S&P 500 Starts Big Macro Week on Weaker Note

S&P 500 Starts Big Macro Week on Weaker Note

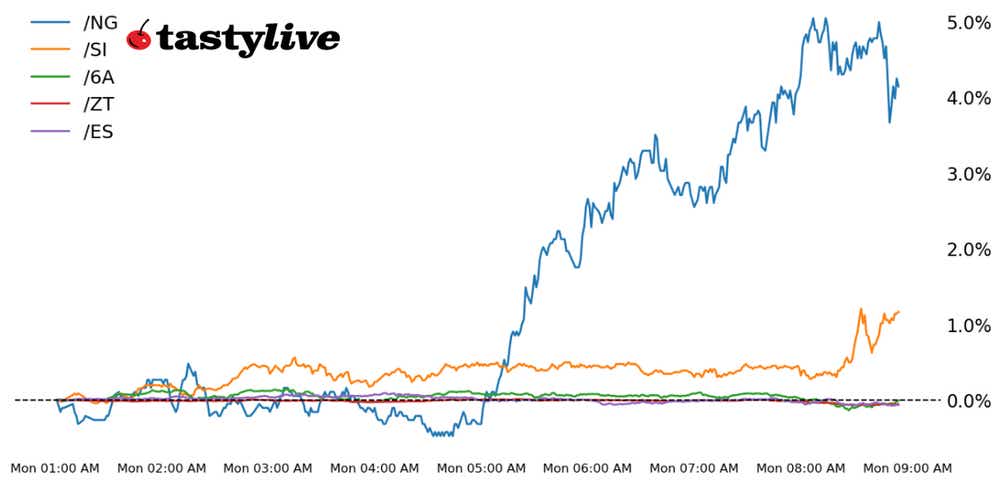

Also, 2-year T-note, silver, natural gas, and Australian dollar futures

- S&P 500 e-mini futures (/ES): -0.22%

- Two-year T-note futures (/ZT): -0.07%

- Silver futures (/SI): +0.89%

- Natural gas futures (/NG): +6.92%

- Australian dollar futures (/6A): -0.25%

Investors are stepping back to start the week following Friday’s bullish performance that saw the S&P 500 U.S. benchmark close at a record high.

The story was the same in overnight trading in Asia and Europe. Traders are assessing the outlook for the economy, with several high-impact prints expected this week, including rate decisions from Canada and the European Central Bank.

We will also hear from Federal Reserve Chair Jerome Powell on Wednesday, and the U.S. jobs report is due out on Friday. Analysts expect a big slowdown in job growth for February, slowing to 200,000 from January’s 353,000 print.

Oil steady, chip sector moves higher

Oil prices held steady after OPEC decided to extend production cuts into the second quarter of the year, disappointing expectations that the cartel would push the cuts through the end of the year.

The energy sector on the equity side should be supported by a decision from a U.S. natural gas producer to cut production.

While Apple (AAPL) is dragging lower due to a fine from European Union (EU) regulators, the chip sector is moving higher to start the week, which may help to carry stocks.

Symbol: Equities | Daily Change |

/ESH4 | -0.22% |

/NQH4 | -0.02% |

/RTYH4 | +0.54% |

/YMH4 | -0.52% |

Stock traders hesitate

Equity markets are flashing signs of hesitation after Friday’s run into record highs for the S&P 500.

This morning, /ESH4 futures are trading 0.20% lower but remain firmly above 5,100, a reassuring level that was closed above to end last week.

A decision out of the European Union to hit Apple with a $2 billion fine is weighing on stocks, although the chip sector is pulling technology higher, with SMH—the VanEck Semiconductor ETF—adding nearly 2% in pre-market trading.

Strategy: (46DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 5050 p Short 5100 p Short 5300 c Long 5350 c | 37% | +1262.50 | -1237.50 |

Short Strangle | Short 5100 p Short 5300 c | 53% | +4362.50 | x |

Short Put Vertical | Long 5050 p Short 5100 p | 70% | +587.50 | -1912.50 |

Symbol: Bonds | Daily Change |

/ZTM4 | -0.07% |

/ZFM4 | -0.18% |

/ZNM4 | -0.28% |

/ZBM4 | -0.62% |

/UBM4 | -0.69% |

Treasury notes slip

Treasuries are under some pressure to start the week as optimism from last week’s inflation data settles.

Two-year T-note futures (/ZTH4) slipped by 0.06% ahead of the opening bell, although the underlying yield remains near three-week lows. Today will see auctions for 13- and 26-week bills and there are several more offerings for short-term bills due later this week. However, we don’t have any note or bond auctions due until next week.

Strategy (53DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 101.625 p Short 101.75 p Short 103.25 c Long 103.375 c | 45% | +93.75 | -156.25 |

Short Strangle | Short 101.75 p Short 103.25 c | 54% | +437.50 | x |

Short Put Vertical | Long 101.625 p Short 101.75 p | 95% | +46.88 | -203.13 |

Symbol: Metals | Daily Change |

/GCJ4 | +0.36% |

/SIK4 | +0.89% |

/HGK4 | +0.09% |

Precious metals rise

Precious metal traders are brushing off the move higher in yields this morning and remain focused on the prospect for a rate cut from the Federal Reserve, which would help the non-interest-bearing metal.

Stronger-than-expected economic data has also helped the case for silver prices, which benefit from industrial applications. /SIH4 is outpacing gold prices this morning, with a gain of 0.67%.

Strategy (52DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 22.75 p Short 23 p Short 24.25 c Long 24.5 c | 28% | +855 | -395 |

Short Strangle | Short 23 p Short 24.25 c | 56% | +5295 | x |

Short Put Vertical | Long 22.75 p Short 23 p | 65% | +485 | -765 |

Symbol: Energy | Daily Change |

/CLJ4 | +0.25% |

/HOJ4 | +0.96% |

/NGJ4 | +6.92% |

/RBJ4 | +1.47% |

Natural gas keeps soaring

Natural gas futures (/NGJ4) rose nearly 7% Monday morning after EQT Corporation (EQT) announced a production cut of almost 1 billion cubic feet per day (bcf/d).

The company—among the largest producers of natural gas in the U.S.—is responding in a similar fashion to other producers, who have announced their own cuts in recent weeks as price trade near multi-decade lows.

It was an unusually warm winter throughout the U.S. and Europe, which has left inventory levels at above-average levels, and with the withdrawal season nearly over, a sustained price recovery is less likely. That said, traders could expect more volatility and sharp moves with prices at these extreme levels.

Strategy (52DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.6 p Short 1.7 p Short 2.4 c Long 2.5 c | 58% | +340 | -660 |

Short Strangle | Short 1.7 p Short 2.4 c | 67% | +1200 | x |

Short Put Vertical | Long 1.6 p Short 1.7 p | 79% | +160 | -840 |

Symbol: FX | Daily Change |

/6AH4 | -0.25% |

/6BH4 | +0.13% |

/6CH4 | -0.05% |

/6EH4 | +0.06% |

/6JH4 | -0.28% |

Traders wait for Australian rate decision

We are two weeks away from the next Reserve Bank of Australia (RBA) meeting and traders are undecided on whether Australian policymakers will take a hawkish or neutral approach to their rate setting.

Prices remain relatively high in Australia, which has led the RBA on a more aggressive calculus against inflation than their European and U.S. counterparts.

However, short bets have risen against the Aussie, with fund managers increasing their bets to short the currency. According to Friday’s Commitments of Traders report (COT), non-commercial traders (speculators) increased their short position to 128,816 contracts, which was the second highest on record.

If those funds are wrong, however, it leaves /6AH4 susceptible to upside risk on short covering.

Strategy (32DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.64 p Short 0.645 p Short 0.665 c Long 0.67 c | 54% | +220 | -280 |

Short Strangle | Short 0.645 p Short 0.665 c | 64% | +520 | x |

Short Put Vertical | Long 0.64 p Short 0.645 p | 78% | +120 | -380 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.