Is Fed Hiking Coming to a Close?

Is Fed Hiking Coming to a Close?

Bonds are behaving as if the Fed is finished raising rates The U.S. 10-year yield is down to 4.412%

- Long-end U.S. Treasury bonds hit fresh monthly highs today.

- Fed funds futures are [riced assuming there will be no rate hikes in either December 2023 or January 2024, with small but meaningful odds of a rate cut by March 2024.

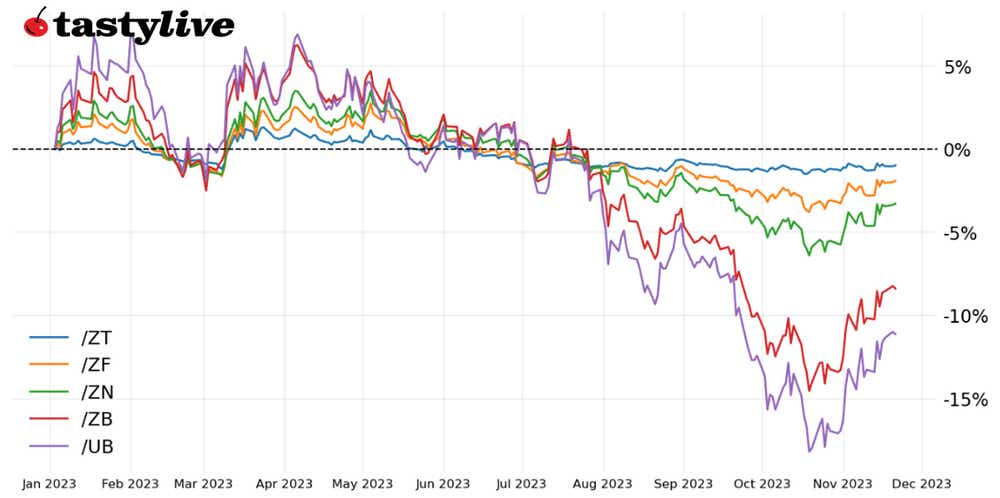

- Volatility is coming down but remains relatively elevated in 30s (/ZBZ3) and ultras (/UBZ3).

In the week since the (apparent) earth-shattering October U.S. inflation report, bonds have continued to exhibit signs of carving out a major bottom.

Federal Reserve rate hike odds have been zeroed out for December 2023 and January 2024, and there is now a 30% chance of a 25-basis-point (bps) rate cut at the March 2024 meeting, according to Fed funds futures. If the trend is your friend, then the trend is for high bond prices and lower yields, particularly at the long end of the curve.

/10Y U.S. 10-year note yield technical analysis: daily chart (May to November 2023)

The uptrend in the U.S. Treasury 10-year yield has been broken. /10Y remains under rising trendline from the May, July, and September swing lows, as well as the neckline of a head and shoulders topping pattern around 4.472%.

Momentum is pointed lower, with /10Y below its daily 5-, 13-, and 21-day exponential moving average (EMA) envelope—which is in bearish sequential order. Slow stochastics are holding in oversold territory, and exponential moving average (MACD) is trending lower below its signal line for the first time since early-May. The measured move in the head and shoulders pattern continues to eye a target of 3.931% in the coming weeks.

/ZB US 30-year bond price technical analysis: daily chart (May to November 2023)

The long end of the curve remains the most interesting portion of bonds, given the relatively higher volatility at the long end of the curve (IV Rank = 32.8, IV Index = 14.2%).

When we looked at 30s (/ZBZ3) last week, it was observed that “a short put vertical (long 108 put/short 110 put) for the November 24 expiry (10DTE) is suggesting a POP of 97%.” Now, that same trade (3DTE) is pricing in a POP of >99%. Extending the time horizon to 38DTE, the POP is 91%.

The momentum profile is solidly bullish at present. /ZBZ3 is above its daily EMA envelope, which is in bullish sequential order, and has been holding the daily 5-EMA (one-week moving average) as near-term trend support.

MACD continues to trend higher above its signal line and slow stochastics remain in overbought territory. The evidence suggests that the bottom is in place.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.