S&P 500 Resumes Rally as Treasuries Turn Higher

S&P 500 Resumes Rally as Treasuries Turn Higher

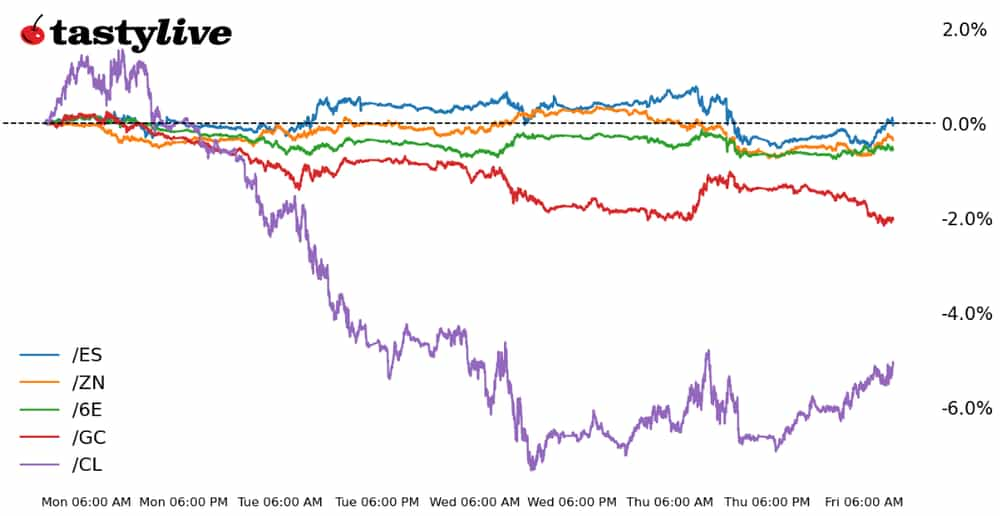

Also, 10-year T-note, gold, crude oil and euro futures

- S&P 500 e-mini futures (/ES): +0.37%

- 10-year T-note futures (/ZB): +0.22%

- Gold futures (/GC): -0.98%

- Crude oil futures (/CL): +1.36%

- Euro futures (/6E): +0.12%

A weak 30-year bond auction and seemingly hawkish commentary from Fed Chair Jerome Powell on Thursday tipped markets lower into the end of the session, but thus far on Friday, traders are shaking off any of yesterday’s concerns.

Both stocks and bons are trading higher around the opening bell in New York, while precious metals remain pressured and energy markets are rebounding after a devastating week.

Symbol: Equities | Daily Change |

/ESZ3 | +0.37% |

/NQZ3 | +0.42% |

/RTYZ3 | +0.22% |

/YMZ3 | +0.42% |

S&P 500 traders pick up pieces

The S&P 500’s (/ESZ3) and Nasdaq 100’s (/NQZ3) best winning streaks in years ended yesterday, but traders are picking up the pieces ahead of the weekend.

The deleveraging seen throughout October on Fridays, due to concerns around the Israel-Hamas war, seems to be a pattern relegated to history at this point as well. The Russell 2000 (/RTYZ3) is working on its first green day this week.

Strategy: (49DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 4370 p Short 4380 p Short 4470 c Long 4480 c | 16% | +395 | -105 |

Long Strangle | Long 4370 p Long 4480 c | 50% | x | -5962.50 |

Short Put Vertical | Long 4370 p Short 4380 p | 62% | +157.50 | -342.50 |

Symbol: Bonds | Daily Change |

/ZTZ3 | +0.06% |

/ZFZ3 | +0.16% |

/ZNZ3 | +0.22% |

/ZBZ3 | +0.64% |

/UBZ3 | +0.69% |

Cyberattack in China has bond markets on edge

10-year T-note futures (/ZNZ3) pushed higher this morning as markets moved back into a risk-on stance going into the weekend.

However, bond traders are on edge after a cyberattack hit Industrial & Commercial Bank of China’s U.S. trading desk overnight. The attack crippled the bank’s ability to clear Treasury transactions, although the bank said that all trades had been settled as of this morning.

Still, the extent of the damage and the fear of more attacks from the unknown ransomware group have Treasury markets on edge. Still, bond yields are moving lower across the curve and that should bode well for equities today.

Strategy (42DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 105.5 p Short 106 p Short 110 c Long 110.5 c | 52% | +203.13 | -296.88 |

Long Strangle | Long 105.5 p Long 110.5 c | 32% | x | -609.38 |

Short Put Vertical | Long 105.5 p Short 106 p | 84% | +93.75 | -406.25 |

Symbol: Metals | Daily Change |

/GCZ3 | -0.98% |

/SIZ3 | -2.01% |

/HGZ3 | -1.17% |

Yesterday’s gains in gold prices (/GCZ3) are already gone as prices moved sharply lower through the morning, pushing into fresh three-week lows.

The move comes despite a moderating dollar and falling Treasury yields. It looks like traders are deploying their cash into equity markets as the market affirms its view that the Federal Reserve is done hiking interest rates. Raphael Bostic, president of the Federal Reserve Bank of Atlanta is due to speak later today, but other than that, there is little in the way of economic data that would influence precious metal prices.

Strategy (46DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1940 p Short 1950 p Short 1990 c Long 2000 c | 24% | +730 | -270 |

Long Strangle | Long 1940 p Long 2000 c | 42% | x | -4210 |

Short Put Vertical | Long 1940 p Short 1950 p | 66% | +390 | -610 |

Symbol: Energy | Daily Change |

/CLZ3 | +1.36% |

/HOZ3 | +0.84% |

/NGZ3 | +0.13% |

/RBZ3 | +1.32% |

Energy market confusion

There is a lot of confusion in energy markets recently and traders continue to search for answers.

The other day, Saudi Energy Minister Prince Abdulaziz bin Salman pushed back against the narrative of weakening demand, saying “people are pretending it is weak.”

That is up for debate, as gasoline demand in the United States has decreased for four straight days, according to GasBuddy’s Patrick De Haan. Speculators have also grown increasingly short over the past several weeks, however, floating storage—according to Kpler data—has been falling. That typically does not happen in a loose market. For now, traders will have to follow the price action.

Strategy (34DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 74 p Short 74.5 p Short 78.5 c Long 79 c | 20% | +380 | -120 |

Long Strangle | Long 74 p Long 79 c | 43% | x | -4810 |

Short Put Vertical | Long 74 p Short 74.5 p | 60% | +190 | -310 |

Symbol: FX | Daily Change |

/6AZ3 | -0.18% |

/6BZ3 | -0.02% |

/6CZ3 | -0.09% |

/6EZ3 | +0.12% |

/6JZ3 | -0.08% |

Bullish sentiment grows for euros

Euro futures (/6EZ3) are inching higher but the currency remains on track to record a loss for the week going into the weekend.

Still, bullish sentiment has grown recently, which explains last week’s rally, bolstered on the view that the Federal Reserve is done hiking interest rates. Next week might provide the answer on if we continue higher or not, with traders focused on updated Euro Area Q2 GDP numbers and October inflation data out of the United States.

Treasury premiums against their comparative European counterparts have moved lower over the past several weeks, although they remain near multi-year highs.

Strategy (28DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.0575 p Short 1.06 p Short 1.08 c Long 1.0825 c | 43% | +175 | -137.50 |

Long Strangle | Long 1.0575 p Long 1.0825 c | 36% | x | -725 |

Short Put Vertical | Long 1.0575 p Short 1.06 p | 78% | +87.50 | -225 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2024 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.