Filter

What is Scalp Trading? Scalping Strategies for Beginners

What is scalp trading (scalping)?

Scalp trading in the financial markets refers to a short-term trading strategy where investors/traders aim to profit from small price movements in assets, such as stocks, currencies, or cryptocurrencies. Scalp traders often make numerous quick trades throughout the day, holding positions for as little as a few seconds to a few minutes, or sometimes even longer.

The goal of scalp trading is to book small gains from each trade by exploiting short-term price fluctuations. Over time, the accumulation of profits from each trade can lead to larger gains. Scalp traders rely on a variety of different strategies and tactics to identify potential scalping opportunities, such as technical analysis or other chart-intensive approaches.

Options Scalping

It should be noted that scalping may also be used to describe an options-focused trading strategy, whereby the investor, trader or portfolio manager “gamma scalps” around options-focused positions that are hedged with the underlying stock. This is sometimes referred to as “delta-neutral hedging.”

The goal of this approach is to adjust the stock component of the position to account for changes in the underlying. This involves buying or selling the underlying stock, to ensure that the hedge is proportional to the options position.

How does scalp trading work?

It's important to note that scalp trading is a high-risk, high-reward strategy that requires significant skill, experience, and mental discipline. It may not be suitable for all market participants because of the potential for significant capital losses. As with any trading strategy, it's therefore essential to thoroughly understand the risks and consider one’s risk tolerance and suitability before engaging in scalp trading.

In terms of the basic framework, scalp trading generally involves the following steps:

Asset Selection: Scalp traders typically focus on highly liquid assets, such as stocks, currencies, or cryptocurrencies, as they offer frequent price movements and narrow bid-ask spreads.

Strategic Analysis: Scalp traders rely heavily on technical analysis and use various indicators, charts, and patterns to identify potential entry and exit points for their trades. They may use tools like moving averages, stochastic oscillators, and relative strength index (RSI) to guide their decisions.

Timeframe: Scalp traders operate on very short timeframes, ranging from seconds to a few minutes. They aim to capitalize on rapid price fluctuations that occur within these brief periods.

Quick Execution: Rapid execution of trades is crucial for scalp traders. They use trading platforms with low latency and direct market access to ensure their orders are executed quickly.

Small Profit Targets: Scalp traders aim for small, incremental profits on each trade. These gains may seem insignificant individually but can accumulate over a series of successful trades.

Tight Stop-Losses: To manage risk, scalp traders typically employ tight stop-loss orders (buy stop orders or sell stop orders). If a trade moves against them, the stop-loss order is triggered to limit potential losses.

High Frequency: Scalp traders make multiple trades in a single day, sometimes even within a few minutes of each other. This may be opening and closing the same position, or opening/closing multiple positions over a short period. Scalpers are constantly monitoring the market for attractive opportunities.

Discipline: Scalp traders typically adhere to a highly regimented approach, and often employ a trading plan as well as a risk management plan. Scalp traders aim to make mechanical decisions which minimize knee-jerk (aka emotional) decisions.

Capital and Leverage: Scalp traders often use significant leverage to amplify their position sizes, which can magnify both gains and losses. Risk management is therefore crucial when scalping.

How forex scalping works

Forex scalping is a trading strategy focused on exploiting very short-term price movements in the foreign exchange (forex) market. Scalpers operate on extremely short timeframes, often using 1-minute or 5-minute charts to identify opportunities. They rely on technical analysis indicators like moving averages, stochastic oscillators, and Relative Strength Index (RSI) to pinpoint potential entry and exit points. The goal of forex scalping is to profit from small price differentials between currency pairs, and as a result, market participants typically prioritize currency pairs with tight spreads to minimize transaction costs.

Forex scalpers execute trades quickly, usually through limit or market orders, and employ tight risk management strategies. This involves setting narrow stop-loss orders to limit potential losses and using small position sizes. Forex scalpers may make numerous trades within a single trading session, aiming to accumulate small gains from each trade. To maximize opportunities, forex scalpers often focus on the most liquid trading hours when major financial centers overlap, such as during the London-New York session.

Like any scalping endeavor, forex scalpers typically focus on quick execution, small profit targets, stop-loss orders, and adherence to strict discipline. It's important to note that forex scalping is a high-risk, high-reward strategy that requires a deep understanding of the forex market, strong technical analysis skills, and the ability to make quick decisions under pressure. Potential scalpers should also be aware of transaction costs associated with frequent trading, including spreads and commissions.

Benefits and risks of scalping

Scalping, like any trading strategy, comes with its own set of benefits and risks, as outlined below.

Potential Benefits Associated With Scalping

Quick Profits: Scalpers aim to profit from small price movements, allowing them to generate income in a short amount of time, often within minutes or hours.

Reduced Exposure: Since scalping involves short-term trades, it generally reduces the exposure to overnight or long-term market risks, such as unexpected news events.

Leveraging High Liquidity: Scalpers often target highly liquid assets and trade during peak market hours. That means they can easily enter and exit positions without significantly affecting the market price. The ability to utilize market liquidity allows scalpers to execute their trades with minimal slippage, which can be beneficial for capturing precise price movements.

Flexibility: Scalping can be adapted to various financial markets, including stocks, forex, and cryptocurrencies, offering traders versatility in their trading choices.

Potential Risks Associated With Scalping

Transaction Costs: Frequent trading results in higher transaction costs due to spreads and commissions, which can eat into profits, particularly when capturing small price movements.

Mentally Demanding: Scalping requires constant attention to the markets, rapid decision-making, and a disciplined mindset. It can be mentally and emotionally taxing for some traders.

Slippage: In fast-moving markets, orders may not be executed at the desired price, leading to slippage. This can result in losses that exceed expectations.

Connectivity Issues: Scalping relies on the fast and reliable execution of orders. Technical issues, slow internet connections, or platform outages can disrupt trading and lead to capital losses.

Scalp trading strategies

When it comes to scalp trading, market participants often utilize one of the following approaches: scalping breakout, scalping dips, or scalping breaking news.

Each of these three approaches is outlined in further detail below.

Scalping Breakout

The scalping breakout strategy involves identifying and trading when an asset's price breaks out of a well-defined trading range or consolidating pattern. Scalpers use this approach to enter positions when they anticipate a significant price movement following the breakout. The goal is to capture quick profits as the price accelerates in the direction of the breakout. Technical indicators like Bollinger Bands or support/resistance levels are often used to spot potential breakout opportunities.

Scalping Dips

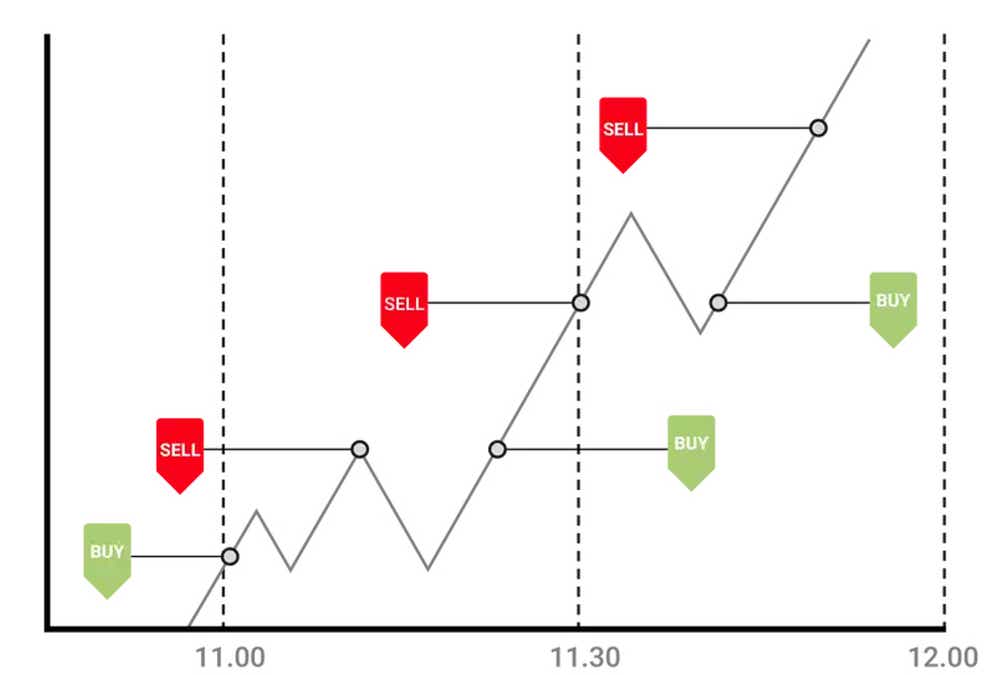

Scalping dips, also known as "buying the dip," involves looking for short-term price declines within an overall uptrend. Scalpers identify instances when an asset's price retraces or pulls back temporarily before resuming its upward momentum. The goal is to enter a long position amidst a dip, hoping for a swift rebound in price. Technical indicators like Fibonacci retracement levels or moving averages are often used to help identify potential dip-buying opportunities.

Scalping Breaking News

Scalping breaking news is a strategy where market participants attempt to react swiftly to significant news events, such as economic releases or corporate announcements that may trigger sudden and high-magnitude price movements. Scalpers monitor news feeds and economic calendars for potential market-moving events and prepare to enter positions as soon as one presents itself. This approach requires rapid decision-making and execution, as market sentiment can change rapidly in response to breaking news. Traders often use stop-loss orders (buy stop or sell stop) to manage risk in such environments.

Scalp trading indicators

When it comes to scalp trading indicators, market participants often utilize one of the following approaches: moving average, RSI, parabolic SAR, or stochastic oscillator.

Each of these four approaches is outlined in further detail below.

Moving Average

Moving averages are commonly used in scalp trading to analyze trends and potential entry/exit points. There are two main types of moving averages: Simple Moving Averages (SMA) and Exponential Moving Averages (EMA). SMAs offer a straightforward average of prices over a specific period, while EMAs give more weight to recent price data. Scalpers often use moving averages to identify trend direction and potential reversals. For example, monitoring crossovers between short-term and long-term moving averages, which may be viewed as a key signal.

Relative Strength Index (RSI)

RSI is a momentum oscillator that gauges the speed and magnitude of price movements. It ranges from 0 to 100 and is used to spot overbought (above 70) or oversold (below 30) conditions in an asset’s price. Scalpers employ RSI to identify potential trend reversals or exhaustion points, making it a valuable tool for entry and exit decisions.

Parabolic SAR (Stop and Reverse)

The Parabolic SAR is a trend-following indicator that helps scalpers identify potential stop and reverse points in the price trend. They often present as dots above or below the price chart, indicating potential trend changes. When the dots switch from being above to below the price, that can indicate a shift from an uptrend to a downtrend, and vice versa. Scalpers use the Parabolic SAR to confirm trend direction and consider position changes.

Stochastic Oscillator

The Stochastic Oscillator is a momentum indicator that compares a security's closing price to its price range over a specified period, often 14 periods. This gauge ranges between 0 and 100, highlighting overbought and oversold conditions. Scalpers typically look for crossover signals, divergences, and extreme readings to identify potential trading opportunities. In that regard, the stochastic oscillator assist in assessing the speed and potential for price reversals.

It should be noted that scalpers sometimes combine the aforementioned indicators with other technical analysis tools and strategies to improve the accuracy of their trades and to help manage risk effectively.

Scalp trading key takeaways

Scalping is a short-term trading strategy where market participants aim to profit from small, rapid price movements in financial markets. The main goal is to accumulate numerous small gains throughout the day by making quick trades. Over time, the accumulation of profits from each trade can lead to larger gains.

While scalping offers the benefit of quick profits and a high trading frequency, it comes with significant risks. These include transaction costs, high stress levels, limited profit potential per trade, and the need for fast and reliable execution. Scalpers must be mentally disciplined and make decisions in real-time, often within minutes or seconds.

When it comes to scalp trading, market participants often utilize one of the following approaches: scalping breakout, scalping dips, or scalping breaking news. And within an approach, scalpers often use an indicator such as moving average, RSI, parabolic SAR, or stochastic oscillator to identify potential scalping opportunities.

It should be noted that scalpers sometimes combine the aforementioned indicators with other technical analysis tools and strategies to improve the accuracy of their trades and to help manage risk effectively.

Lastly, it's important to note that scalp trading is a high-risk, high-reward strategy that requires significant skill, experience, and mental discipline. It may not be suitable for all market participants because of the potential for significant capital losses. As with any trading strategy, it's essential to thoroughly understand the risks and consider one’s risk tolerance before engaging in scalp trading.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2024 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.