Vertical Debit Spread

A vertical debit spread is a defined risk, directional options trading strategy where we buy an option that we want to increase in value, while selling a similar option type against it to reduce the overall cost and risk of the trade.

“Vertical” in this case just means that the options are in the same expiration cycle.

“Debit” means we are paying for the spread, and we want the overall spread to increase in value. The long option is our asset in a debit spread, and the short option is our cost basis reduction component.

“Spread” indicates that we have a long and short option component in the same trade, where one offsets the P/L of the other to a degree.

How Do Vertical Debit Spreads Work?

When you break down stock options to their core, they are leverage instruments used to control the theoretical equivalent of 100 shares of stock past your strike price for a finite period of time. This is important to keep in mind when breaking down the math behind debit spreads and credit spreads as well.

When you think of spreads in this manner, think of the spread’s worth and implication at expiration:

- A long call represents the theoretical intrinsic value equivalent of 100 shares of long stock at expiration, if that strike is in-the-money (ITM)

- A short call represents the theoretical intrinsic value equivalent of -100 shares of short stock at expiration, if that strike is ITM

- A long put represents the theoretical intrinsic value equivalent of -100 shares of short stock at expiration, if that strike is ITM

- A short put represents the theoretical intrinsic value equivalent of 100 shares of long stock at expiration, if that strike is ITM

With this in mind, when we buy debit spreads we are simply paying to control the theoretical equivalent of 100 shares of stock from point A to point B (long strike to short strike), if the stock passes through that zone by the expiration of our contract. How much we pay will depend on where the strikes are placed, how much time is associated with the contract, and how high implied volatility is in the product.

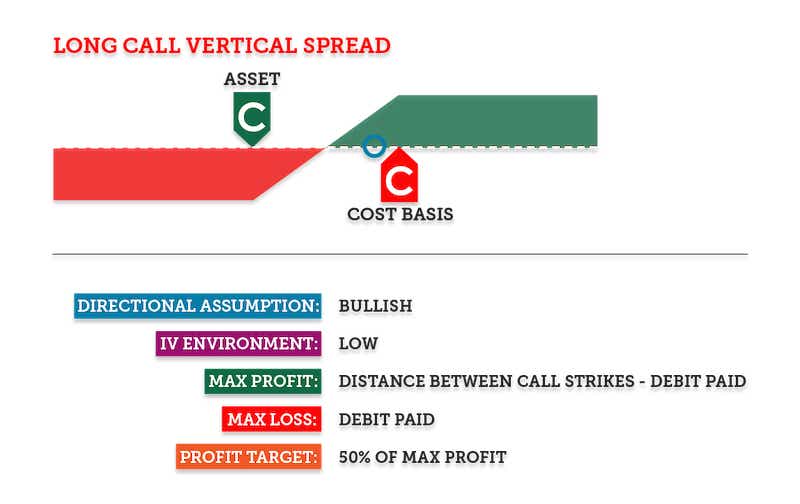

Vertical Call Debit Spread Basics

Setup:

- Buy a call below the stock price (ITM)

- Sell a call above the stock price (OTM)

Vertical spread options offset each other to a degree, which is why our risk and max profit is defined with debit spreads.

Extrinsic value plays a role with debit spreads, and ideally we sell a call that is worth more than the extrinsic value we are paying for in the long call option.

To find the extrinsic value in the long option, subtract the distance between the stock price and the ITM long call from the overall option premium. Any remaining value is extrinsic value.

If we cover the extrinsic value we are buying with the option that we’re selling, we’re left with a positive extrinsic value debit spread, which will have a slight positive theta upon setup.

The more our breakeven is pushed below the stock price, the more we can be directionally wrong at expiration and still make a profit. This translates to a high probability trade, or at least higher than 50%.

Ideal Implied Volatility Environment:

From a cost perspective, a low IV environment means a lower cost for your asset, which is the long call option in a call debit spread. Ideally this is paired with a bullish movement in the stock price. So, from a cost perspective, low IV is great, but for perceived movement in your favor, a high IV environment is great too. Either way, the most important thing is to be comfortable with the risk you are taking with a directional trade like a call debit spread.

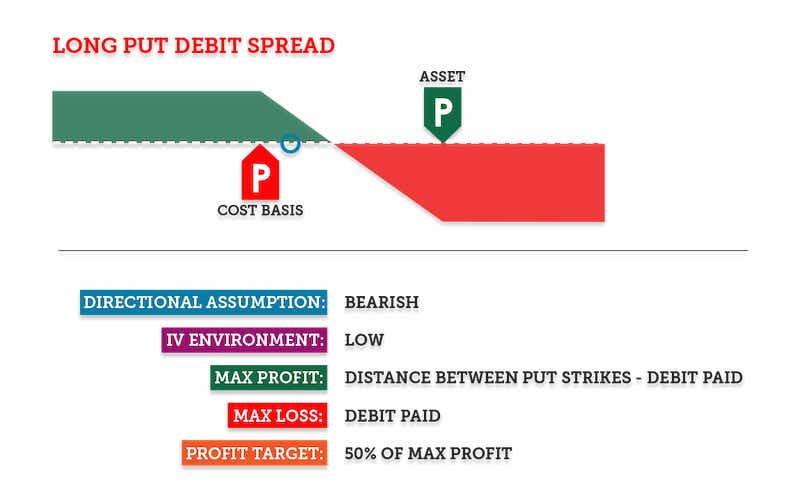

Vertical Put Debit Spread Basics

Setup:

- Buy a put above the stock price (ITM)

- Sell a put below the stock price (OTM)

The idea behind a put debit spread is similar to a call debit spread, but everything is opposite from a directional perspective.

Ideally, we sell a put that is worth more than the extrinsic value we are paying for in the long put option.

To find the extrinsic value in the long option, subtract the distance between the stock price and the ITM long put from the overall option premium. Any remaining value is extrinsic value.

If we cover the extrinsic value we are buying with the option that we’re selling, we’re left with a positive extrinsic value debit spread, which will have a slight positive theta upon setup. In other words, the spread will appreciate in value over time if the stock is exactly the same at expiration.

The more our breakeven is pushed above the stock price, the more we can be directionally wrong at expiration and still make a profit. This translates to a high probability trade, or at least higher than 50%.

Ideal Implied Volatility Environment:

From a cost perspective, a low IV environment means a lower cost for your asset, which is the long put option in a put debit spread. Ideally this is paired with a bearish movement in the stock price. So, from a cost perspective, low IV is great, but for perceived movement in your favor, a high IV environment is great too. Either way, the most important thing is to be comfortable with the risk you are taking with a directional trade like a put debit spread.

Now that you’ve got the basics down, let’s look at a few examples of how we might set up some debit spreads.

Vertical Call Debit Spread Example, XYZ at $100 per share:

A vertical call debit spread, which is a bullish options trade, may consist of buying the $95 strike call and selling the $102 strike call for a $4.00 debit.

The 95 strike call is our asset in this trade, and we want the stock price to rally up to $102 (or higher) by the expiration of our contracts, so that our long call appreciates in value and gains intrinsic value as our short call depreciates in extrinsic value over time.

The maximum value in this spread is the distance between the strikes of $7 if XYZ is above $102, but we paid $4.00 for this trade up front, so our max profit is only $3.00 and our max loss is the debit paid of $4.00.

Our breakeven at expiration is $99, since we paid a $4.00 debit for this trade and we need our spread to maintain $4.00 of value at expiration to not lose any money. This means the stock needs to be at $99 at expiration or better, so that our $95 strike call is $4.00 ITM at expiration. This also means that our breakeven is $1.00 lower than the stock price, so we can still absorb some movement against us.

Vertical Put Debit Spread Example, XYZ at $100 per share:

A vertical put debit spread, which is a bearish options trade, may consist of buying the $105 strike put and selling the $98 strike put for a $4.00 debit.

The $105 strike put is our asset in this case, and we want the stock price to go down to $98 (or below) so that our $105 long put appreciates in value, as our $95 strike short put decreases in extrinsic value over time.

The maximum value in this spread is the distance between the strikes of $7 if XYZ is below $98, but we paid $4.00 for this trade up front, so our max profit is only $3.00 if the stock is below $98 at expiration, and our max loss is the debit paid of $4.00 if the stock is above $105 at expiration.

Our breakeven at expiration is $101, since we paid a $4.00 debit for this trade and we need our spread to maintain $4.00 of value at expiration to not lose any money. This means the stock needs to be at $101, so that our $105 strike put is $4.00 ITM at expiration. As you can see, this means our breakeven is $1.00 above the stock price in this case, so we can actually absorb some movement against us here and still breakeven at expiration.

How do you Close a Vertical Debit Spread?

For any options trade, or stock/futures trade for that matter, the closing order is simply the opposite order of what you’re trading. For example if I buy 100 shares of XYZ, if I want to close the trade I would sell 100 shares of XYZ.

If I buy a call option at the 100 strike price in the June monthly cycle and I want to close the order, I would sell the 100 strike call in the June cycle.

Routing the opposite order completely cancels out the risk and reward of my active trade, and the position disappears.

For the two examples above, closing the vertical call debit spread where I bought the 95 strike and sold the 105 strike means I would need to sell the 95 strike and buy the 105 strike call back in the same expiration cycle to close the trade

Closing the vertical put debit spread where I bought the 105 strike put and sold the 98 strike put consists of selling the 105 strike put and buying the 98 strike put back in the same expiration cycle.

When closing an order, just think of routing the exact opposite order that you have in the same expiration cycle. Once the order is filled, the position will be “flattened” and risk will be removed.

For debit spreads, we pay a debit up front to open the trade. That means to close it, we would collect a credit. If I buy a debit spread for $4.00 and sell it for a $5.00 credit later, I would lock in $1.00 of profit.

tastylive Approach to Vertical Debit Spreads: Setup & Tips

For both put and call vertical debit spreads, our setup preference is the same - ideally we purchase an ITM option and sell an ATM/OTM option against it to reduce the cost basis of our long option. To make sure we have a surplus of extrinsic value, the short option must have more extrinsic value than the long option.

If we achieve this, our breakeven will be better than the stock price for the spread.

For call debit spreads, that means the breakeven will be below the stock price. This means we have some wiggle room to the downside if our bullish assumption is wrong.

For put debit spreads, that means the breakeven will be above the stock price. This means we have some wiggle room to the upside if our bearish assumption is wrong.

In both cases, a breakeven improvement from the current stock price translates to a trade that has a higher than 50% probability of profit.

When do we close vertical debit spreads?

We close profitable vertical debit spreads for around 50% max profit. Max profit is the width of the spread, less the debit paid.

We close at 50% max profit for the same reason we close short premium trades at 50% max profit. The more unrealized profit we see, the less we can make, and we can still lose everything we see on the table.

With profit-defined trades, risk:reward skews out of our favor the more profit we see, even if that means a higher probability of max profit happening. We keep this contained by closing around 50% of our max profit.

When do we defensively manage vertical debit spreads?

Debit spreads are tough to manage defensively since the most we can make is our debit paid, and our extrinsic value component lies in the short option that is worth less than the long option.

In the case of debit spreads gone wrong, we can roll the short option closer to the long option to reduce our max loss, and max profit potential.

For example, a +90 /-100 call vertical debit spread with XYZ at $96.50 might cost $6.00 to enter, with a max profit of $4.00. If XYZ drops to $90, we may consider rolling down the 100 strike call to the $96, which would consist of buying back the 100 strike call and selling the 96 strike call for a credit. If we pick up an additional $1.00 credit for this roll, our cost basis would be reduced from $6.00 to $5.00, and since our new spread would be $6.00 wide, we can now make $1.00 max profit instead of $4.00 max profit.

This same concept can be applied to put debit spreads, but we would be rolling the short put up closer to the long put in that case.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.