What on Earth is Happening with Oil Prices?

What on Earth is Happening with Oil Prices?

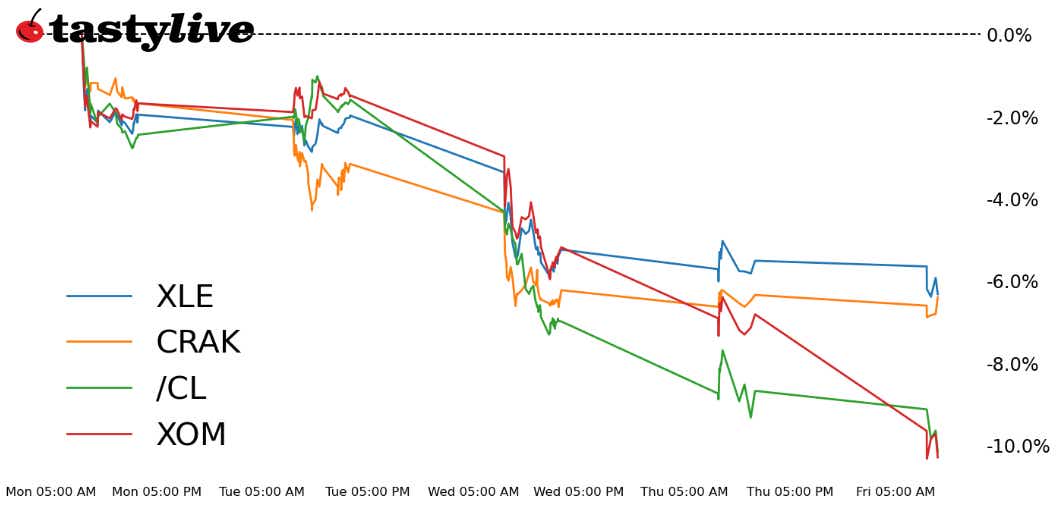

Crude Oil is down roughly 9% month-to-date

- Crude oil prices (/CL) have cratered at the start of October, losing over 9%.

- The 3-2-1 crack spread has fallen apart, undercutting refiners.

- XLE, XOP and CRAK have sustained significant technical damage.

The calendar turned to October and so did fortunes of the energy market. This week is on course to produce the year's worst weekly performance for crude oil prices (/CL). The conversation has quickly shifted from “when will oil hit $100?” to “how far can oil fall?” It’s been a dramatic shift in sentiment in a short period of time.

There may be a few catalysts to this abrupt turnaround:

— Increased supply: Russia reduced its self-imposed diesel ban to Europe stemming from the Ukraine war sanctions;

— Decreased demand: net crude imports to the U.S. fell by 1.96 million barrels per day, or bpd, according to the U.S. Energy Information Administration;

— The 3-2-1 crack spread (gasoline, heating oil and crude oil) fell to $19.34/brl, the lowest level since January 2022;

— As discussed on Monday's episode of Futures Power Hour, net-long speculative positioning in oil futures reached its highest level since March 2022, suggesting the move may have been driven by profit taking. By Tuesday, it was no longer time to be "an oil man."

These might be the reasons, and they might be completely unrelated. Regardless, meaningful technical damage has been levied against /CLZ3, XLE, XOP and CRAK.

/CL Price Technical Analysis: Daily Chart (April 2023 to October 2023)

When we last wrote about /CLZ3, it was noted that “while /CLX3 has reached the 100% Fibonacci extension of the June 28 swing low/Aug. 10 swing high/Aug. 28 swing low range at 93.03, /CLZ3 has not yet: 92.40 is still in reach. The technical measurement higher may be complete, which turns the technical outlook into a pure momentum play at this point in time.” Momentum broke earlier this week, with /CLZ3 trading at its lowest level since Aug. 31.

Momentum is now bearish, with /CLZ3 below its daily 5-, 13- and 21-EMA envelope, which is in bearish sequential order. The moving average convergence/divergence indiacor, or MACD, has issued a bearish crossover and has started to move below its signal line, and Slow Stochastics are buried in oversold territory. A further drop to the late-August swing low as well as the uptrend from the May and June swing lows closer to 77 may be in the cards before bulls feel emboldened to step in.

XLE Price Technical Analysis: Daily Chart (August 2022 to October 2023)

A rule of thumb is “when prices break out then return to a consolidation, the other side of the consolidation is likely to be test.” XLE broke out of a multi-year triangle in August, only to fall back into it this week. This puts triangle support in focus closer to 82. Momentum is deteriorating rapidly, with XLE below its daily EMA envelope (which is in bearish sequential order, MACD has issued a sell signal while moving below its signal line, and Slow Stochastics are in oversold territory.

XOP Price Technical Analysis: Daily Chart (September 2022 to October 2023)

XOP is taking it on the chin like XLE, except that the former appears to have formed a head and shoulders pattern. The measured move calls for a drop to 131.68; this pattern would be invalidated if XOP were to return above the neckline at 143.17.

CRAK Price Technical Analysis: Weekly Chart (May 2019 to October 2023)

The collapse of the 3-2-1 crack spread (((2*42*(/RB)+42*(/HO))-3*(/CL))/3) to its lowest level since January 2022 has been a gut punch for CRAK, the refiners ETF. The failed triangle breakout to all-time highs has dramatically changed the technical outlook: The weekly timeframe above shows support comes into play at 31. While the big picture bullish outlook remains valid, the short-term shift suggests that bulls will need to remain patient.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.