U.S. NFP Preview: Stocks Look for Direction in Key Jobs Data

U.S. NFP Preview: Stocks Look for Direction in Key Jobs Data

By:Ilya Spivak

Stock markets are struggling for direction after the Fed policy decision. Will April’s U.S. jobs report clear things up?

- Stock markets liked the Fed policy decision, until they didn’t

- April’s U.S. jobs report may turn out softer than anticipated.

- If Wall Street can’t find strength in weak data, trouble lurks.

Wall Street seemed satisfied as the Federal Reserve appeared to opt for the least painful path to reducing scope for interest rate cuts in 2024.

The central bank acknowledged that progress on bringing down inflation has stalled and signaled that it will hold off on easing until it can be confident that the march to its 2% objective has resumed in earnest.

Speaking at the press conference after the policy announcement, Fed Chair Jerome Powell described the current policy setting as “restrictive,” adding that it is still expected to become sufficiently so over time. This hinted that raising rates further remains off the table for now, despite hints at such a possibly by other central bank officials.

Stocks liked what the Fed did, until they didn’t

Stocks, bonds, and gold prices rose while the U.S. dollar tumbled as after the policy statement from the rate-setting Federal Open Market Committee (FOMC) crossed the wires and while Mr. Powell spoke.

Then, just as the press conference wound down, a rapid reversal swept share prices and erased intraday gains. The bellwether S&P 500 equity index and the tech-tilted Nasdaq 100 closed the session with slight losses having been up close to 1.5% each. They have since recovered about half of the Fed-inspired rally.

This makes for a confounding backdrop as the spotlight turns to the release of April’s U.S. employment data. The post-FOMC selloff seems to imply that risk appetite is so fragile that even a mostly friendly Fed is unable to sustain bullish resolve. The absence of follow-through is hardly encouraging for the bearish side of the argument, however.

Will U.S. jobs data give stocks clear direction?

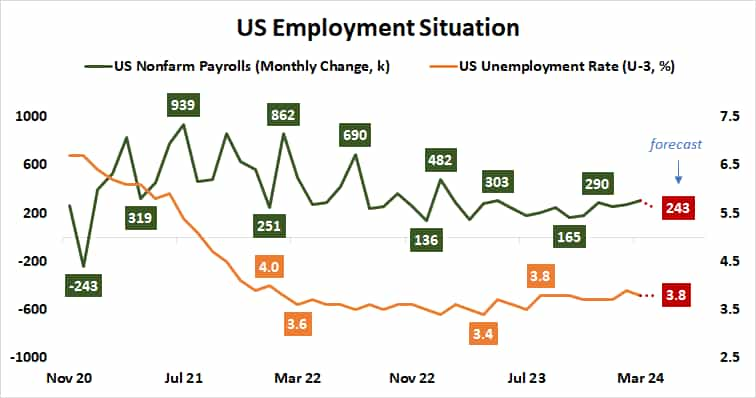

The jobs report is expected to bring an increase of 243,000 in non-farm payrolls while the unemployment rate holds steady at 3.8%. That would fall well within the narrow range of outcomes since March 2023. Average hourly earnings growth of 4% year-on-year is set to mark the slowest pace of wage inflation since June 2021.

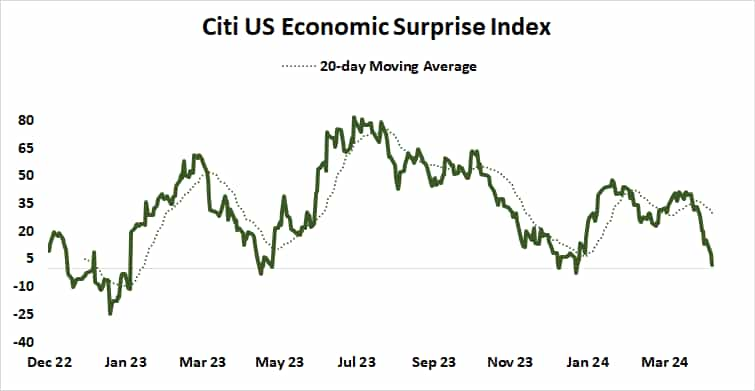

Analytics from Citigroup show that U.S. macro data outcomes have deteriorated relative to baseline forecasts in the past two weeks, warning that economists’ models are tuned rosier than reality has validated. This opens the door for downside surprises.

How stocks react to such results may prove to be trend-defining. If markets reason that the data implies that the worst of the Fed’s hawkish repositioning is behind them, a risk-on reaction will prevail. However, failing to capitalize on signs of a softer labor market in a repeat of the post-Fed reversal would make for an emphatically bearish signal.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2024 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.