Stocks May Rise on U.S. PCE Data, Euro at Risk on German CPI: Macro Week Ahead

Stocks May Rise on U.S. PCE Data, Euro at Risk on German CPI: Macro Week Ahead

By:Ilya Spivak

Wall Street is looking for PCE inflation data to greenlight stock gains, U.S. dollar weakness. Meanwhile, the euro hangs in the balance as German CPI numbers shape ECB rate cut expectations.

- Euro hangs in the balance as German inflation data shapes ECB rate cut outlook.

- Chinese PMI surveys may encourage bargain-hunting in local stocks, Aussie dollar.

- U.S. PCE data unlikely to dislodge Fed policy bets, triggering a “risk on” response.

Financial markets put in a muted performance last week as liquidity drained around U.S. market closures for the Thanksgiving holiday.

The bellwether S&P 500 stock index eked out a modest gain of 0.9%. The high-flying Nasdaq, the small-cap Russell 2000 and the blue-chip Dow Jones Industrial Average put in similarly tame results.

Bond prices inched negligibly lower, and yields rose as Treasuries digested the prior week’s spirited gains. Gold edged up toward the top of its recent range but struggled to break higher despite a weaker U.S. dollar as geopolitical risk premium continued to leech out of the market. Crude oil prices tellingly fell for a fifth week, albeit modestly.

Here are the key macro waypoints for traders in the week ahead:

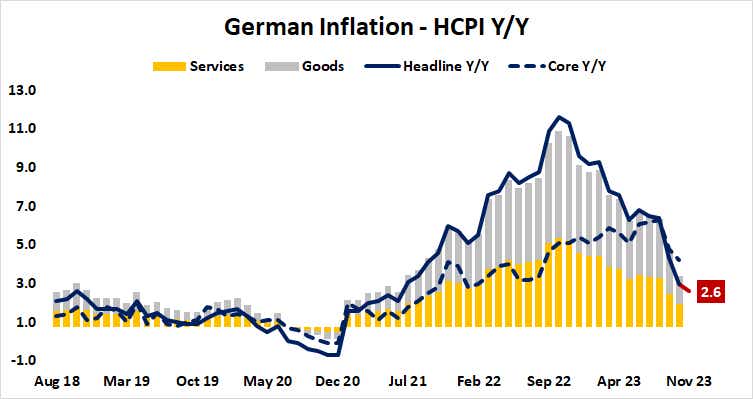

German consumer price index (CPI) data

Inflation is expected to slow for the fifth consecutive month in the Eurozone’s largest economy. Experts expect the EU-harmonized measure of German CPI–the version most relevant for policymaking at the European Central Bank (ECB)—to grow 2.6% year over year in November. That would be the lowest since June 2021.

Leading purchasing managers index (PMI) data from S&P Global showed inflation picking up in both Germany and the broader Euro Area in November, with wages in the service sector flagged as the culprit. Meanwhile, numbers from Citigroup (C) show that regional economic data outcomes have increasinglyimproved against baseline forecasts recently.

This might set the stage for an upside surprise. Taken at face value, which might delay the expected onset of ECB interest rate cuts and boost the euro.

However, hopes for speedier stimulus have seemingly helped the currency in recent weeks, stoking bets on a quicker recovery and underpinning demand for euro-denominated assets. If that dynamic holds, higher CPI may turn out to pressure the euro alongside local stock markets–and ETFs benchmarked to their performance, like the iShares MSCI Eurozone ETF (EZU).

China purchasing managers index surveys

Economic activity in China is expected to remain near standstill in November. Two sets of PMI surveys—an official one from the China Federation of Logistics and Purchasing (CFLP) and a private-sector analog from Caixin and S&P Global—are due to show that a weak but growing service sector continued to pull along the world’s second-largest economy even as manufacturing contracted for a second consecutive month.

Analytics from Citigroup suggest Chinese data outcomes now skew toward surprising on the upside relative to expectations. This may mean that markets have already priced in the bulk of the bad news about the country’s disappointing performance this year.

Results need not be “good” in this case, with investors settling for “tolerable” to nibble on bargain-hunting opportunities in China-sensitive assets. That might lift local stocks and the ETFs tracking them, like iShares China Large-Cap ETF (FXI) and Xtrackers Harvest CSI 300 China A-Shares ETF (ASHR). The Australian dollar may also get a lift.

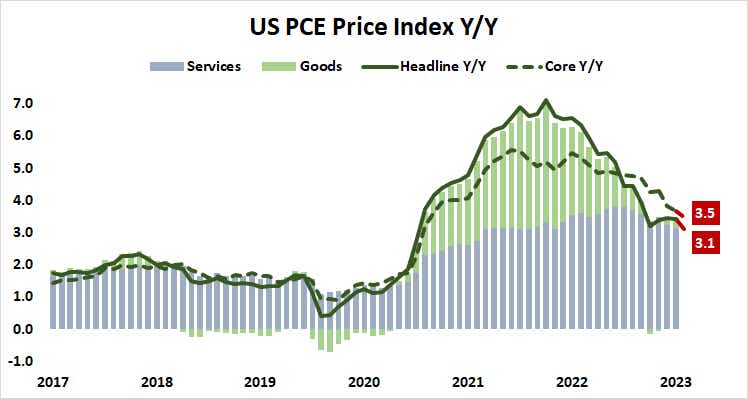

US personal consumption expenditure (PCE) inflation data

The Federal Reserve’s favored measure of U.S. inflation is expected to show that headline price growth slowed to 3.1% year-on-year in October. The core gauge excluding volatile food and energy prices is seen falling to 3.5%, the lowest since April 2021.

Absent a dramatically sharp deviation from the forecast—an inherently unlikely outcome–the release is unlikely to shift Fed policy bets in a lasting way. The uneventful passing of event risk may then be read as a “risk on” signal for the markets, pushing up stocks and weighing on the U.S. dollar.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.