Macro Week Ahead: U.S. Employment Data, ECB Rate Decision and ISM Reports

Macro Week Ahead: U.S. Employment Data, ECB Rate Decision and ISM Reports

By:Ilya Spivak

Markets are eying interest rates and jobs data for direction after last week’s blistering reversals

Stocks seesawed after the release of U.S. PCE data, leaving investors with conflicting cues.

The U.S. services ISM survey and labor market data will shape the Fed rate cut outlook.

The euro hangs in the balance with the ECB set to cut rates even as inflation picks up.

Stock markets finished a quiet holiday-shortened week with a head-scratching performance on Friday.

The much-anticipated U.S. personal consumption expenditure (PCE) report registered in line with expectations, putting core inflation at 2.8% year-on-year for the fourth month straight. This was hardly unusual. Market-watchers are typically good at forecasting PCE once they have consumer (CPI) and producer (PPI) price index data in hand.

Traders responded optimistically at first, as though relieved by the passing of event risk. The bellwether S&P 500 stock index rose with U.S. Treasury bonds as yields fell alongside the U.S. dollar. Gold prices popped higher. The markets seemed encouraged that the data didn’t beckon further dilution of Federal Reserve interest rate cut expectations.

That response proved short-lived, however. A mere hour of optimism quickly gave way to a broadly risk-off pivot. While Treasury yields idled near the lows for most of the day, stocks and gold prices turned sharply lower while the greenback rebounded against the major currencies, erasing its intraday losses.

Then, in the waning hours of the day, another sharp reversal struck. Major Wall Street benchmarks roared higher, seemingly without rhyme or reason, unraveling previous selling. The tech-tilted Nasdaq would close nearly flat having been down almost 2%. The S&P 500 finished with a gain of 0.9%, having been down by just as much at the session lows.

Curiously, this sudden about-face appeared to be localized to the equity space. Currencies, commodities and rates markets seemed to stand aside. That made the late-day seesaw still more puzzling because the absence of broader participation hinted its impetus might have been a one-off rather than a broad, macro readjustment.

Which of these conflicting cues—the post-PCE selloff or the late-day recovery—will investors opt to embrace from here?

Here are the macro waypoints likely to shape price action in the week ahead.

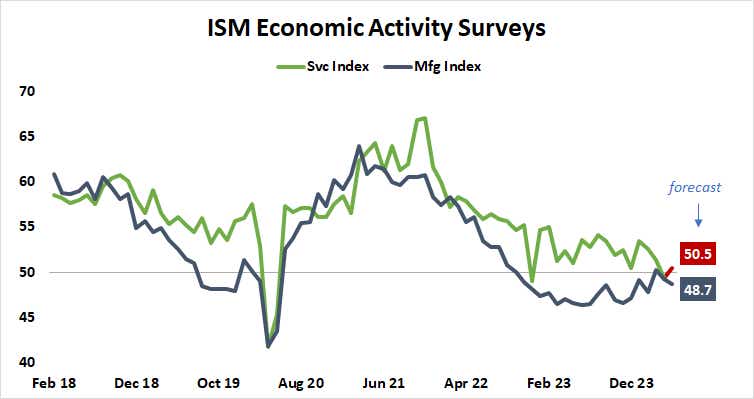

ISM non-manufacturing survey

The service-sector economic activity survey from the Institute of Supply Management (ISM) is expected to show the dominant engine of U.S. growth returned to expansion mode in May after a shock contraction in the previous month. The headline index is seen rising to 50.5 from 49.4, crossing back above the 50 “boom-bust” threshold.

Traders will keep a close eye on the inflation sub-index embedded in the data, which has tended to lead CPI and PCE inflation readings by about two months. It shot up to a three-month high in April despite slowing orders and shrinking employment. Another month of sticky price growth may trim Fed rate cut bets, cooling risk appetite.

ECB interest rate decision

The European Central Bank (ECB) is widely expected to begin cutting interest rates this month. Futures markets are fully pricing in a 25-basis-point (bps) reduction at this month’s meeting of the policy-steering Governing Council. A total of 62bps in stimulus are penciled in for 2024, implying two standard-sized cuts and a 52% probability of a third one.

With the move itself widely expected, traders are likely to focus on the tone and guidance presented at the press conference with ECB President Christine Lagarde following the policy announcement.

Leading purchasing managers index (PMI) data from S&P Global shows the currency bloc recovering from last year’s brief recession. It put the pace of economic activity growth at an 11-month high in May. That has helped nudge up inflation, which unexpectedly rose to a three-month high of 2.6% year-on-year last month.

The markets might reckon that this sets the stage for a somewhat feisty tone from Ms. Lagarde, where she tries to keep inflation expectations anchored by playing down scope for stimulus even as the central bank begins to deliver it. Much might be priced in already, so an unexpectedly dovish outturn may be most impactful for the markets.

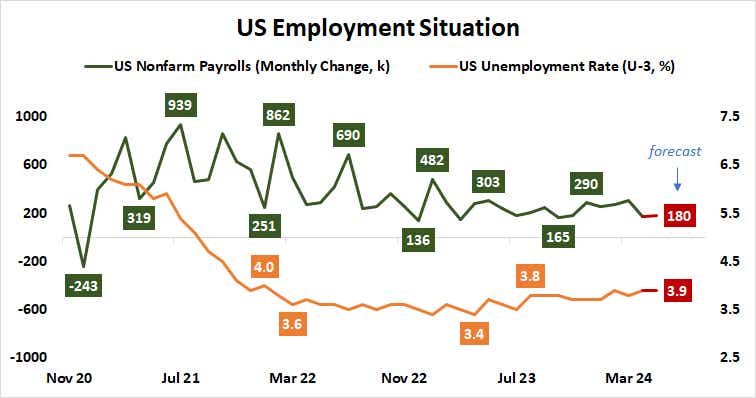

U.S. employment data

The May edition of official U.S. labor market figures takes top billing on the weekly economic calendar. It is projected to show the economy added 180,000 jobs last month while the unemployment rate held at 3.9%. Such outcomes would fall broadly within the pace of job creation prevailing for close to a year.

Analytics from Citigroup reveal an upturn in U.S. economic data outcomes in the past two weeks, punctuated by blisteringly strong May PMI data. If that foreshadows unexpectedly strong results, a hawkish revision of Fed rate cut expectations might weigh on stocks, bonds and precious metals—all while the dollar pushes higher.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2024 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.