U.S. NFP Preview: Stocks at Risk if Warm Jobs Data Cools Fed Rate Cut Bets

U.S. NFP Preview: Stocks at Risk if Warm Jobs Data Cools Fed Rate Cut Bets

By:Ilya Spivak

Upbeat U.S. jobs data might hurt stocks if Fed rate cut expectations come down further.

- Stocks swoon as solid earnings from tech champions fail to cheer the markets

- U.S. jobs data now in focus, with traders probably primed for one-off weakness

- The mood on Wall St. may sour further if Fed rate cut speculation cools again

Wall Street was in a sour mood on the last day of October. The bellwether S&P 500 stock index fell over 1.5% to post its biggest daily loss in almost two months. The tech-minded Nasdaq 100 found no solace in another round of solid earnings from its “Mag7” champions, from Microsoft (MSFT) and Meta (FB). It fell over 2.3%.

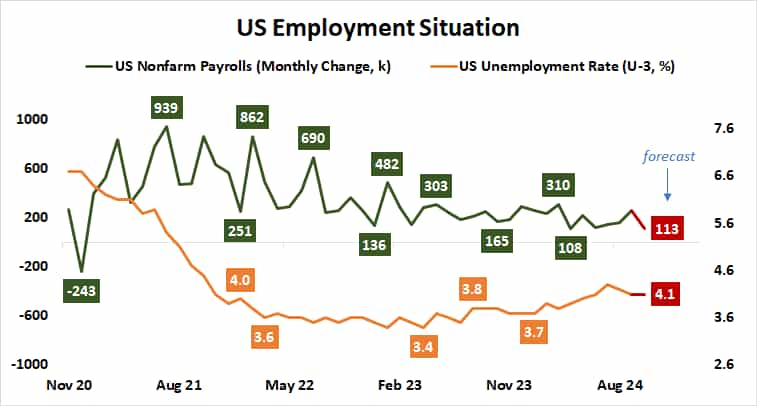

Against this troubled backdrop, markets now face the crescendo in a blistering week of high-profile economic news: the release of October’s U.S. employment data. It is expected to show nonfarm payrolls rose by a meager 113,000 jobs, the smallest in six months. The unemployment rate is expected to remain unchanged at 4.1%.

U.S. jobs data may surprise markets primed for weakness

Traders may be primed for a weak report, reasoning that Hurricanes Helene and Milton as well as a wave of labor strikes – like those at Boeing – will exact a toll. Such factors are unlikely to weigh in the long term, however. That wages are seen growing 4% year-on-year again, nearly double the rate of inflation, helps insulate consumption and growth.

With that in mind, an upside surprise may be most market-moving. Analytics from Citigroup show that U.S. economic data outcomes have increasingly outperformed relative to consensus forecasts since late August. What’s more, positive momentum has been growing, suggesting reality is outpacing adjustments in analysts’ models.

Leading purchasing managers index (PMI) data from S&P Global reported that U.S. employment conditions improved in October relative to the prior two months. A blistering estimate from Automatic Data Processing (ADP), an HR services giant, said payrolls rose by 233,000 in October, the most since July 2023.

Stock markets may struggle if Fed rate cut bets fall further

Battered stock markets may not take kindly to an upside surprise. Strong jobs growth will probably be met with cheers in the moments after the numbers hit the wires, but a more circumspect perspective might arise after the dust settles and traders weigh what the report might mean for the Federal Reserve.

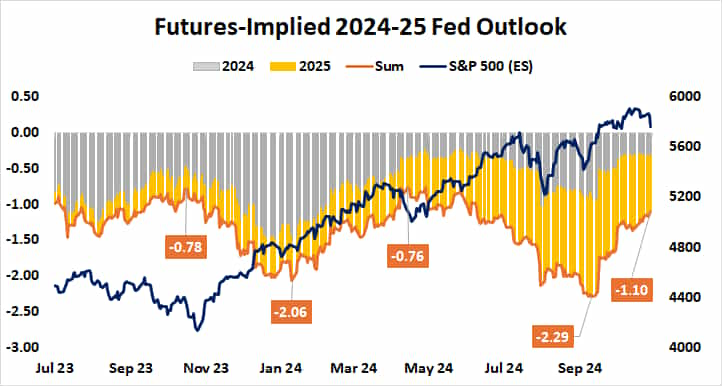

The U.S. central bank all but promised that it would cut interest rates by a further 100 basis points (bps) this year after its outsized 50bps reduction in September. That implies cuts of 25bps apiece at its meetings in November and December. The recent run of strong economic data has dented confidence in that outlook.

As it stands, the markets have priced in one 25bps down move and a mere 28% probability of another one. The outlook for 2025 has become less dovish too. Interest rate futures imply just 77bps in further easing, down from 123bps in the wake of last month’s Fed policy update. At that time, the central bank itself envisioned 100bps.

Faster than expected jobs growth may cut into rate cut prospects further, pointing to higher borrowing costs ahead than previously discounted just as the markets turn wobbly. The proximity of potent event risk by way of the looming U.S. presidential election may add to the drive to liquidate, sending stock markets reeling.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2024 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.