S&P 500 Struggling as Oil, Yields Continue Topside Push

S&P 500 Struggling as Oil, Yields Continue Topside Push

Also 10-year T-note, silver, crude oil and euro futures

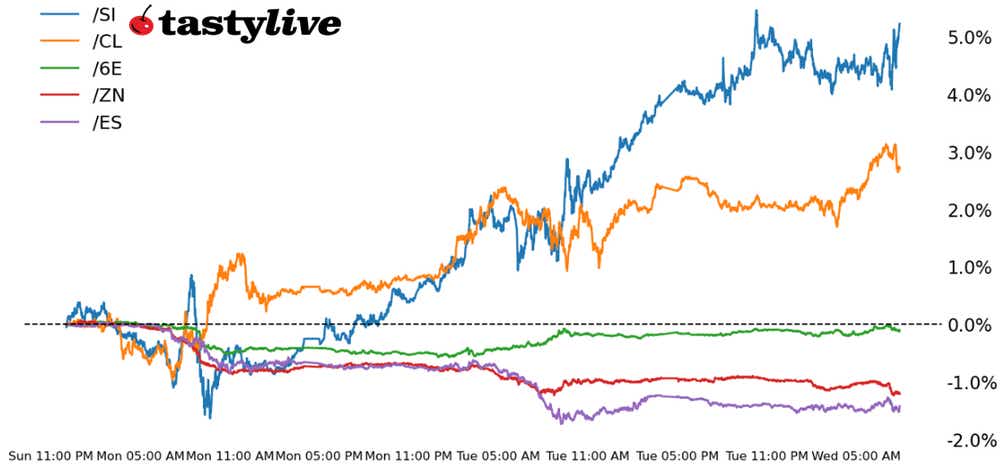

S&P 500 E-mini futures (/ES): -0.22%

10-year T-Note futures (/ZN): -0.30%

Silver futures (/SI): +2.94%

Crude Oil futures (/CL): +0.75%

Euro futures (/6E): +0.17%

A late-day rally yesterday in stocks and bonds has found no follow through today. U.S. economic data continues to run hotter, with the Atlanta Federal Reserve GDPNow growth tracker for 1Q ’24 pointing to 2.8% real annualized growth. The March U.S. ADP (Automatic Data Processing) employment change report did little to dispel the notion that the economy is reaccelerating. Coupled with rising energy prices spurred on by fears of widening conflict from the Israel-Hamas war, bonds are quickly back to their yearly lows. Markets may be crossing the proverbial Rubicon whereby moves higher in oil and yields can no longer be ignored. All eyes are on Fed Chair Jerome Powell’s speech at 12:10 p.m. EST today.

Symbol: Equities | Daily Change |

/ESM4 | -0.22% |

/NQM4 | -0.38% |

/RTYM4 | -0.37% |

/YMM4 | -0.11% |

U.S. equity markets are on track for a third day of losses, with S&P 500 futures (/ESM4) down 0.22%, after better-than-expected data from ADP showed the labor market will likely stand in the way of three interest rate cuts this year from the Federal Reserve. Semiconductor stocks are also dragging on sentiment after Intel (INTC) reported big losses in its foundry business. Traders will look to tomorrow’s jobless claims data before Friday’s non-farm payrolls report, which is teed up as the main event risk for this month.

Strategy: (44DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 4975 p Short 5000 p Short 5500 c Long 5525 c | 63% | +287.50 | -962.50 |

Short Strangle | Short 5000 p Short 5500 c | 69% | +2025 | x |

Short Put Vertical | Long 4975 p Short 5000 p | 85% | +137.50 | -1105 |

Symbol: Bonds | Daily Change |

/ZTM4 | -0.07% |

/ZFM4 | -0.18% |

/ZNM4 | -0.30% |

/ZBM4 | -0.56% |

/UBM4 | -0.70% |

Ten-year T-Note futures (/ZNM4) are breaking below a price floor that has been in place since February, with prices now pushing into fresh lows for the year. The stronger-than-expected jobs data from this morning and rising energy prices are pushing yields higher as the threat of a strong economy and price pressures force traders to rethink Fed interest rate cut bets. The Treasury will auction 17-week bills today.

Strategy (51DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 106.5 p Short 107 p Short 112 c Long 112.5 c | 64% | +109.38 | -390.63 |

Short Strangle | Short 107 p Short 112 c | 71% | +484.38 | x |

Short Put Vertical | Long 106.5 p Short 107 p | 89% | +62.50 | -437.50 |

Symbol: Metals | Daily Change |

/GCM4 | +0.65% |

/SIK4 | +2.94% |

/HGK4 | +1.76% |

Silver prices (/SIK4) continued to surge higher today as safe-haven demand amid rising inflation pressures helps fuel investor sentiment in the metal. Speculative traders increased their long positions on the metal again in the latest week, according to CFTC data. Non-commercial traders are long 80,721 contracts, the largest long position since May 2021. If Friday’s jobs report confirms the ADP’s numbers, it could help to underpin the metal further.

Strategy (55DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 25 p Short 25.5 p Short 28.5 c Long 29 c | 42% | +1235 | -1265 |

Short Strangle | Short 25.5 p Short 28.5 c | 59% | +5665 | x |

Short Put Vertical | Long 25 p Short 25.5 p | 70% | +720 | -1780 |

Symbol: Energy | Daily Change |

/CLK4 | +0.75% |

/HOK4 | +1.81% |

/NGK4 | +2.15% |

/RBK4 | +0.79% |

Crude oil futures (/CLK4) rose firmly above the 85 handle overnight as geopolitical concerns in the Middle East and Russia reinforced concerns around supply. At the same time, the U.S. economy remains resilient, evidenced by the latest jobs data released this morning. And because of high oil prices, the Department of Energy (DOE) canceled planned purchases of oil meant to go into the Strategic Petroleum Reserve (SPR).

The Energy Information Administration (EIA) will release inventory data today. Yesterday, data from the American Petroleum Institute (API) showed a 2.3 million barrel decrease in stocks last week. Meanwhile, crack spreads remain supportive for refiners to keep production high, and the prompt spread in WTI futures, currently trading at a backwardation of 86 cents, points to a tight market.

Strategy (43DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 77 p Short 77.5 p Short 92.5 c Long 93 c | 63% | +140 | -360 |

Short Strangle | Short 77.5 p Short 92.5 c | 71% | +1580 | x |

Short Put Vertical | Long 77 p Short 77.5 p | 83% | +70 | -430 |

Symbol: FX | Daily Change |

/6AM4 | +0.09% |

/6BM4 | +0.03% |

/6CM4 | +0.04% |

/6EM4 | +0.17% |

/6JM4 | -0.20% |

In a world where U.S. equities are weaker and yields are higher, one might assume that would cater to U.S. dollar strength. But not recently. Instead, the past two sessions have produced U.S. dollar weakness, with the beleaguered euro (/6EM4) as the prime example of quizzical strength in the face of seemingly difficult fundamental conditions. Yet there may be a perfectly reasonable explanation: weakness in stocks, bonds and the U.S. dollar is a sign capital is flowing out of U.S. financial markets—an ominous signal that portends increasing concern around inflation and how the Fed is positioning its communications around recent data.

Strategy (30DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.065 p Short 1.07 p Short 1.1 c Long 1.105 c | 61% | +200 | -425 |

Short Strangle | Short 1.07 p Short 1.1 c | 69% | +550 | x |

Short Put Vertical | Long 1.065 p Short 1.07 p | 83% | +125 | -500 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2024 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.