erased. The first 25 bps rate cut is set to appear no later than June. The likelihood of an earlier decrease in May is at a hefty 71.4%. Three 25 bps cuts are in the price by the end of 2024, with a 60% probability of a fourth one.

November FOMC minutes: whispering sweet nothings

As liquidity begins to drain ahead of U.S. market closures, a FOMC minutes document reiterating that the cost of capital has probably stopped rising may soothe investors. Would-be stressors like wars in the Middle East and Europe and corporate chaos at OpenAI, a darling of the high-flying tech sector, might seem more digestible when capital is seen getting cheaper rather than more expensive in the future.

With that in mind, the FOMC minutes need to break new ground for the policy outlook. A status quo message in line with the pathway already expected by investors may see the markets breathing a welcome sigh of relief, allowing stocks to drift higher while the greenback retreats as participation levels drop.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.